Fast Take

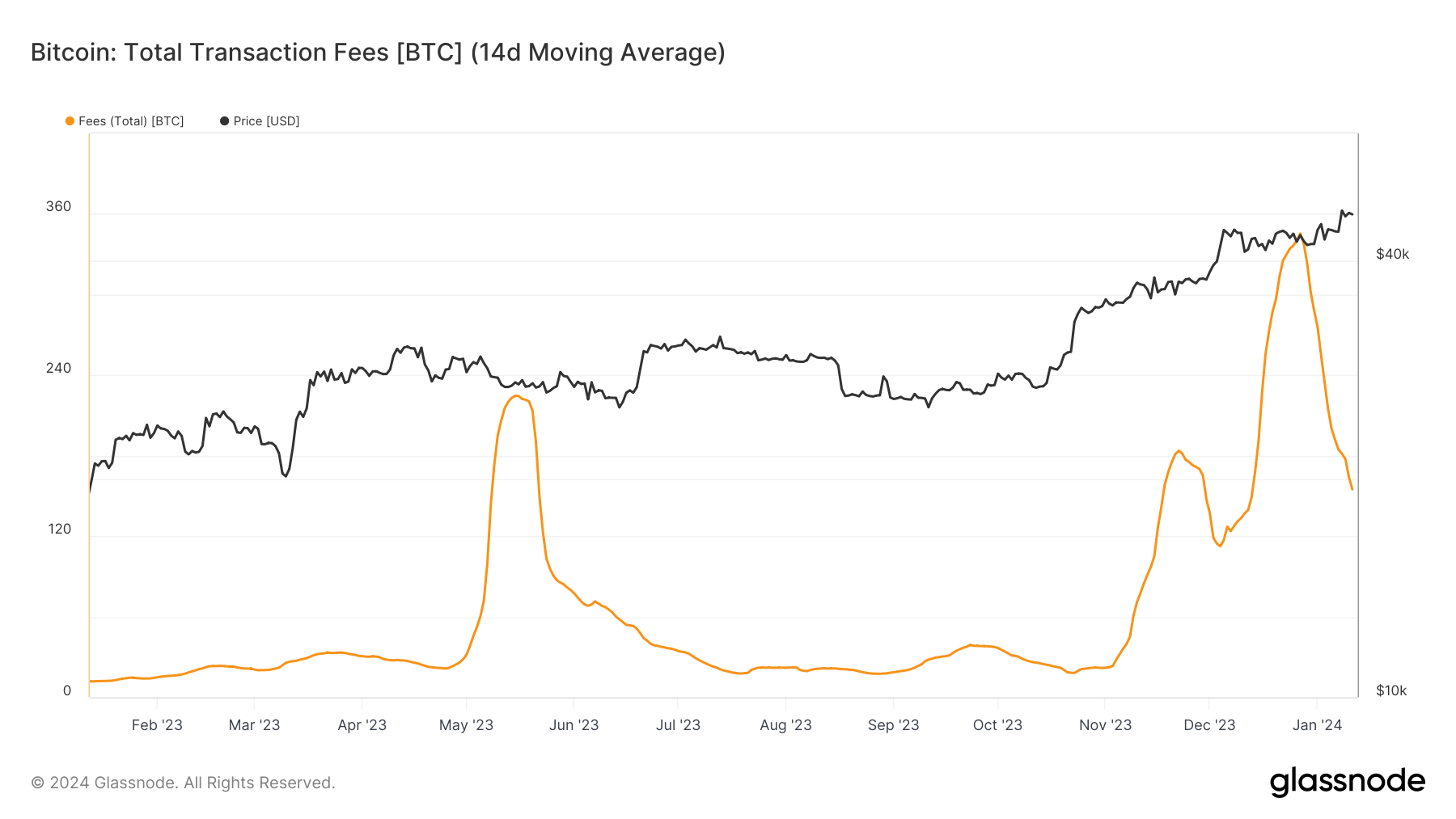

A marked shift in Bitcoin’s charge construction has turn out to be noticeable because the digital asset continues to fluctuate. Bitcoin’s charges have seen a big lower of fifty% from the height of its latest mini-bull run.

In numerical phrases, by the top of Dec. 2023, the overall quantity paid to miners in charges stood at roughly $15 million, which has dwindled to round $7 million. This state of affairs means that we’re in barely uncharted territory, simply above the zenith of the “inscription frenzy” noticed in Might 2023.

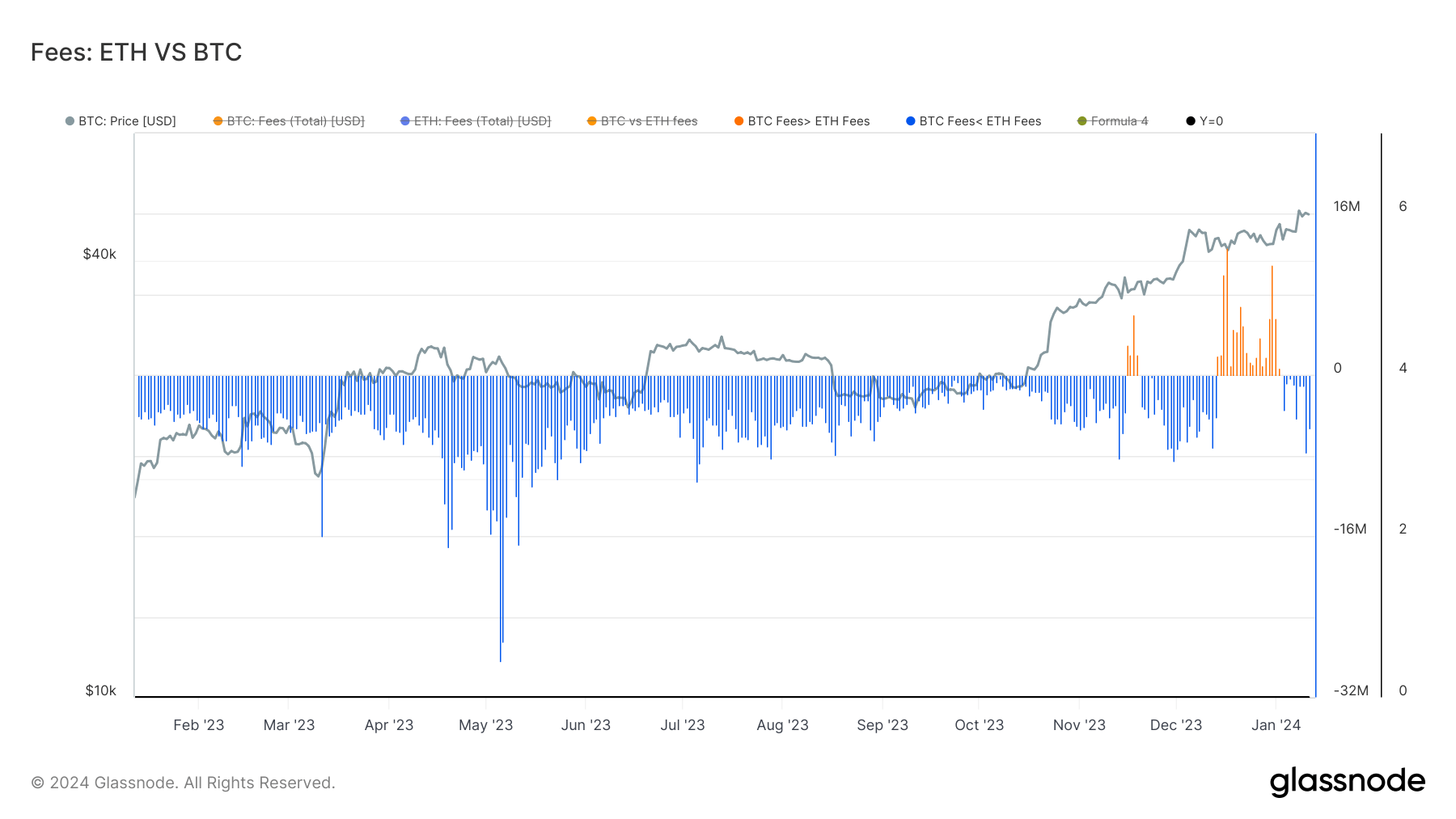

The proportion of miner income derived from charges, calculated as charges divided by the sum of charges and minted cash, at present sits at about 14%, a drop from its peak of 25%. Whereas Bitcoin reveals these adjustments, Ethereum’s charges have maintained a steadier course, persistently outpacing Bitcoin’s since Jan. 3.

These contrasting developments in charge buildings spotlight the distinctive dynamics between Bitcoin and Ethereum, additional underlining the need for traders and miners to observe and contemplate such components intently of their strategic decision-making.

The publish Bitcoin’s miner charge income plummets by 50% from latest highs appeared first on CryptoSlate.