Fast Take

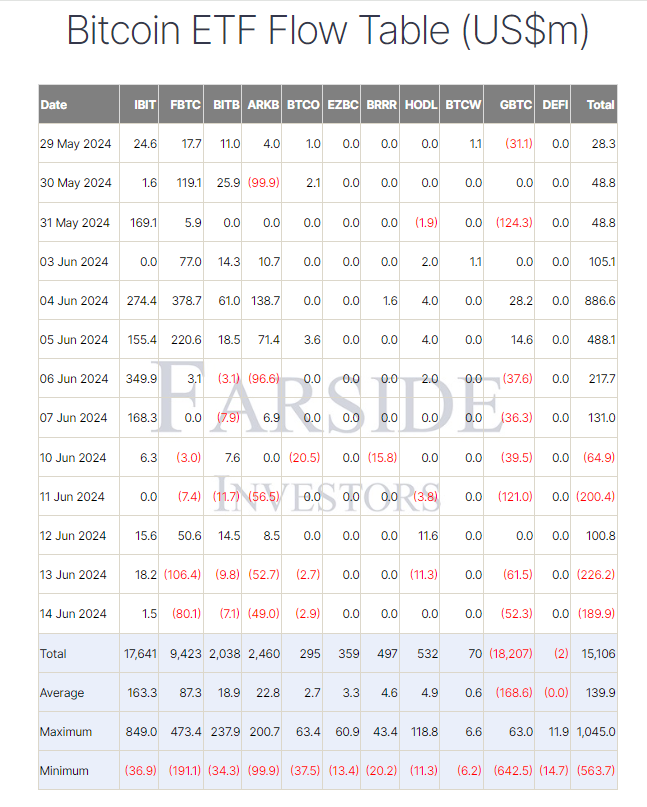

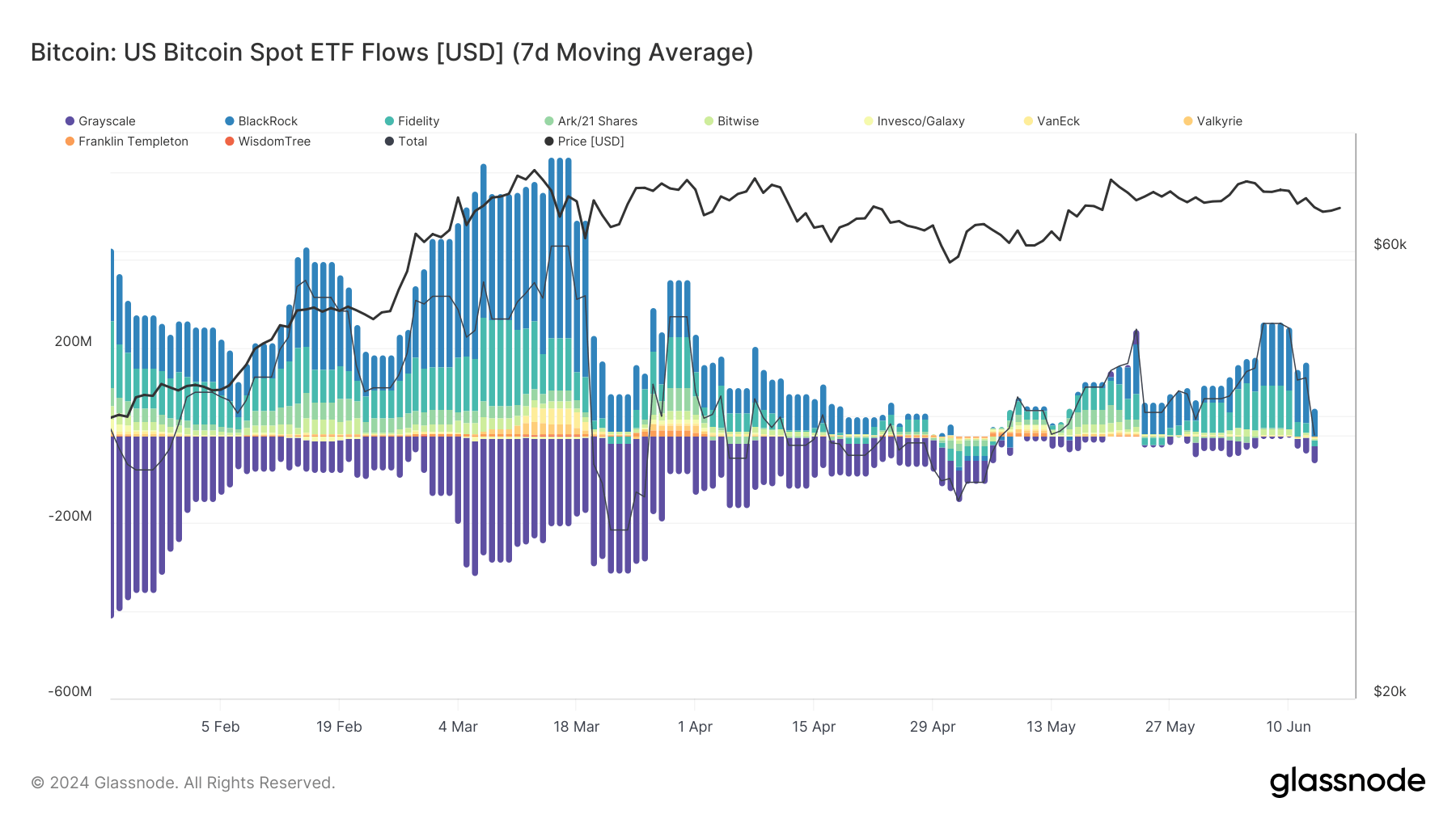

Since June 10, Bitcoin has skilled a notable decline, dropping from roughly $72,000 to as little as $65,200. This drop coincides with important exercise in Bitcoin exchange-traded funds (ETFs), which have seen round $580.6 million in outflows, in accordance with Farside information.

This starkly contrasts the earlier record-setting 19 consecutive buying and selling days of inflows, amounting to roughly $4 billion, which coincided with Bitcoin’s worth from round $60,000 to $72,000 between Might 13 and June 7.

The latest outflows symbolize roughly 4.3% of the overall inflows, aligning with a roughly 10% correction in Bitcoin’s worth.

This discrepancy has led to questions on why Bitcoin’s worth didn’t rise regardless of the substantial inflows. One believable clarification is the “foundation commerce,” a method employed by hedge funds and traders.

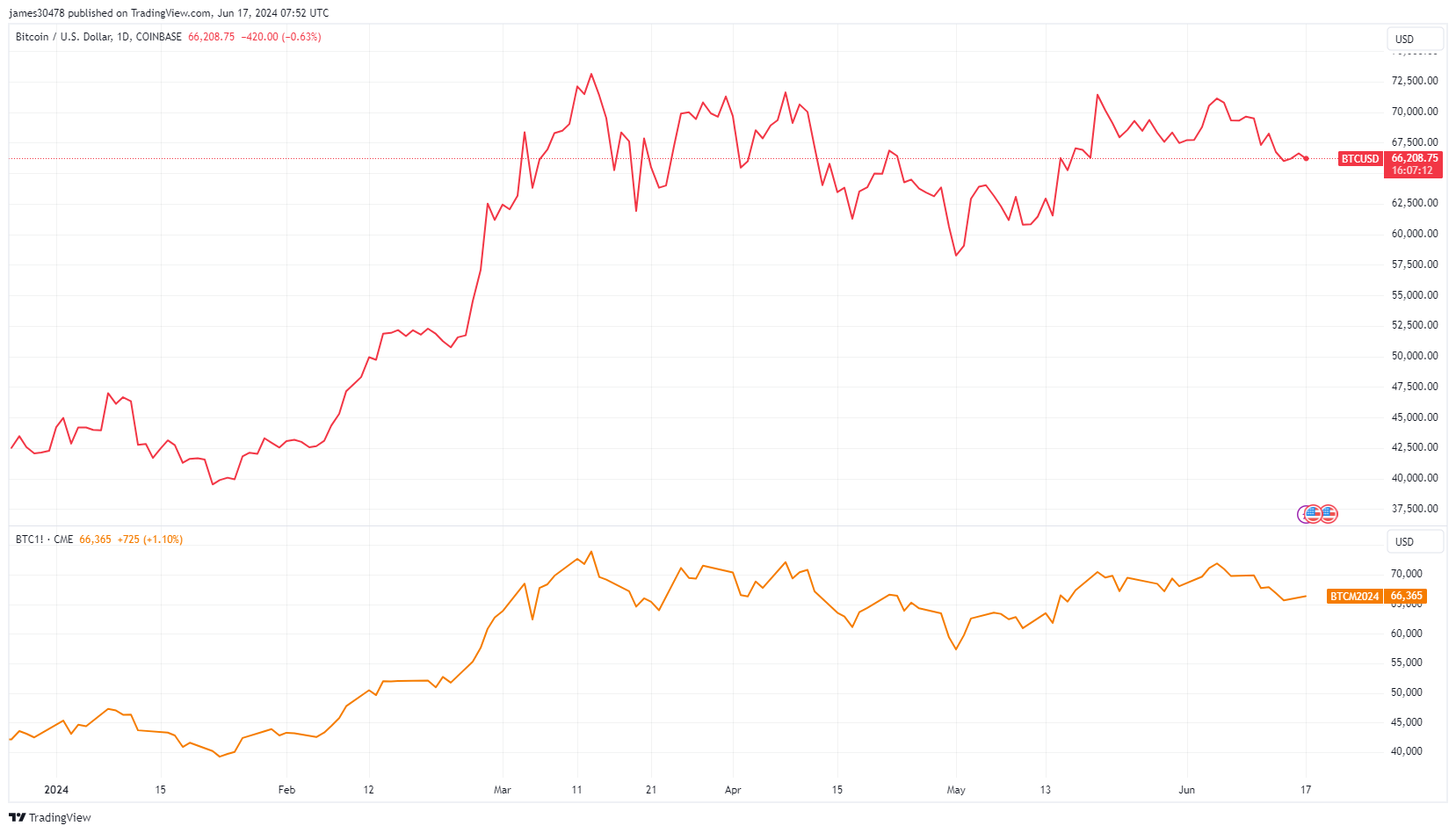

On this technique, traders go lengthy on the underlying spot ETF merchandise and brief the futures market, making a net-neutral commerce that protects them no matter whether or not the value goes up or down. Buyers deal with the unfold between the spot worth and the futures worth, as this differential determines the profitability of the idea commerce.

This method is influenced by the present optimistic funding charges, that are round 6%, in accordance with Coinglass. Merchants are keen to incur greater prices to leverage lengthy positions in Bitcoin, typically utilizing calendar futures on the CME. These futures, buying and selling at a premium to the spot worth, might be rolled over by means of a course of referred to as “rolling ahead.” The CME defines this as exiting an expiring futures contract whereas concurrently getting into a brand new one with a later expiration date, thus extending the place with out interruption.

By shorting the futures market whereas being lengthy on the spot market, merchants create a hedge that mitigates worth actions, ensuing within the noticed “suppression” of Bitcoin’s worth.

The rolling ahead technique permits merchants to keep up publicity to Bitcoin with out closing their positions at contract expiration. Consequently, the Bitcoin worth is much less delicate to Bitcoin inflows regardless of important flows, providing a possible clarification for why it hasn’t reached new all-time highs following the $4 billion inflow.