Fast Take

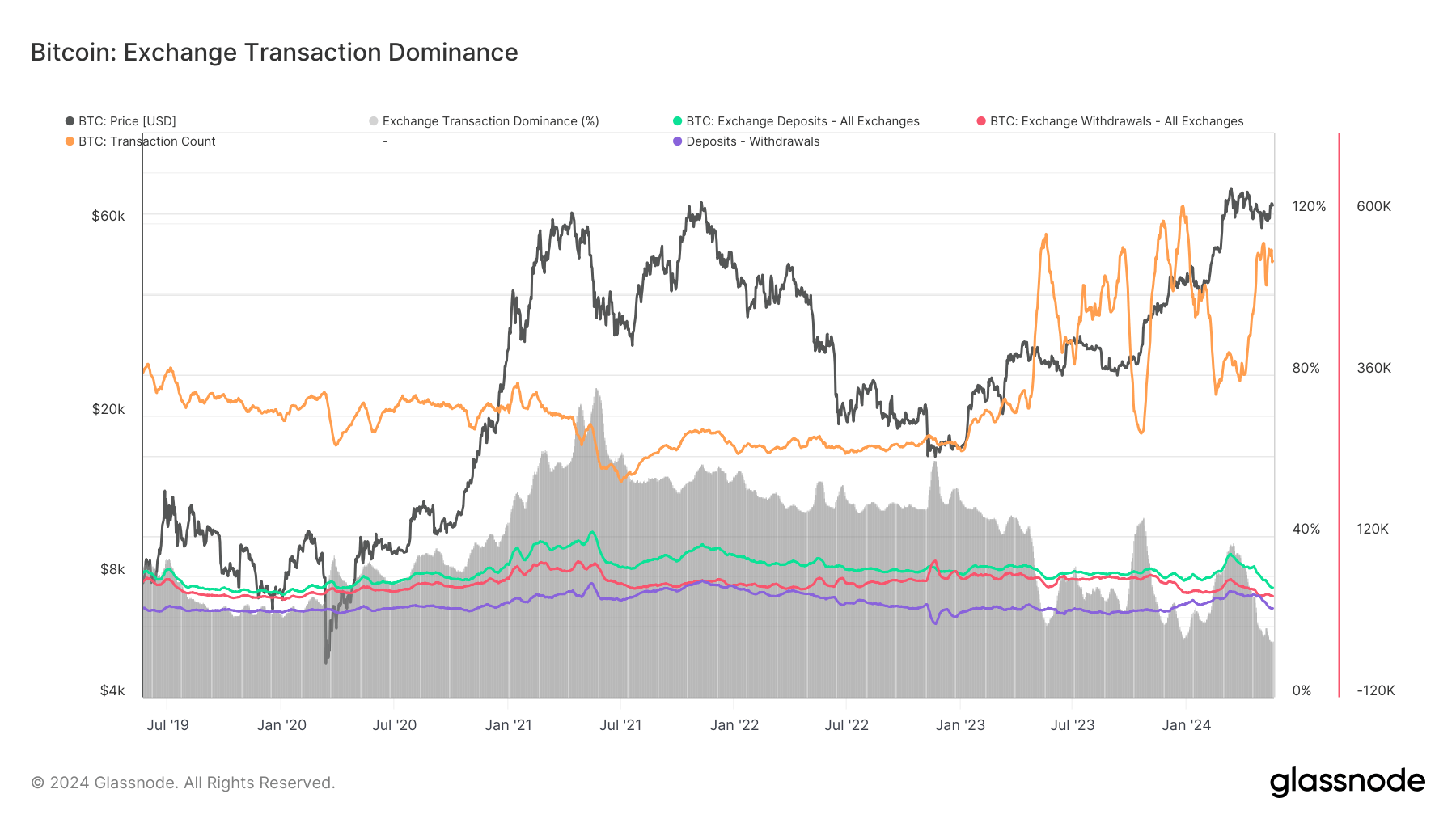

Traditionally, deposits onto exchanges are likely to outpace withdrawals, with one notable exception up to now 5 years occurring throughout the FTX collapse in November 2022 when withdrawals spiked.

Sometimes, Bitcoin deposit surges correlate with worth run-ups, as buyers look to promote their holdings. This was evidenced by the over 90,000 BTC deposited onto exchanges in a single day throughout Bitcoin’s all-time excessive worth peak in March 2024. Since then, deposits have declined to round 43,000 BTC as of Could 19.

Whereas withdrawals have trailed deposits, the hole between the 2 metrics continues to slim. As of Could 19, withdrawals sat at roughly 30,000 BTC, with the distinction between deposits and withdrawals dropping to round 13,000 BTC – the bottom degree since This autumn 2023.

This dynamic means that whereas substantial deposits are nonetheless occurring, indicating promote stress, the diminished distinction factors to lessening web deposits quite than a spike in withdrawals. The discount of deposits each day has helped Bitcoin reclaim its virtually 20% climb from the native backside on Could 1.

The publish Bitcoin’s deposit-to-withdrawal hole reaches smallest margin since This autumn 2023 appeared first on CryptoSlate.