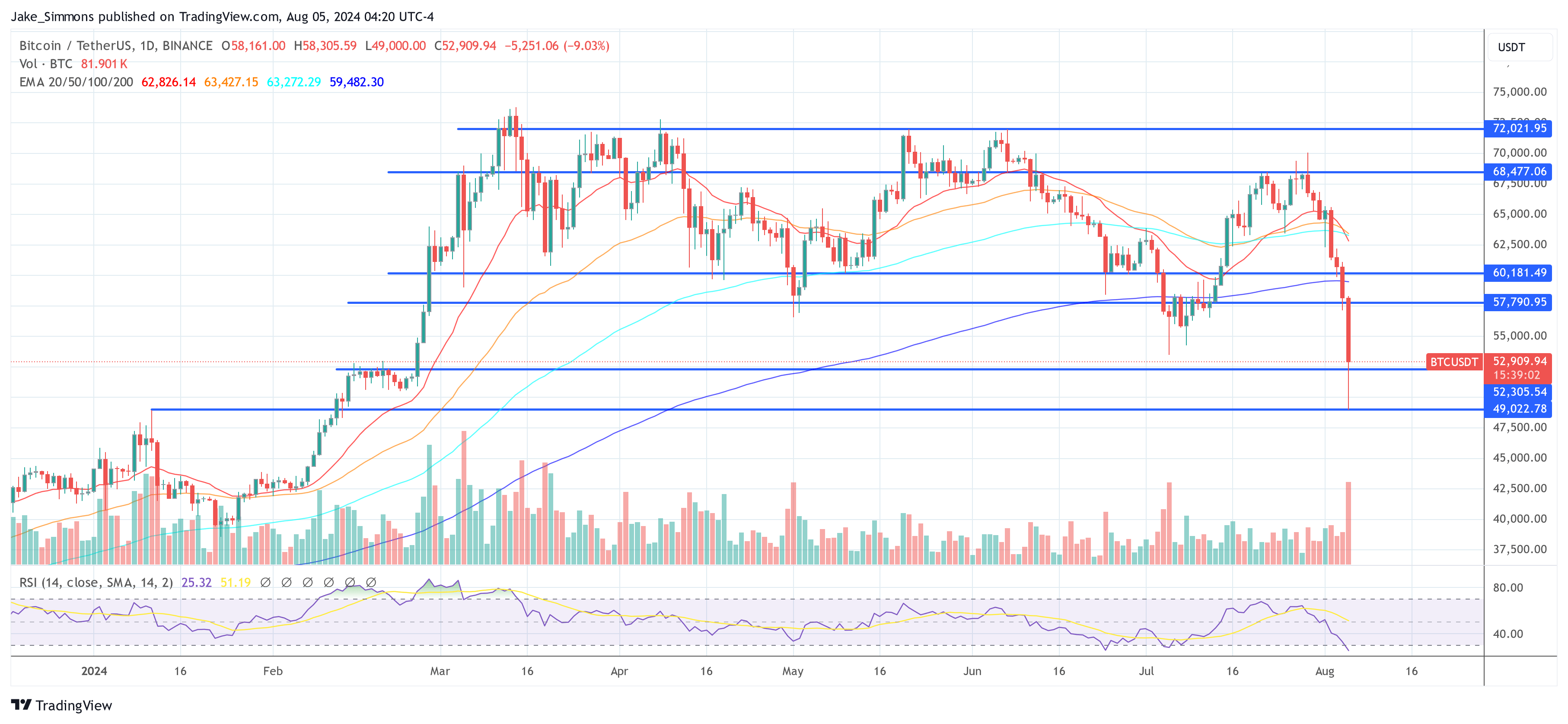

Over the previous 24 hours, the crypto market has witnessed a extreme downturn, with Bitcoin’s value tumbling down 15% to a low of $49,000 on Binance (BTC/USDT), marking a big departure from its $70,000 excessive final week—a 26% crash. Equally, Ethereum (ETH) plunged 39% from $3,400 to $2,100. This downward development was not remoted however echoed throughout the altcoin spectrum, which skilled even steeper declines.

#1 Recession Fears Trigger Bitcoin Crash

The preliminary spark for the present market volatility seems to stem from intensifying fears of a US recession, triggered by unexpectedly weak US job market knowledge on Friday. The July report confirmed a achieve of solely 114,000 jobs—considerably under the Wall Road prediction of 175,000. This was the weakest job progress since December of the earlier yr and almost the bottom because the begin of the COVID-19 pandemic in March 2020.

Charles Edwards of Capriole Investments remarked by way of X, “Each single time the unemployment fee turns up because it has at this time, we now have a recession. Simply because the Fed was too gradual to tighten in 2021, it appears to be like like they had been too gradual to ease in 2024.”

Additional compounding the market’s nervousness was the revelation that Warren Buffett’s Berkshire Hathaway bought about 50% of its Apple holdings. This sell-off by one of many world’s most watched traders was interpreted as a transfer to hedge in opposition to potential market downturns, contemplating Berkshire Hathaway disclosed holding a file $277 billion in money in its Q2 report.

Associated Studying

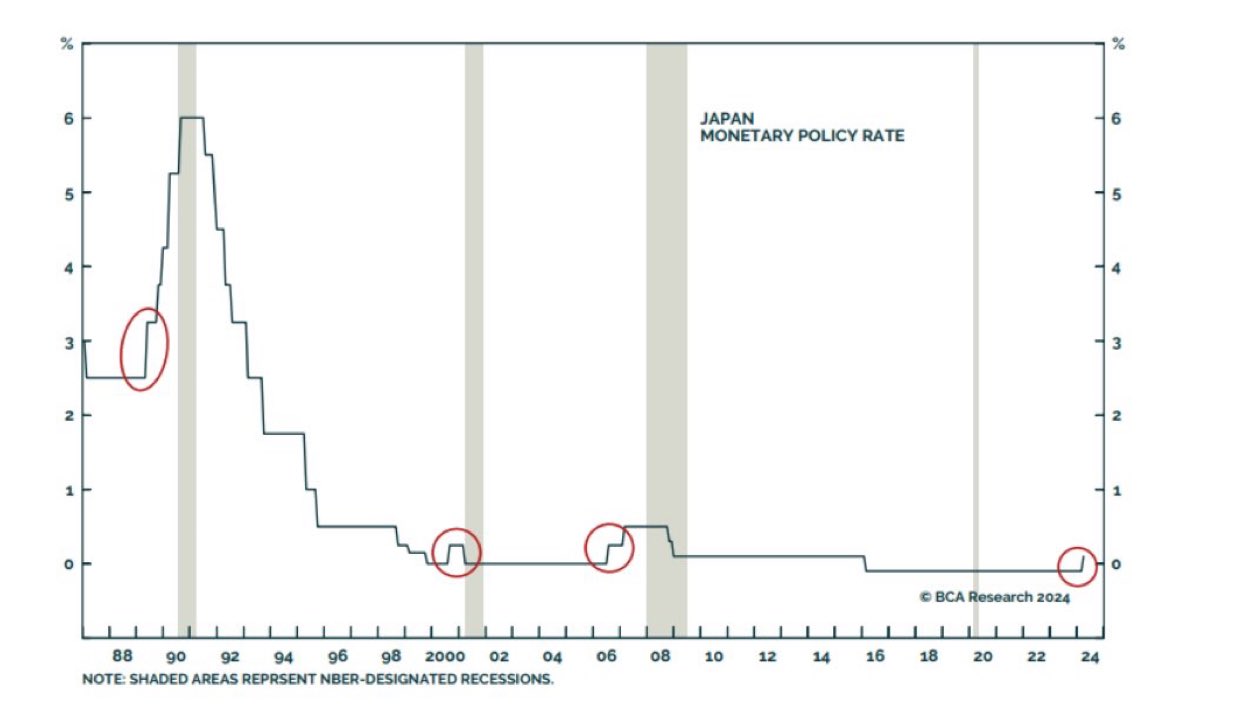

Moreover, the Financial institution of Japan’s determination to lift its key rate of interest to about 0.25% from a spread of zero to about 0.1% has had vital implications. This fee hike, the second since 2007, despatched shockwaves by means of the monetary sectors globally. Traditionally, fee hikes by the Japanese central financial institution have been precursors to international recessions. Following the announcement, the Nikkei skilled its largest 2-day drop in historical past, surpassing even the declines seen on Black Monday in 1987.

Nick Timiraos, sometimes called the “Fed’s mouthpiece” and a reporter for the Wall Road Journal, revealed, “Goldman Sachs says there are good causes to suppose the rising unemployment fee within the weak-across-the-board July payroll report is much less fearsome than regular…However raises its recession-probability-tracking odds to 25% from 15%.”

Goldman Sachs additionally adjusted its expectations for the Federal Reserve’s coverage response, anticipating fee cuts at every upcoming assembly, with a risk of a extra aggressive 50 foundation level lower if the August employment report mirrors July’s weak spot.

#2 Yen Carry Commerce Unwind

Additional exacerbating the market’s fall was a big motion within the foreign exchange markets, significantly with the Japanese yen. After the Financial institution of Japan raised its key rate of interest, the yen strengthened significantly in opposition to the US greenback. This transfer pressured merchants who had engaged within the “yen carry commerce”, borrowing yen at low charges to buy higher-yielding US belongings.

Associated Studying

Adam Khoo famous, “The sharp rise within the JPY/USD is inflicting an enormous unwind of yen carry commerce positions and contributing to the sharp decline in US shares.” The reversal of those trades has in all probability not solely impacted the foreign exchange and inventory markets but in addition had a cascading impact on Bitcoin and crypto as belongings are liquidated to cowl losses and repay yen-denominated liabilities.

BitMEX founder Arthur Hayes commented by way of X, “My TradFi birdies are telling me any person huge bought smoked, and is dumping all #crypto. No thought if that is true, I received’t title names, however let the fam know in case you are listening to the identical?????”

#3 Soar Buying and selling And Giant Sellers

There have been uncommon promote orders recorded throughout main exchanges similar to Kraken, Gemini, and Coinbase, predominantly on a Sunday, which is usually a quieter buying and selling day. This implies orchestrated actions by giant gamers, probably involving the unwinding of positions by companies like Soar Buying and selling.

Soar Buying and selling has reportedly been concerned in substantial unloading of Ethereum, amounting to about $500 million price over the previous two weeks. Market rumors counsel that the corporate’s sell-off might be a strategic exit from its crypto market-making ventures or an pressing want for liquidity. Ran Neuner commented by way of X: “I’m watching this promoting by Soar Buying and selling […] They’re the neatest merchants in world, why are they promoting so quick on a Sunday with low liquidity? I’d think about they’re being liquidated or have an pressing obligation.”

Dr. Julian Hosp, CEO of the Cake Group, advised on X: “The explanation for the loopy crypto unload appears to be Soar Buying and selling, who’re both getting margin referred to as within the conventional markets and wish liquidity over the weekend, or they’re exiting the crypto enterprise on account of regulatory causes (Terra Luna associated). The sell-off is relentless atm.”

Moreover, Mike Alfred highlighted the opportunity of misery throughout the market, suggesting that a big Japanese fund may need collapsed, holding substantial quantities of Bitcoin and Ethereum. “A giant Japanese fund blew up. Sadly, it was holding some Bitcoin and Ethereum. Soar and different market makers sensed the misery and exacerbated the transfer. That’s it. Sport over. On to the following one,” Alfred said.

#4 Liquidation Cascade Exacerbates Bitcoin Worth Crash

The market witnessed a dramatic enhance in liquidations, with CoinGlass reporting that 277,937 merchants had been liquidated within the final 24 hours, resulting in complete crypto liquidations of roughly $1.06 billion. The most important single liquidation order, valued at $27 million, occurred on Huobi for a BTC-USD place.

In complete, $302.07 in Bitcoin longs had been liquidated within the final 24 hours, in keeping with CoinGlass knowledge. These pressured liquidations, pushed by margin calls and stop-loss orders, have amplified the downward strain on cryptocurrency costs, pushing them additional into the purple.

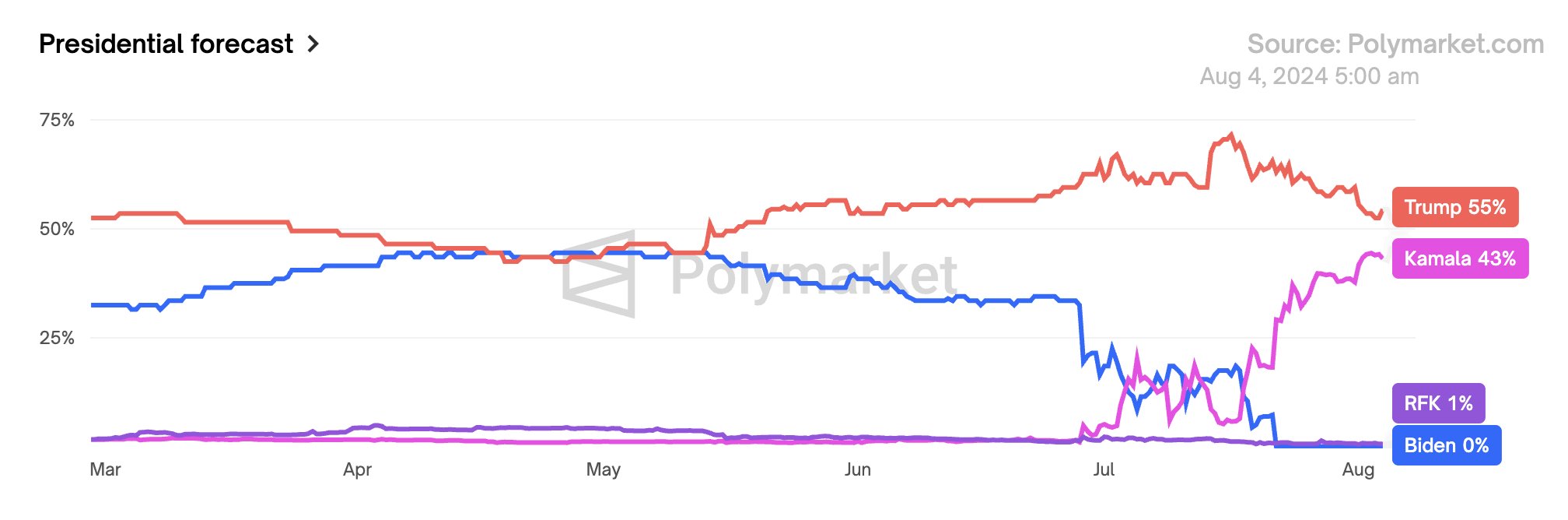

#5 Trump Momentum Fades

One other much less vital issue might contain the shifting political panorama, as Kamala Harris positive aspects in keeping with Polymarkets in opposition to Donald Trump (Harris 43% vs. Trump 55%). This shift is perceived negatively by the Bitcoin and crypto market. The complete market is favoring a Trump win. He desires to construct a “strategic Bitcoin stockpile” and over the weekend stated BTC might be used to repay the US debt of $35 trillion.

#6 Mt. Gox Distributions Nonetheless Affecting Market Liquidity

Lastly, the continuing distribution of Bitcoins from the defunct Mt. Gox trade continues to affect the market. As former customers of the trade obtain and probably promote their returned Bitcoins, this has added to the promoting strain available on the market, additional miserable costs.

At press time, BTC bounced off the assist and recovered to $52,909.

Featured picture created with DALL.E, chart from TradingView.com