The Bitcoin worth has not too long ago proven indicators of restoration, climbing again to the $58,000 degree after hitting a five-month low of $53,500. Nonetheless, technical evaluation means that the digital asset might battle to surpass essential indicators, probably revisiting cheaper price ranges.

In a latest submit on social media platform X (previously Twitter), market professional Jackis highlights the bearish D1 pattern indicator on the 12-hour chart, indicating the necessity for Bitcoin to reclaim the $64,000 zone to reverse the prevailing bearish every day pattern.

Regardless of this cautionary outlook, there are encouraging indicators, together with important inflows to Bitcoin exchange-traded funds (ETFs) and long-term holders accumulating extra BTC.

BTC Struggles To Break Bearish Development

Regardless of the latest restoration, Bitcoin’s technical evaluation means that the bearish pattern stays. Jackis emphasizes that even when the Bitcoin worth makes a brand new leg greater to $60,300, the D1 pattern indicator stays bearish until BTC manages to recapture the $64,000 zone, which has already confirmed to be a serious resistance for the bulls, as the worth of BTC didn’t breach it on its earlier try on July 1st.

In line with Jackis’ evaluation, the goal vary for the following every day leg is projected to be between $51,000 and $49,000, with a pivotal degree at $63,800 that bulls should goal to reverse the every day pattern.

Associated Studying

Nonetheless, there may be potential to reverse this case as “dip consumers” have returned, leading to important inflows into the US Bitcoin ETF market, supporting the Bitcoin worth this week to forestall a deeper retracement with consecutive days of inflows to handle promoting stress from the German authorities’s holdings.

ETF Influx Information And Bitcoin Worth Efficiency

JPMorgan information reveals that spot Bitcoin ETFs witnessed inflows of $882 million in the course of the week ending July 11, with a mean of $175 million per day, marking the very best inflows since Might 23.

BlackRock’s IBIT ETF and Constancy’s FBTC led the surge, attracting $403 million and $361 million, respectively. Nonetheless, Grayscale’s ETF continued its pattern of outflows, dropping almost $87 million after three weeks of outflows within the ETF market totaling over $1.1 billion.

Associated Studying

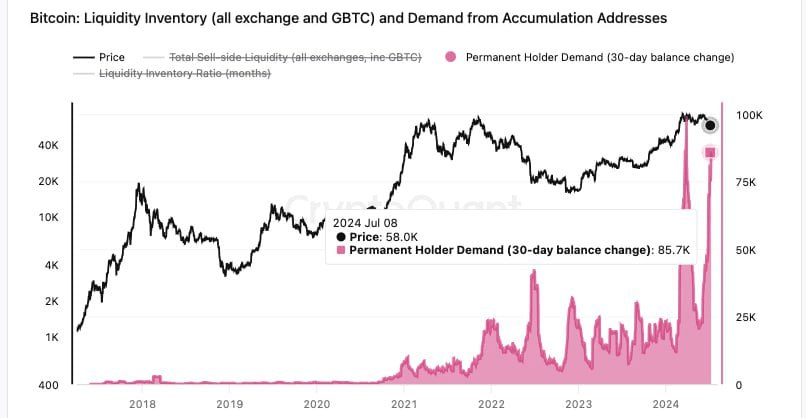

Supporting the bullish outlook, crypto analyst CryptoSoulz carried out an in-depth evaluation of Bitcoin’s worth efficiency in July, discovering that long-term holders have accrued BTC, having bought over 85,000 BTC up to now 30 days.

In line with the analyst, this accumulation by long-term holders is a bullish catalyst for the worth, indicating confidence in Bitcoin’s potential.

CryptoSoulz, just like Jackis, means that Bitcoin is presently discovering help within the greater time-frame (HTF), anticipating a bounce from this degree, significantly contemplating the latest bearish information.

Nonetheless, the analyst additional defined that if the Bitcoin worth fails to carry above the $54,000 zone within the coming days, the following degree of help is anticipated at $49,500.

When writing, the Bitcoin worth stands at $58,300, surging merely 0.7% within the 24-hour time-frame as BTC appears to consolidate above the aforementioned essential ranges.

Featured picture from DALL-E, chart from TradingView.com