Fast Take

Bitcoin, usually dubbed “digital gold,” shares some traits with the dear metallic, although the 2 are perceived in another way in funding circles. Whereas Bitcoin (BTC) is taken into account a “risk-on” asset, favored during times of market optimism, gold is considered as a “risk-off” asset, most popular throughout uncertainty.

The Aug. 5 sell-off, pushed by the unwinding of the yen carry commerce, led to declines in each Bitcoin and gold. This means that in broad market sell-offs, most belongings have a tendency to maneuver in tandem, difficult the notion of sure belongings, like gold, being categorised as “risk-off.”

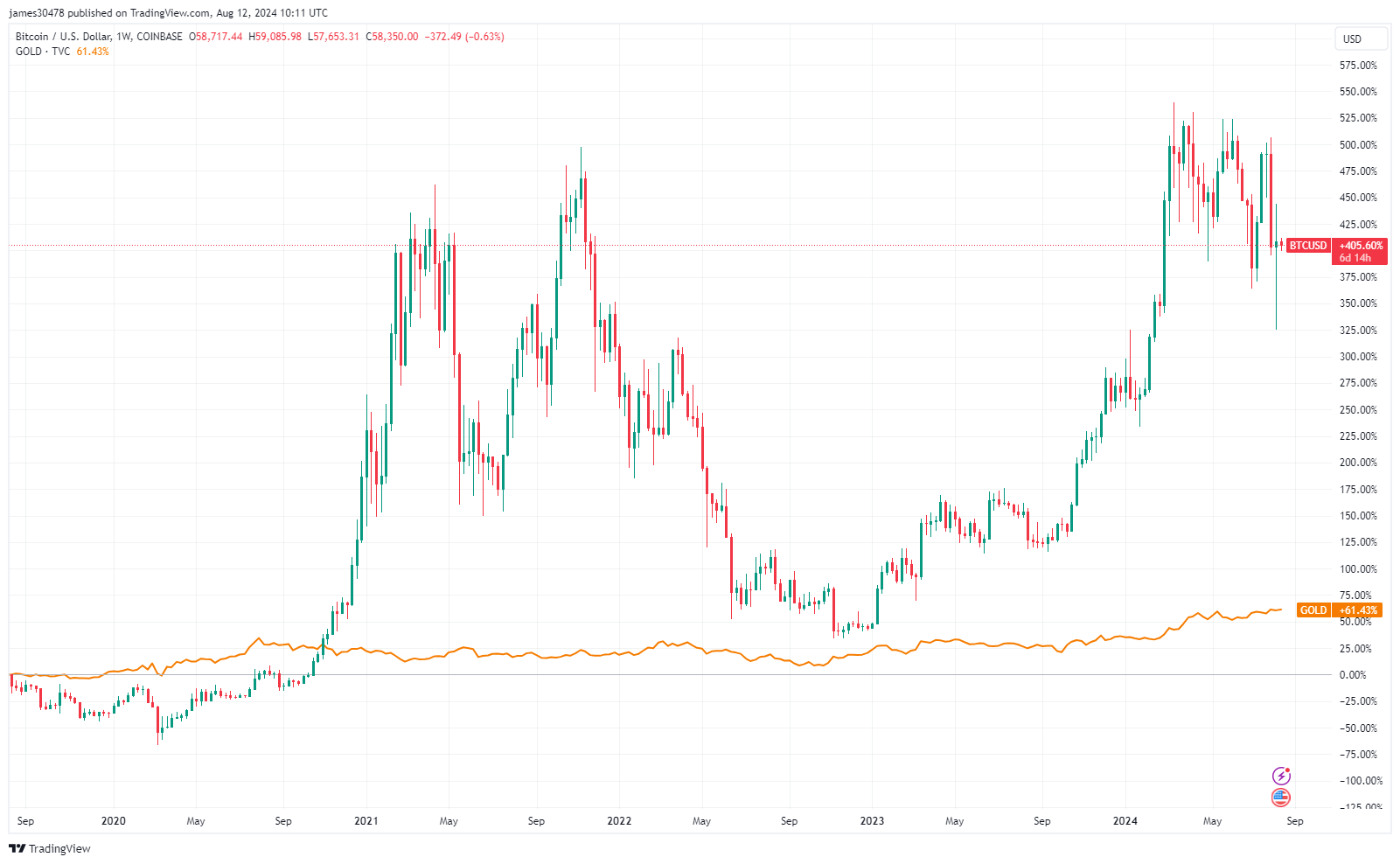

Over the previous 5 years, Bitcoin has delivered spectacular returns of over 400%, in comparison with gold’s 61%. Nonetheless, Bitcoin’s volatility makes it difficult to carry, with important fluctuations each on an absolute and relative foundation.

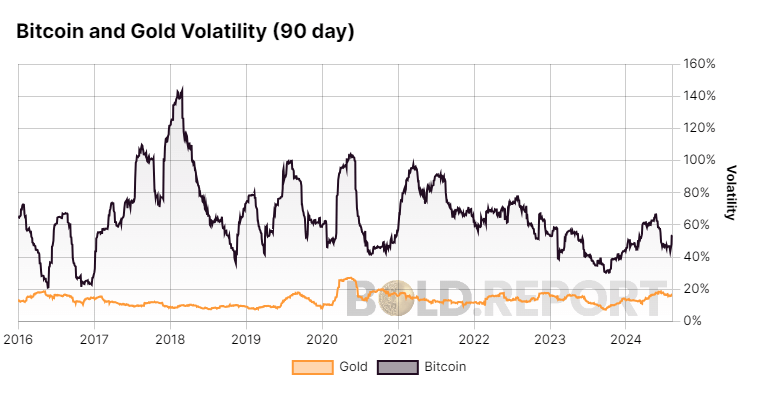

Absolute Volatility

Absolute volatility refers back to the magnitude of value swings over time, and in Bitcoin’s case, it has traditionally been a lot increased than gold’s. For instance, in 2017 and 2018, Bitcoin’s volatility exceeded 100%, although it has since trended downward because the asset matures. Gold’s volatility, in contrast, has remained beneath 20%, in line with the Daring Report.

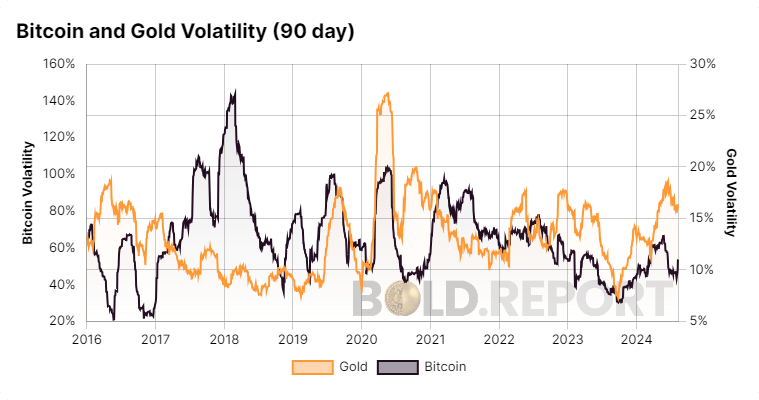

Relative Volatility

Information from the Daring Report additionally reveals relative volatility, which compares the volatility of 1 asset to a different. It additionally signifies Bitcoin’s increased fluctuations, although these have decreased over time.

The Daring Report tracks the Daring ratio weightings by ByteTree, an index weighted at 25% Bitcoin and 75% gold. This ratio has elevated from 19% in June 2021, reflecting Bitcoin’s rising stability and maturity as a monetary asset. As Bitcoin continues to mature, this ratio might rise additional.