On-chain Highlights

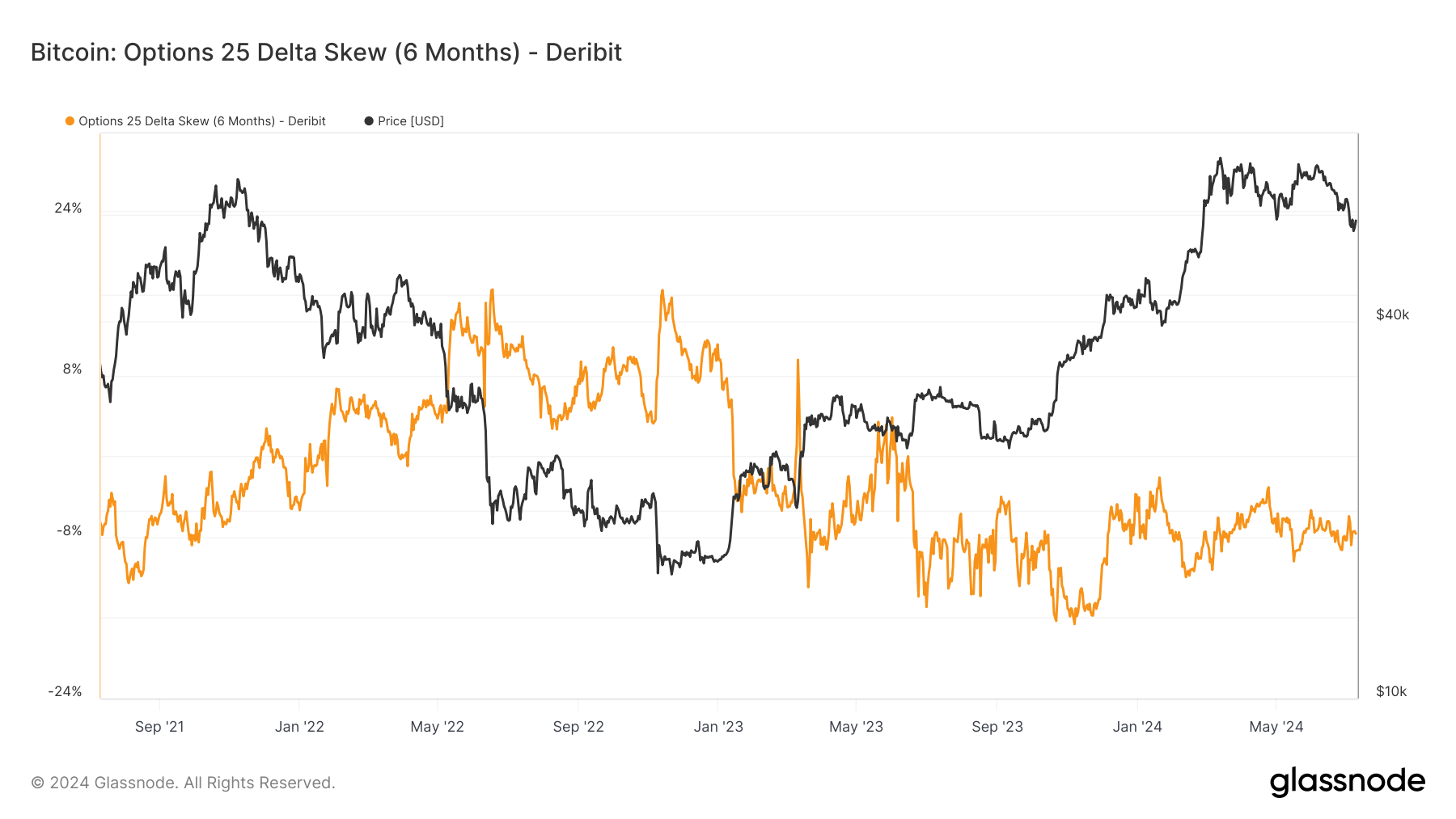

DEFINITION: Skew is the relative richness of put vs name choices, expressed when it comes to Implied Volatility (IV). For choices with a selected expiry, 25 Delta Skew refers to places with a delta of -25% and calls with a delta of 25% to show this distinction out there’s notion of implied volatility. 25 Delta Skew is calculated because the distinction between a 25-delta put’s implied volatility and a 25-delta name’s implied volatility, normalized by the ATM Implied Volatility. This metric focuses on possibility contracts expiring in 6 months.

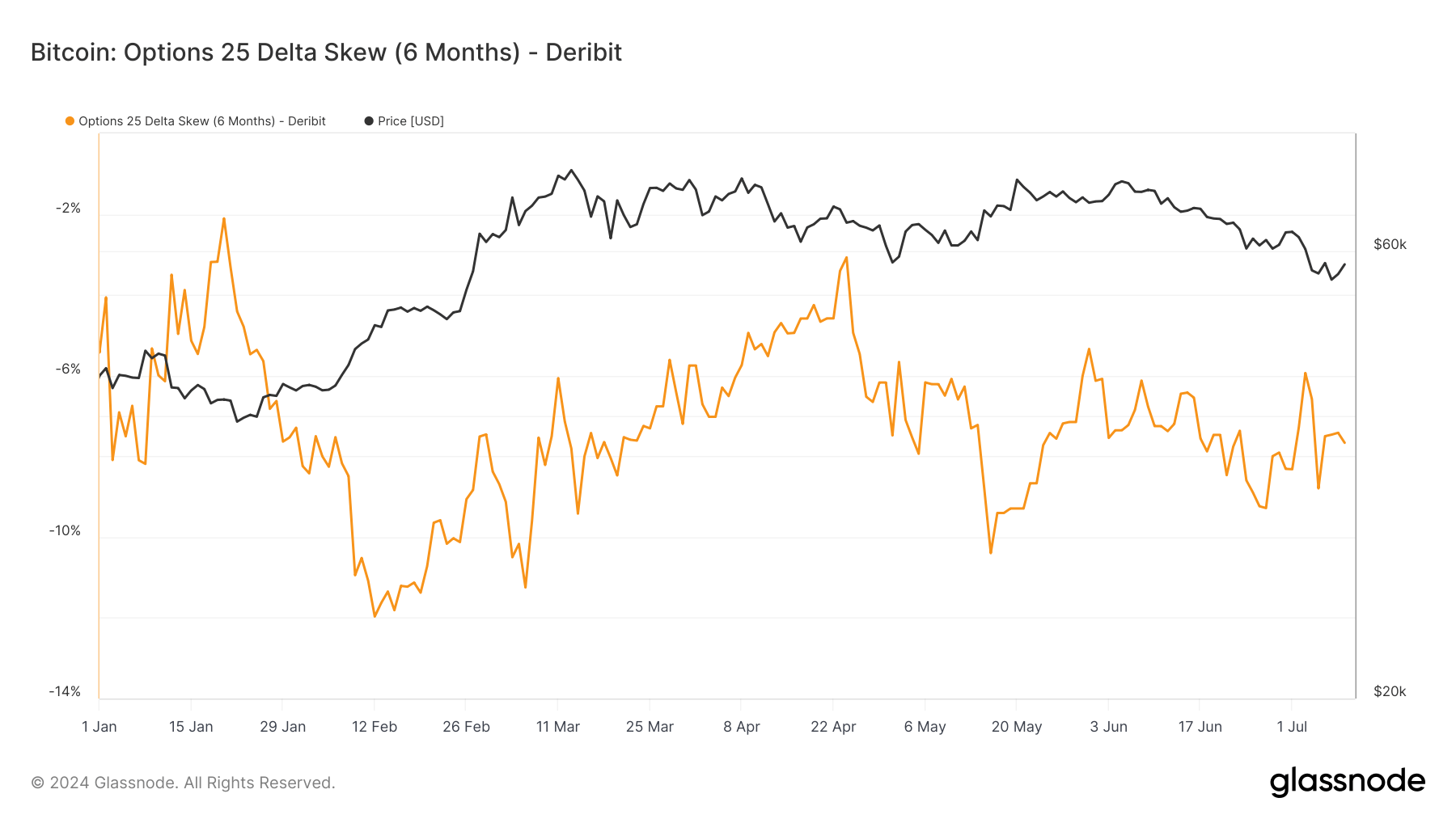

Bitcoin’s 25 Delta Skew for choices expiring in six months has proven notable fluctuations lately. The metric has moved considerably since January 2024. Initially, the skew was round -6%, indicating a choice for places. By late February, it dipped additional to -12%, suggesting a bearish sentiment.

A skew of -12% implies that the implied volatility for the put choices (with a delta of -25%) is 10% decrease than the implied volatility for the decision choices (with a delta of 25%).

Implied volatility measures how a lot the market expects the underlying asset’s worth to maneuver. If places have decrease implied volatility than calls, it means that the market expects much less downward motion (or threat) within the underlying asset’s worth in comparison with upward motion.

This distinction is then normalized by the ATM implied volatility, which is the implied volatility for choices the place the strike worth is roughly equal to the underlying asset’s present worth.

Following the April 2024 halving, the skew maintained a put premium, reflecting a slight bearish sentiment. The value of Bitcoin corresponded with a drawdown, peaking close to $70,000 in mid-March earlier than stabilizing round $55,000 by July.

This current development suggests a bearish outlook amongst choices merchants.

Traditionally, the skew hit an all-time excessive in late 2022 on the backside of the market and its lowest in late 2023 when BlackRock filed for its spot Bitcoin ETF. The skew has solely been constructive for round 10 months in complete since 2021, with an total development leaning towards bearish. A part of this purpose may additionally be on account of buyers utilizing choices contracts to hedge lengthy purchases.