Modifications in futures and choices open curiosity present perception into market sentiment, liquidity, and potential value actions. Futures and choices reveal how merchants place themselves and present their expectations for future value motion. Open curiosity measures the circulate of cash, displaying whether or not new capital is coming into or exiting the market.

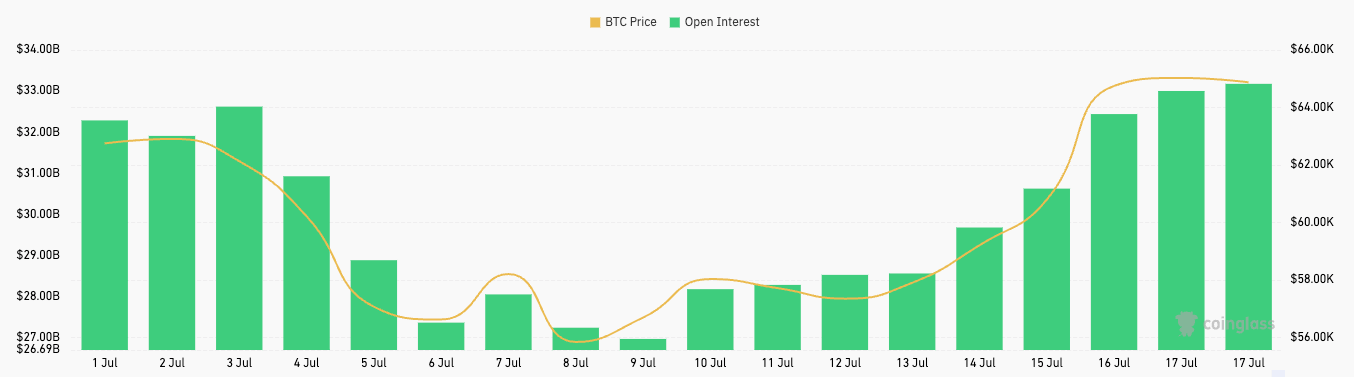

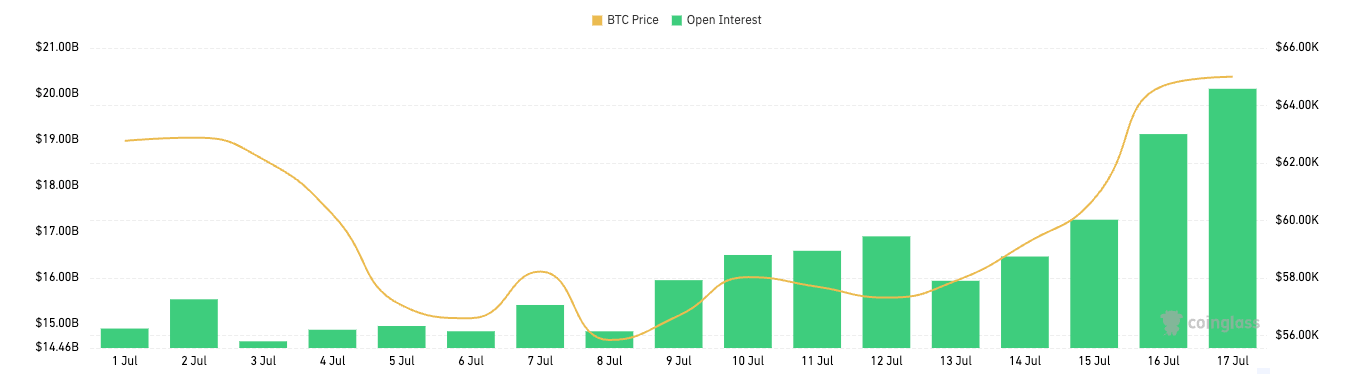

open curiosity, we will see that Bitcoin’s current rally has introduced new life into the derivatives market, which noticed a comparatively calm and uneventful July. This stability mirrored the weeks of sideways value motion the market noticed. The lateral pattern turned optimistic final week, as Bitcoin began at $56,680 on July 9. The worth enhance began slowly however started selecting up tempo from July 14 onwards, when the worth surged from $59,205 to $65,025 on July 17.

Futures open curiosity carefully mirrored this value motion. On July 9, open curiosity was $26.97 billion and rose steadily, reaching $33.25 billion by July 17. This fast enhance in OI exhibits that merchants had been opening extra contracts as Bitcoin broke $60,000, most certainly anticipating additional value will increase.

The choices market adopted the identical pattern. On July 9, open curiosity was $15.94 billion. It rose steadily over the next week, reaching $20.11 billion by July 17. Just like the futures market, a notable spike in choices open curiosity was seen from July 15 onwards, mirroring Bitcoin’s value enhance. This surge additionally exhibits a major enhance in exercise from merchants, who rushed to capitalize on value actions.

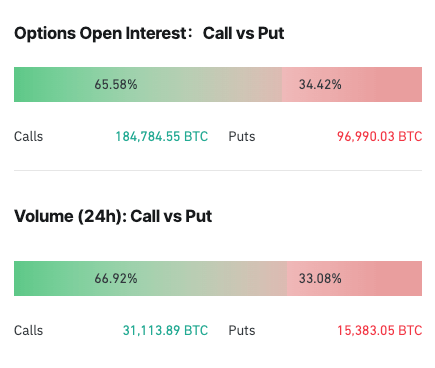

The distribution of calls and places exhibits that over 65% of open curiosity and quantity are calls. Which means that a smaller share of merchants are hedging towards draw back dangers and anticipating additional value will increase on which they need to capitalize. Choices present a mechanism for merchants to leverage their positions with managed danger, which is especially engaging during times of value volatility.

The synchronized rise in each futures and choices open curiosity alongside the worth enhance exhibits how built-in the Bitcoin market is. Because the spot value rallies, it attracts extra futures contracts and prompts elevated choices exercise, indicating a complete response from the market utilizing advanced buying and selling devices.

Moreover, the correlation between open curiosity and value exhibits that the derivatives market loves optimistic value motion. Sideways value motion results in considerably decrease open curiosity in futures and choices, whereas value will increase entice new cash into the derivatives market.

The put up Bitcoin’s rally rekindles the derivatives market appeared first on CryptoSlate.