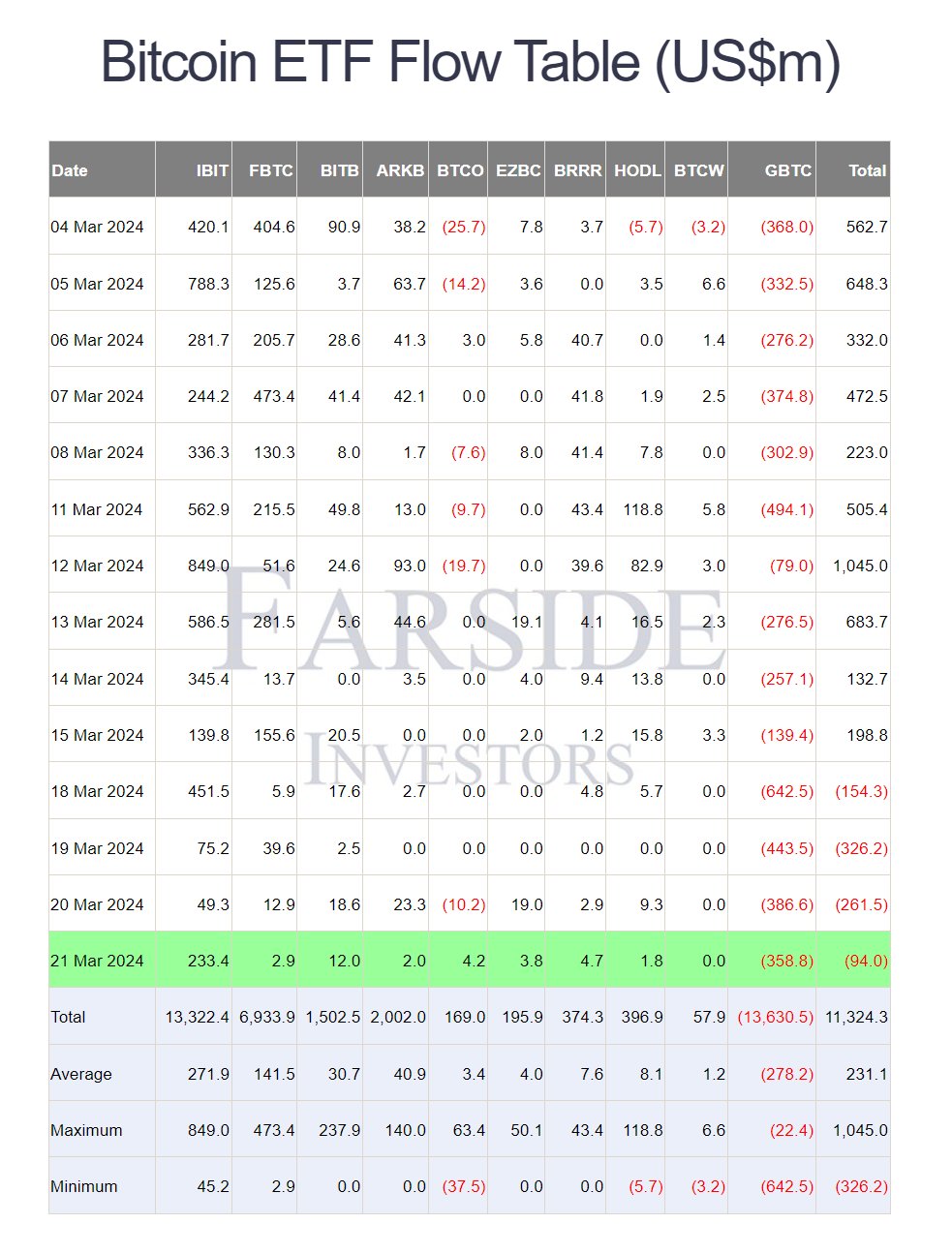

Regardless of a steady four-day streak of web outflows from Bitcoin spot exchange-traded funds (ETFs) totaling $93.85 million, the Bitcoin value has impressively climbed to reclaim the $66,000 mark. In line with knowledge from Farside Buyers, Grayscale ETF GBTC skilled a big outflow yesterday, with a single-day web outflow of $358 million, culminating in a historic web outflow of $13.63 billion for GBTC alone.

In stark distinction, the BlackRock Bitcoin spot ETF (IBIT) witnessed a substantial web influx of $233 million yesterday, elevating IBIT’s complete web influx to $13.32 billion. That is barely beneath the common for BlackRock, which has seen $271.9 million in inflows since its launch on January 11.

Different ETFs haven’t fared as nicely in latest days. Constancy’s FBTC, the second-largest ETF, has to date achieved a mean day by day influx of $141.5 million, however skilled a disappointing $2.5 million in inflows yesterday.

The third-largest, Ark Make investments’s spot Bitcoin ETF, has seen common inflows of $40.9 million so far, with yesterday’s inflows at simply $2.0 million. Bitwise’s BITB, rating fourth, has accrued $30.7 million on common, with a modest $12 million in inflows yesterday.

Throughout the board, all spot Bitcoin ETFs, together with GBTC, have recorded a mean of roughly $230 million in day by day inflows since January 11.

Bitcoin Value Stagnates: Cause To Fear?

CryptoQuant CEO Ki Younger Ju offered insights on the scenario through X, stating, “Bitcoin spot ETF netflows are slowing. Demand could rebound if the BTC value approaches important help ranges. New whales, primarily ETF patrons, have a $56K on-chain value foundation. Corrections sometimes entail a max drawdown of round 30% in bull markets, with a max ache of $51K.”

Crypto analyst WhalePanda highlighted the pattern, noting, “Yesterday’s ETF flows: One other detrimental day, that’s 4 in a row […] Actually stunned by how massive the outflows are from GBTC. One other $358.8 million and that makes a complete of $1.83 billion in simply 4 days.” WhalePanda additionally touched on Genesis’ function, suggesting the corporate’s “in-kind” sale of GBTC shares for BTC may clarify the massive outflows with out corresponding market dumps.

Thomas Fahrer, founding father of Apollo, supplied a bullish perspective, “I do know it’s forbidden to submit something bullish on #Bitcoin ETFs proper now, however I’m gonna do it anyway. GBTC promoting is short-term. Monetary advisors and establishments have barely begun shopping for. $100 BILLION inflows are coming subsequent 1-2 years. Persistence.”

Charles Edwards, founding father of Capriole Investments, commented on the Grayscale scenario, “Grayscale Bitcoin ETF holdings falling off a cliff. Down 50%, or about $20B at present BTC value. We should be days/weeks away from them slashing charges to cease the bleeding. Blackrock holdings anticipated to overhaul Grayscale earlier than the Halving!”

Though the previous couple of days have been reasonably disappointing, it’s price noting that the outflows are coming (virtually) solely from Grayscale’s GBTC, whereas different traders are holding on tight to their Bitcoin investments. Which means that it is just a matter of time earlier than Grayscale’s outflows cease, and even small inflows from the opposite ETFs make a huge impact (with out the outflows).

At press time, BTC traded $66,203.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site solely at your individual threat.