Fast Take

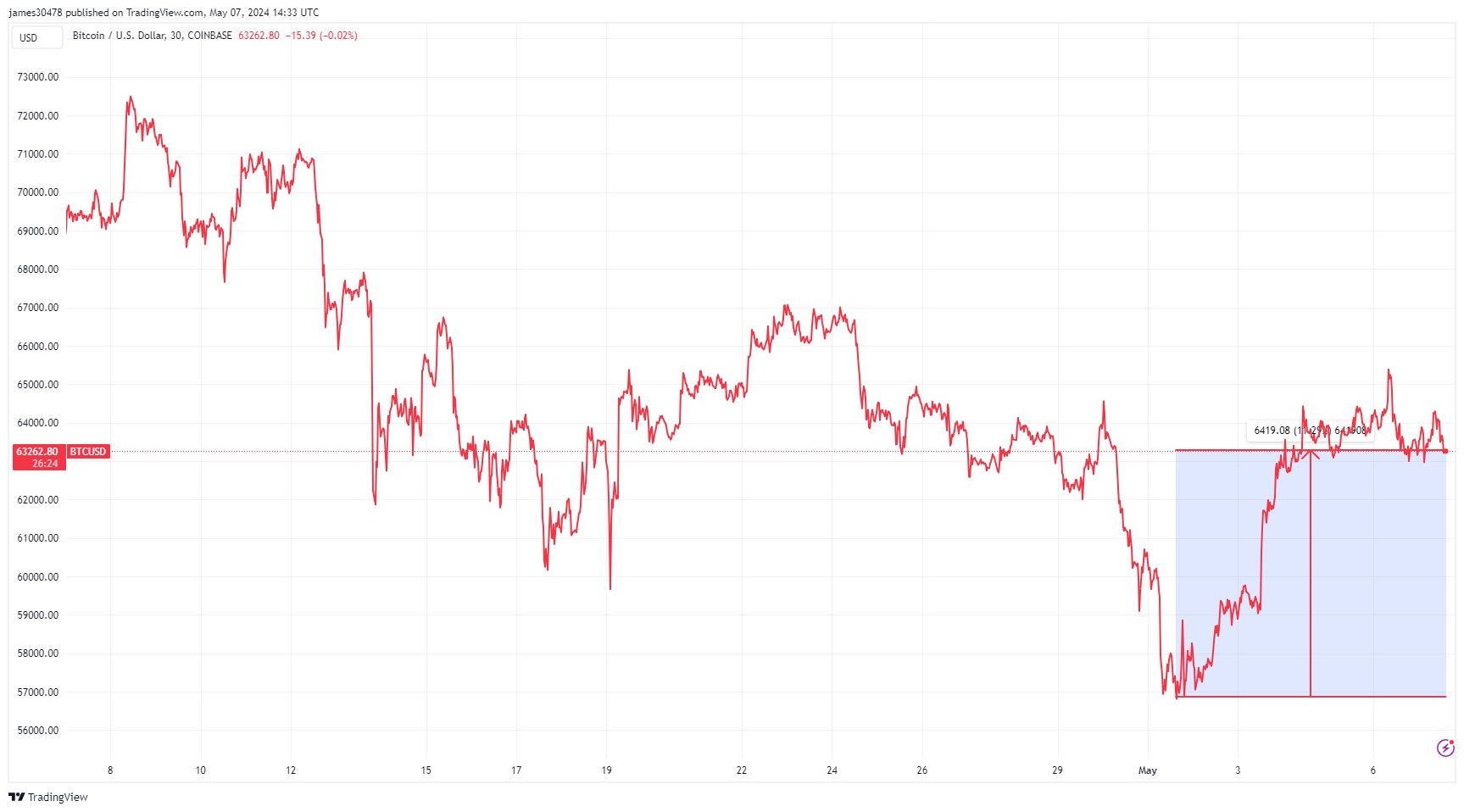

Bitcoin confronted huge promoting strain in April 2024, recording its most vital month-to-month decline of 15% since November 2022, when it dropped over 16%. CryptoSlate beforehand analyzed the components contributing to the dip, discovering that the conclusion of the US tax season, compounded by numerous financial components, prompted the sell-off. Nonetheless, Bitcoin rebounded most of its losses in April and Could.

Bitcoin appeared to have hit a neighborhood backside on Could 1, hitting a low of roughly $56,800. It has since climbed over 11%.

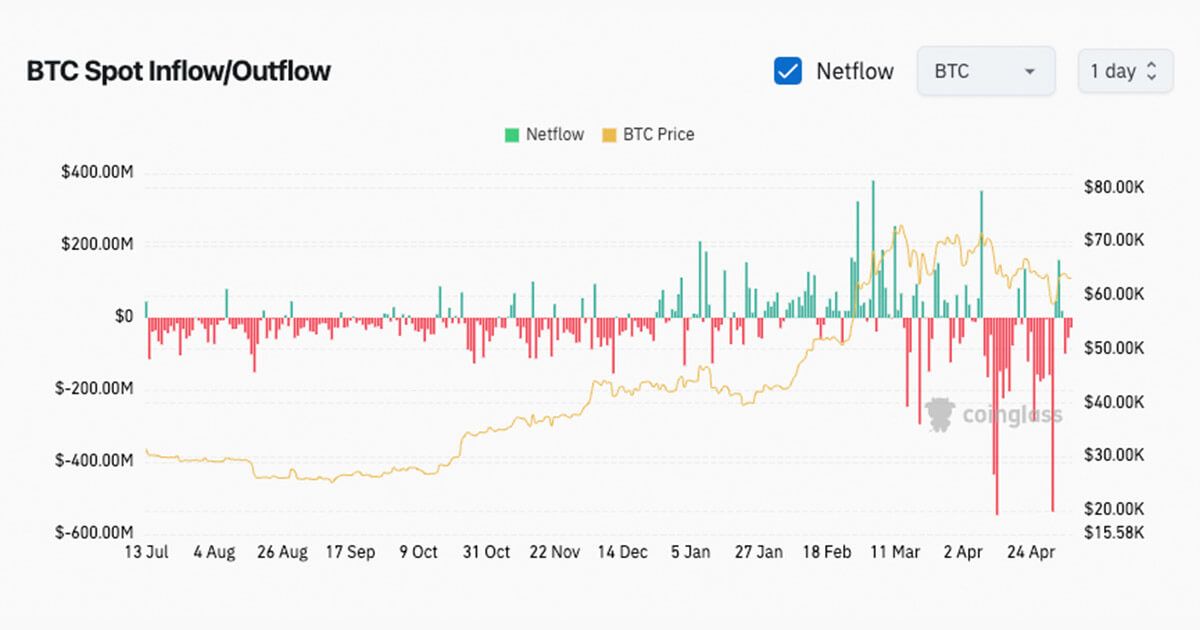

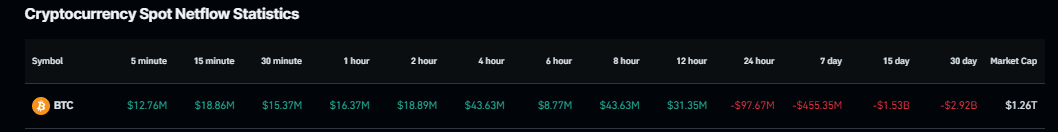

In line with information from Coinglass, Bitcoin noticed substantial internet outflows throughout April and early Could, exceeding $500 million on two events: on April 13 ($547 million) amidst tensions within the Center East and on Could 1 ($536 million). The Could 1 outflows coincided with the largest recorded outflow from the Bitcoin ETFs since its launch. Between April 9 and Could 1, almost each day noticed internet outflows, with solely two exceptions.

Coinglass information exhibits that over the previous 30 days, Bitcoin noticed $2.92 billion in internet outflows.

By way of worth efficiency for the reason that April 20 halving, BTC was buying and selling at roughly $64,000, barely forward of the present worth. This represents the second-weakest post-halving efficiency, simply forward of the primary epoch. Nonetheless, historic information suggests that almost all Bitcoin worth beneficial properties come after the halving. Due to this fact, it will be untimely to evaluate BTC’s efficiency within the present cycle at this stage.