Information reveals the cryptocurrency futures market has seen liquidations amounting to $700 million prior to now day as Bitcoin has gone by means of its volatility.

Bitcoin Has Seen Intense Worth Motion In Previous 24 Hours

The previous day has been a little bit of a rollercoaster for Bitcoin, with the asset registering sharp value motion in each instructions however in the end going up because the bulls win out.

The chart beneath reveals what the value motion for the cryptocurrency has regarded like not too long ago.

The worth of the asset appears to have loved sharp bullish momentum not too long ago | Supply: BTCUSD on TradingView

From the graph, it’s seen that Bitcoin initially witnessed some sharp bullish momentum, during which the coin not solely broke above the $60,000 stage, however went as much as contact the $64,000 mark.

This excessive, which is the height for the yr thus far, solely lasted briefly, nevertheless, as BTC crashed down spectacularly to underneath the $59,000 mark. The asset has since recovered to greater ranges, now floating round $62,700.

The remainder of the cryptocurrency sector has additionally gone by means of its volatility, with costs fluctuating throughout the cash. As is normally the case with such sharp value motion, the futures market has suffered many liquidations.

Crypto Futures Market Has Gone Via A Squeeze In The Previous Day

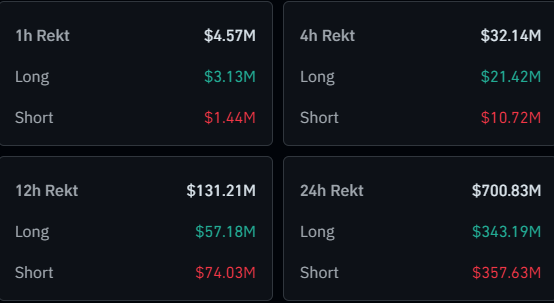

In accordance with information from CoinGlass, the cryptocurrency futures market has witnessed the liquidation of contracts price greater than $700 million within the final 24 hours.

The desk beneath shows the related details about the liquidations.

An enormous quantity of liquidations seem to have occurred prior to now day | Supply: CoinGlass

It could seem that solely $131 million of the liquidations got here inside twelve hours, suggesting that many of the flush was located contained in the previous half-day interval. This is smart, as Bitcoin was most unstable inside this window.

It additionally appears that the long-to-short ratio on this liquidation occasion has been fairly balanced, though the value has elevated prior to now day. This may recommend that some aggressive longing occurred as Bitcoin approached $64,000, and the following pullback wiped these prime consumers.

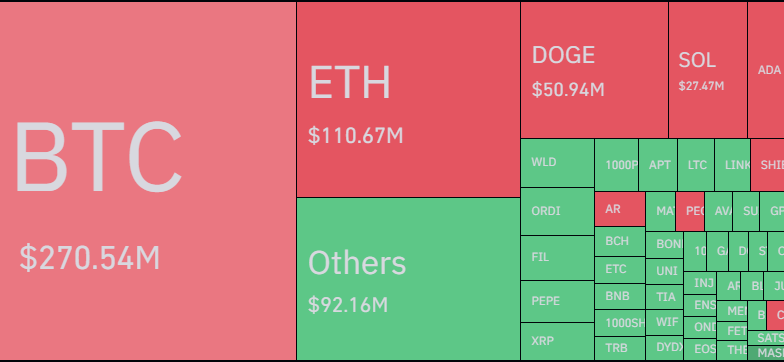

The desk beneath reveals how the distribution has regarded for the assorted symbols.

Seems like BTC has topped the charts as soon as extra | Supply: CoinGlass

As is mostly the case, Bitcoin futures contracts have once more been liable for the most important portion of the entire market liquidations, contributing round $270 million.

What’s totally different this time, nevertheless, is that this share, though the most important, isn’t even half the entire liquidations. This might come right down to the truth that speculators could now be taking part in round with altcoin positions after gaining confidence from the BTC value surge.

Dogecoin, one of the best performer among the many prime cash with its 34% leap, has occupied the most important share among the many alts, with virtually $51 million in liquidations.

Featured picture from André François McKenzie on Unsplash.com, CoinGlass.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual threat.