Bitcoin long-term holders are again in revenue following the flagship crypto’s current worth surge. Nevertheless, the identical can’t be mentioned for many short-term holders but, given the degrees at which they bought their Bitcoin holdings.

Solely 0.03% Of Lengthy-term Bitcoin Holder Provide In Loss

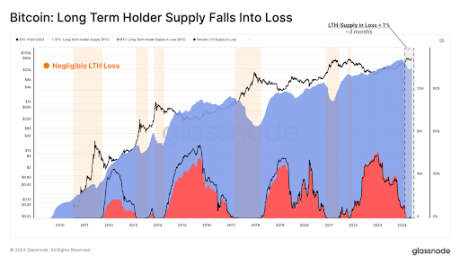

In a current market report, on-chain analytics platform Glassnode claimed that the entire quantity of long-term holder (LTH) provide held in loss is “negligible,” with solely 4,900 BTC (0.03% of LTH) acquired above Bitcoin’s present worth. These long-term holders in loss are mentioned to have been those that purchased the 2021 cycle high and have held since then.

Associated Studying

Lengthy-term holders presently account for over 85% of the Bitcoin provide in revenue. Glassnode famous that this was to be anticipated, provided that the LTH provide in loss through the euphoric section of the bull market “tends in direction of zero.” Due to this fact, this LTH will preserve accounting for many of the provide in revenue because the bull run progresses.

Tokens held for greater than 155 days fall beneath this LTH provide, though most buyers on this class are seemingly those that held with excessive conviction all through the final bear market, whilst Bitcoin dropped under $20,000. Again then, this LTH provide accounted for many of the unrealized losses.

Quick-Time period Holder Provide Accounts For Most Unrealized Loss

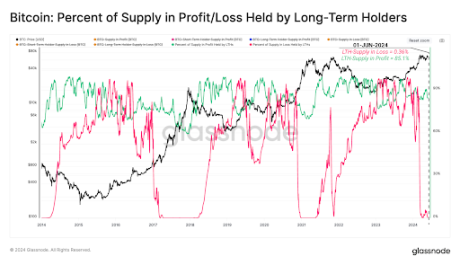

Glassnode revealed that the short-term holder (STH) provide presently accounts for many of the market losses as these buyers proceed to purchase the flagship crypto close to native and world highs. As such, these holders routinely fall again right into a loss at any time when Bitcoin encounters a worth correction.

Knowledge from Glassnode reveals that 1 million BTC (26.6%) out of the three.35 million BTC representing the STH provide are presently at a loss. An amazing 56% (1.9 million BTC) of the STH provide is claimed to have moved into an unrealized loss when Bitcoin just lately skilled a worth drawdown to the $58,000 stage.

Associated Studying

Glassnode additionally revealed {that a} “vital cluster” of STH cash was amassed near the present spot worth. That is vital contemplating how buyers who invested on this area may react to any risky worth fluctuations, regardless of what path they take. A big drop or improve in Bitcoin’s worth could lead on these buyers to dump their tokens.

Apart from these short-term holders, Glassnode instructed that the ‘Single-Cycle holders’ are one other group of buyers to regulate. These buyers have been holding a “vital magnitude of unrealized revenue” since Bitcoin broke above the $40,000 vary. They already took some income when Bitcoin hit its present all-time excessive (ATH) of $73,000 in March and can seemingly offload extra of their tokens as Bitcoin reaches a brand new ATH.