The volatility Bitcoin skilled this week had a very fascinating impression on the derivatives market. Between June 23 and June 27, BTC misplaced its comparatively steady help at above $64,000 and dropped to $60,000, with a short dip beneath $60,000 earlier than recovering on June 25.

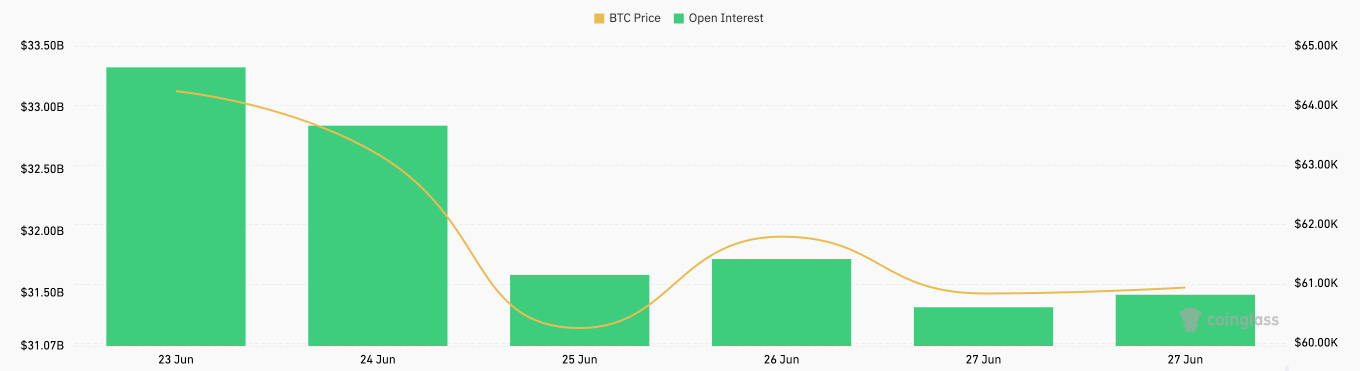

Whereas the value drop won’t appear that important when long-term value motion, a drop beneath $60,000 is a crucial psychological milestone for merchants. For this reason the 6% drop had a notable impression on derivatives. Open curiosity in Bitcoin futures dropped from $33.33 billion on June 23 to $31.39 billion on June 27, reaching its lowest level since Might 17.

The first purpose for this lower was pressured liquidations. As the value fell sharply, a big variety of merchants with leveraged lengthy positions possible confronted margin calls. Unable to satisfy these calls in time, their positions had been liquidated, which might have added to the promoting stress and led to an additional drop in open curiosity.

This usually creates a suggestions loop, exacerbating the value decline as liquidations set off further sell-offs. Moreover, the declining value possible prompted merchants to develop into extra risk-averse. With heightened volatility and uncertainty, merchants might need been discouraged from opening new futures contracts, opting as an alternative to cut back publicity till the market stabilizes.

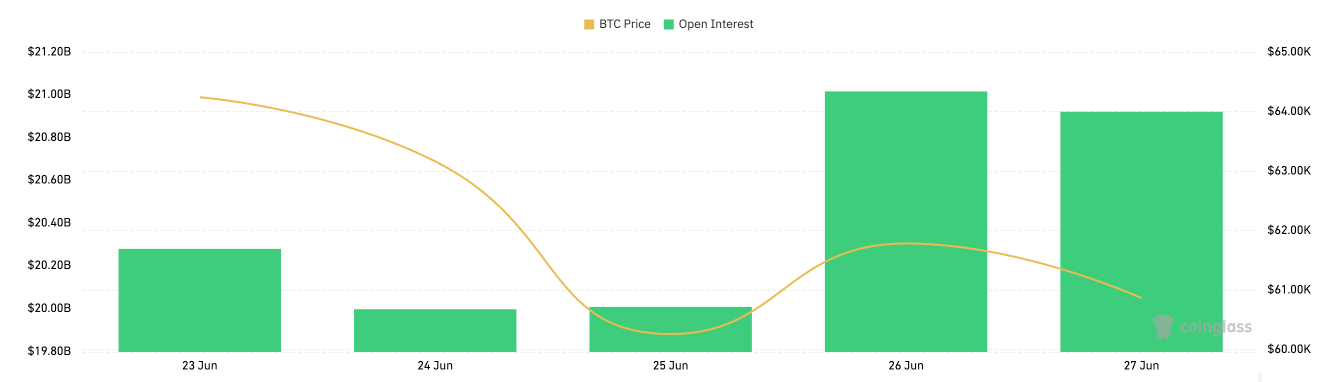

Whereas the futures market contracted, the choices market grew. Open curiosity in Bitcoin choices elevated from $20.28 billion on June 23 to $21 billion on June 26, regardless of a short dip to $20 billion on June 25.

The rise in choices OI throughout this era means that merchants turned to choices as a hedge towards potential value volatility. Choices are a versatile instrument for managing threat, permitting merchants to guard their positions and speculate on value actions with out the identical threat related to futures. The rise in OI, significantly in a interval of value decline, exhibits that merchants had been trying to mitigate threat and place themselves for extra volatility.

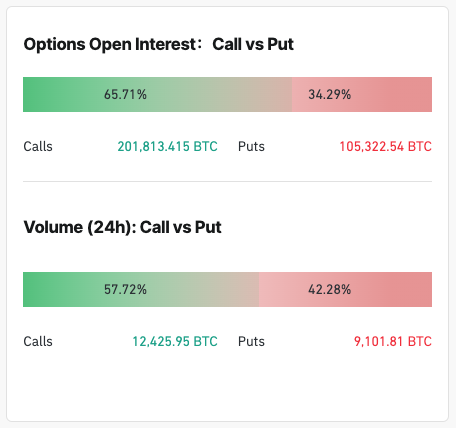

CoinGlass information exhibits that the majority merchants are getting ready for upward volatility. As of June 27, 65.71% of the choices open curiosity consisted of name choices, with the 24-hour quantity favoring calls at 57.72%. The clear dominance of name choices exhibits a bullish sentiment prevailing, and merchants are positioning for value restoration or trying to capitalize on decrease costs with restricted draw back threat.

Arbitrage alternatives between spot, futures, and choices markets might have elevated choices buying and selling exercise. Institutional involvement, with establishments utilizing choices for threat administration and portfolio changes, possible contributed to larger choices open curiosity.

Volatility buying and selling, the place merchants revenue from anticipated adjustments in market volatility, additionally attracted extra exercise within the choices market throughout this era of elevated value swings.

The shifts seen in futures and choices open curiosity present how merchants make use of completely different threat administration methods in response to cost declines. Futures merchants seem to have lowered their publicity as a result of liquidations and elevated threat aversion, whereas choices merchants elevated their publicity for hedging and hypothesis.

The submit Bitcoin volatility sees futures droop, whereas choices open curiosity spikes appeared first on CryptoSlate.