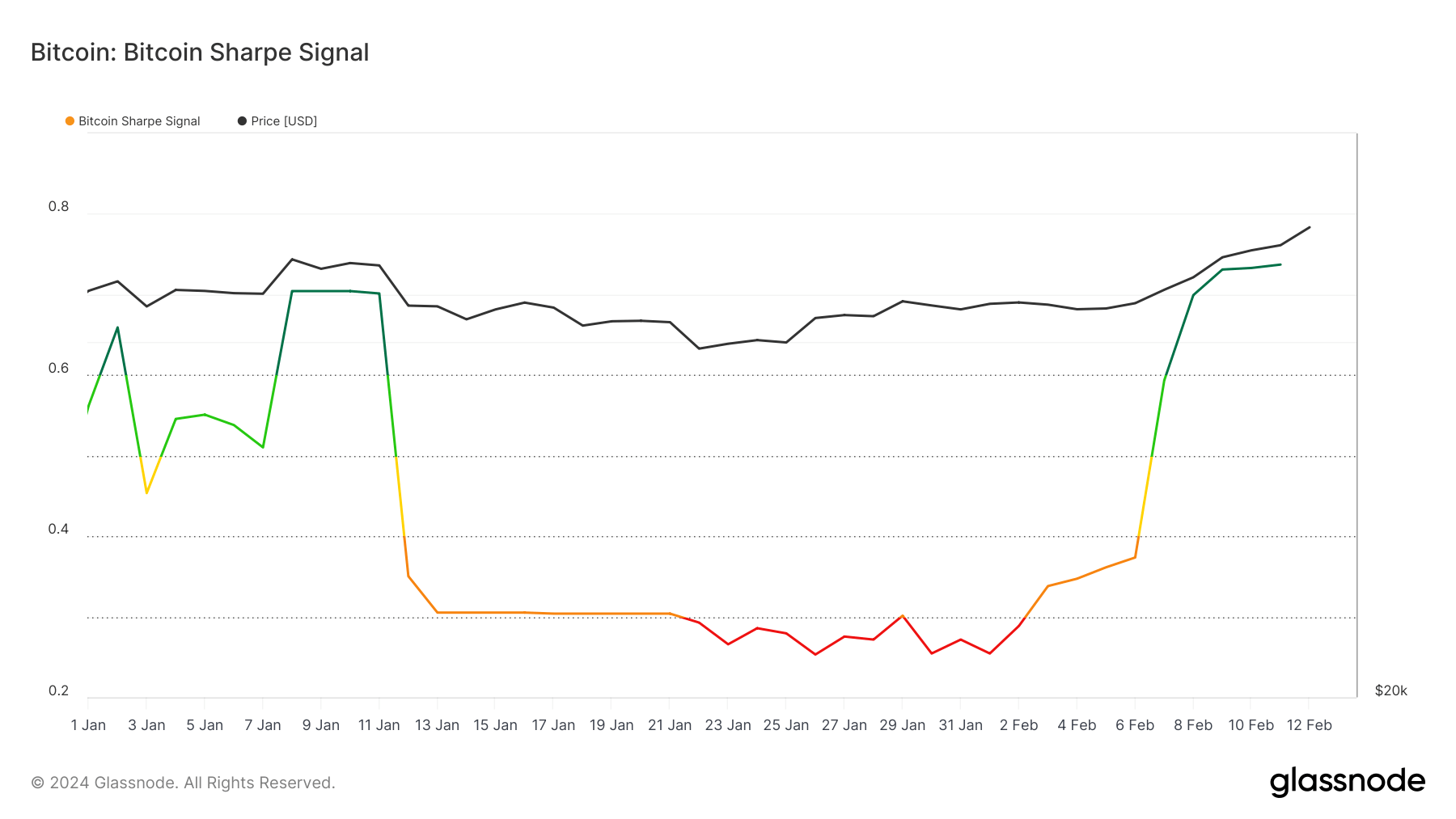

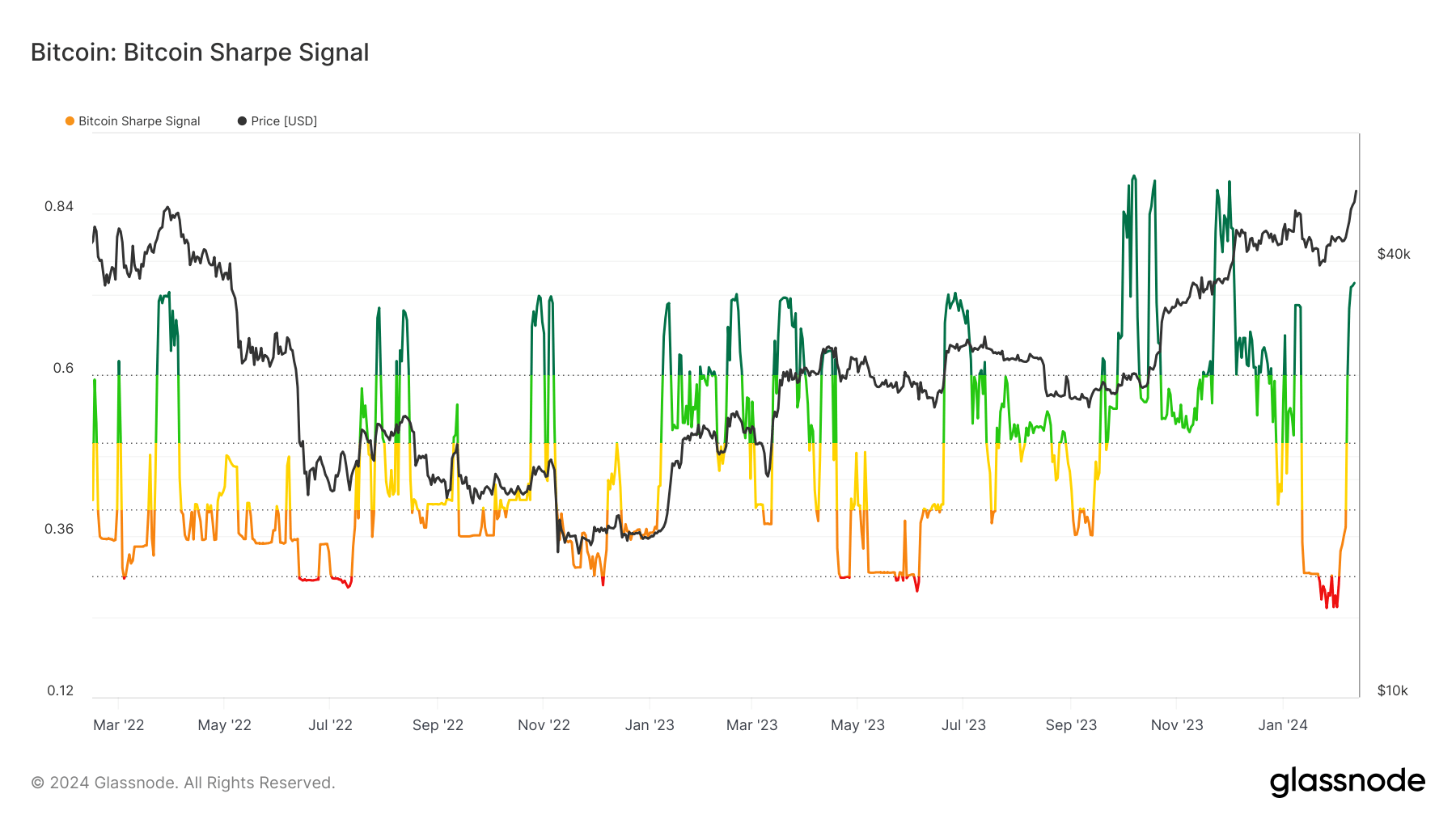

On Jan. 26, Glassnode’s Sharpe Sign hit its lowest stage since March 2020. It dropped to 0.2531 from a excessive of 0.7042 on Jan. 10. Nonetheless, by Feb. 11, as Bitcoin’s worth crossed $48,000, the Sharpe Sign elevated to 0.7371.

This sharp spike within the Sharpe Sign has profound implications for the crypto market, indicating a probably profitable part for buyers attuned to risk-adjusted metrics.

To totally grasp the importance of the sign’s fluctuations, it’s important to grasp the Sharpe ratio.

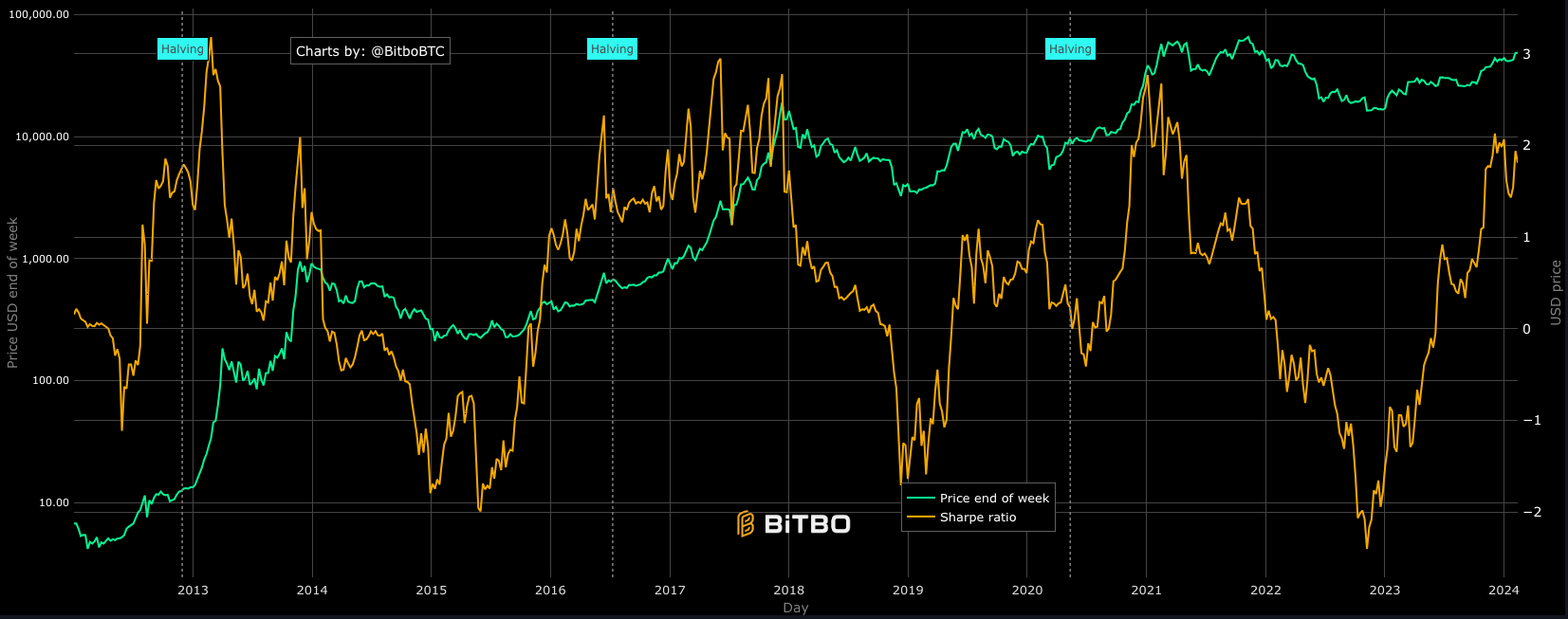

This metric, created by Nobel Laureate William F. Sharpe, measures the efficiency of an funding relative to its danger. The Sharpe ratio compares the anticipated returns of an funding to the risk-free charge of return, adjusting for the funding’s volatility. By doing this, the ratio gives a standardized measure of extra returns per unit of danger. Put merely, it measures how rather more cash you possibly can make on an asset riskier than authorities bonds.

The Sharpe ratio skilled its personal volatility, dropping to 1.43 on Jan. 22 earlier than surging to 1.94 on Feb. 5 and settling at 1.74 as of Feb. 11. These actions provide insights into the altering risk-reward profile of Bitcoin, with increased ratios indicating a extra favorable risk-adjusted return.

The Sharpe Sign, derived from Glassnode’s proprietary mannequin, builds on this idea by incorporating machine studying and on-chain knowledge to foretell Bitcoin’s risk-adjusted return potential. This sign is calculated by analyzing historic knowledge, market developments, and on-chain exercise to gauge the present risk-reward stability. A rise within the Sharpe Sign suggests enhancing risk-adjusted returns, making it a bullish indicator for Bitcoin. Conversely, a lower indicators rising draw back danger or diminishing returns relative to danger, urging warning amongst buyers.

The current actions within the Sharpe Sign, significantly the rebound from 0.2531 to 0.7371, alongside Bitcoin’s worth improve, present a big turnaround in market sentiment and Bitcoin’s risk-adjusted return outlook.

The decline in late January, brought on by the market downturn following the US launch of spot Bitcoin ETFs, indicated buyers have been seeing heightened danger. Nonetheless, the next restoration exhibits a robust resurgence in confidence, fueled by a lower in draw back danger and anticipation of upward worth developments.

This improve within the Sharpe Sign exhibits that buyers are seeing a comparatively low danger in relation to investing in Bitcoin. The rise within the ratio, alongside the rise in worth, additionally exhibits that the market is gearing up for an additional improve in worth.

Because the sign rebounds from its January lows, it brings a couple of part of considerably improved risk-adjusted returns, which might make a compelling case for merchants guided by these metrics for strategic funding in Bitcoin.

The publish Bitcoin’s risk-adjusted return potential skyrockets as Sharpe Sign surges appeared first on CryptoSlate.