Fast Take

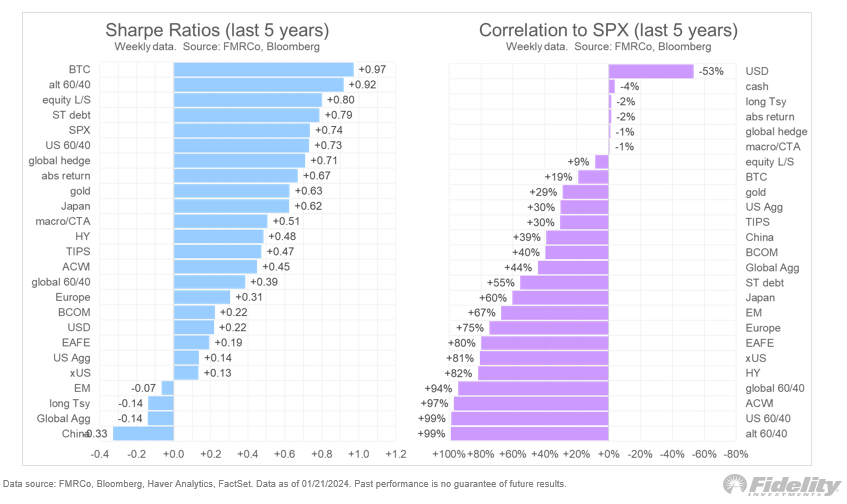

A Sharpe Ratio for Bitcoin (BTC) +0.97 over the previous 5 years presents a noteworthy statement, in keeping with Jurrien Timmer, director of World Macro at Constancy.

Regardless of the famend volatility of Bitcoin, this ratio means that the digital asset has supplied a near even trade between threat and extra return over the risk-free charge. This degree of the Sharpe Ratio implies that the returns gained have been roughly in step with the danger assumed by traders regardless of the turbulent nature of digital asset markets.

This locations Bitcoin in the direction of the higher finish in comparison with different funding classes, equivalent to SPX (+0.74) or the US 60/40 portfolio (+0.73), hinting at a traditionally superior risk-adjusted efficiency.

In relation to the S&P 500 (SPX), Bitcoin displays a correlation of +19%. This interprets to a fairly weak affiliation with the SPX, although not sturdy sufficient to be vital. This implies that whereas Bitcoin does show some synchronized motion with the U.S. fairness market, it nonetheless maintains a considerable degree of independence in its worth actions.

The submit Bitcoin’s Sharpe Ratio indicators balanced risk-reward over 5 years appeared first on CryptoSlate.