Fast Take

As we strategy the Bitcoin halving and bid farewell to the present epoch, it’s essential to replicate on the occasions which have transpired for the reason that earlier halving in Might 2020. The world has witnessed a collection of serious occasions which have formed the financial panorama and influenced the adoption of Bitcoin.

The COVID-19 pandemic, which started in March 2020, had a detrimental impact on the worldwide economic system all through the whole cycle. The aftermath of the pandemic has led to extreme inflation and foreign money debasement, the consequences of that are nonetheless felt in the present day.

In August 2020, Michael Saylor, then CEO of MicroStrategy, made a daring transfer by adopting Bitcoin, ensuing within the firm accumulating greater than 1% of the whole Bitcoin provide as of April 2024. The FASB launched guidelines that may positively affect company adoption by establishing honest worth accounting for Bitcoin in company treasuries.

El Salvador made historical past by making Bitcoin authorized tender and implementing a dollar-cost averaging (DCA) strategy to buying the digital asset.

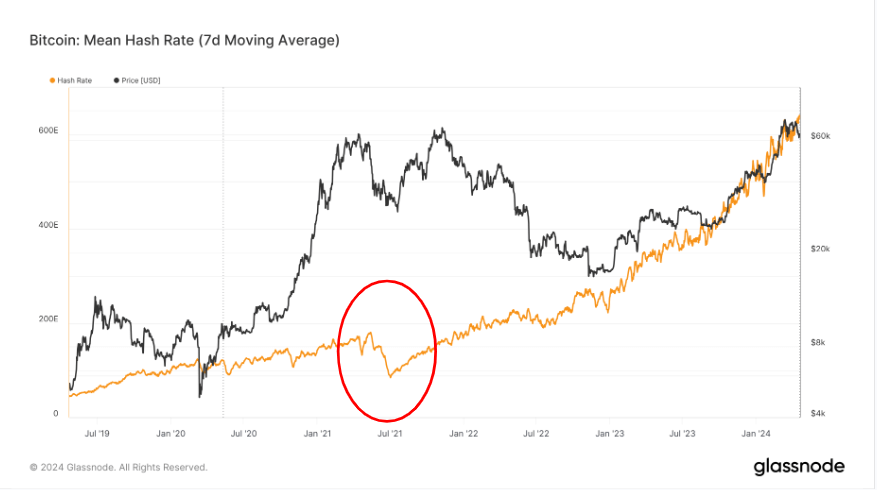

China’s ban on Bitcoin in the summertime of 2021 induced a major drop within the hash charge, which plummeted by roughly 50%.

Geopolitical tensions escalated, with a number of wars and invasions occurring, most notably Russia’s invasion of Ukraine in February 2022 and the latest battle within the Center East.

The introduction of Bitcoin ordinals paved the best way for the launch of Runes at block 840,000.

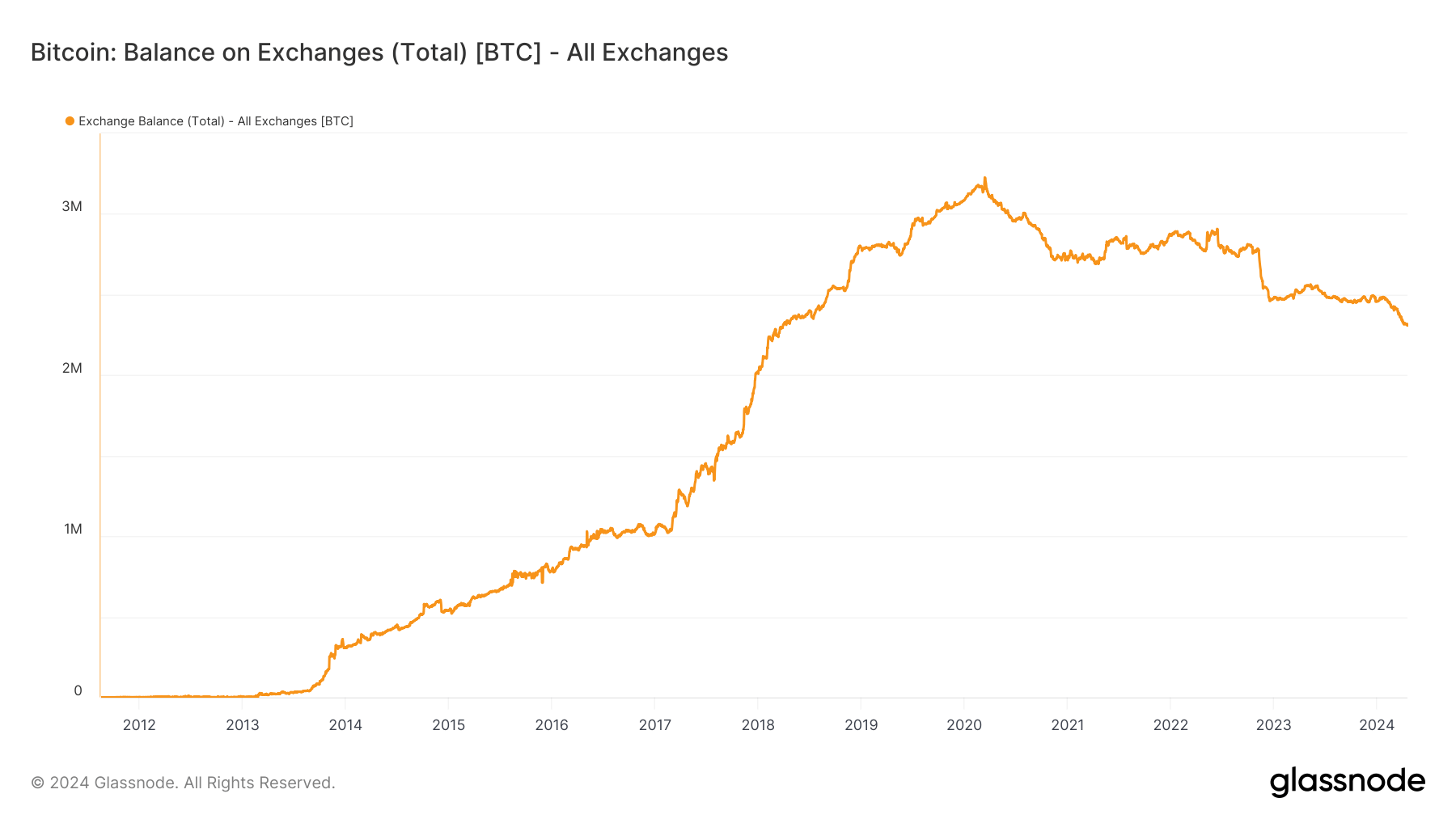

This cycle additionally marked the primary time that the stability of Bitcoin on exchanges decreased, indicating a shift in investor conduct.

On this cycle, the digital asset trade FTX collapsed alongside a number of crypto lending platforms like Celsius and BlockFi.

In January 2024, the launch of Bitcoin ETFs grew to become an prompt success, additional solidifying Bitcoin’s place within the monetary world.

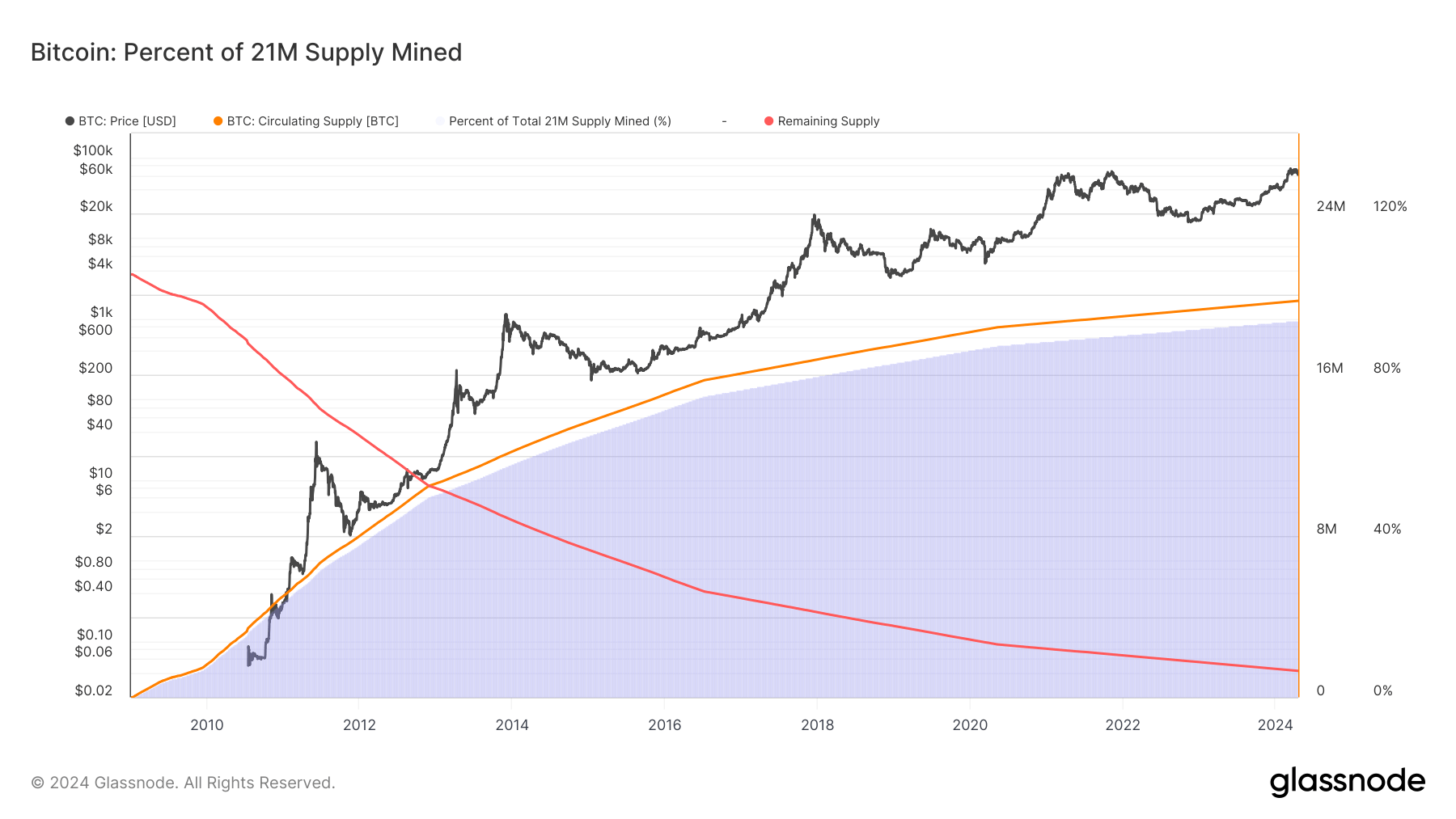

Different notable occasions included the very best inflation and rates of interest in latest historical past, reminding us that whereas the longer term stays unpredictable, the restricted provide of 21 million Bitcoin stays a relentless.

Regardless of the challenges and occasions which have unfolded, Bitcoin has surged a powerful 577% for the reason that final halving.

The publish Bitcoin’s resilience examined: Worth up 577% amid pandemics, struggle and company embrace appeared first on CryptoSlate.