The higher-than-expected United States Shopper Worth Index (CPI) launched on April 10 is already sending shock waves by way of the monetary market. Bitcoin and most crypto property are buying and selling decrease, extending losses recorded on April 9, weighing negatively in opposition to optimists.

United States CPI Knowledge Got here In Scorching

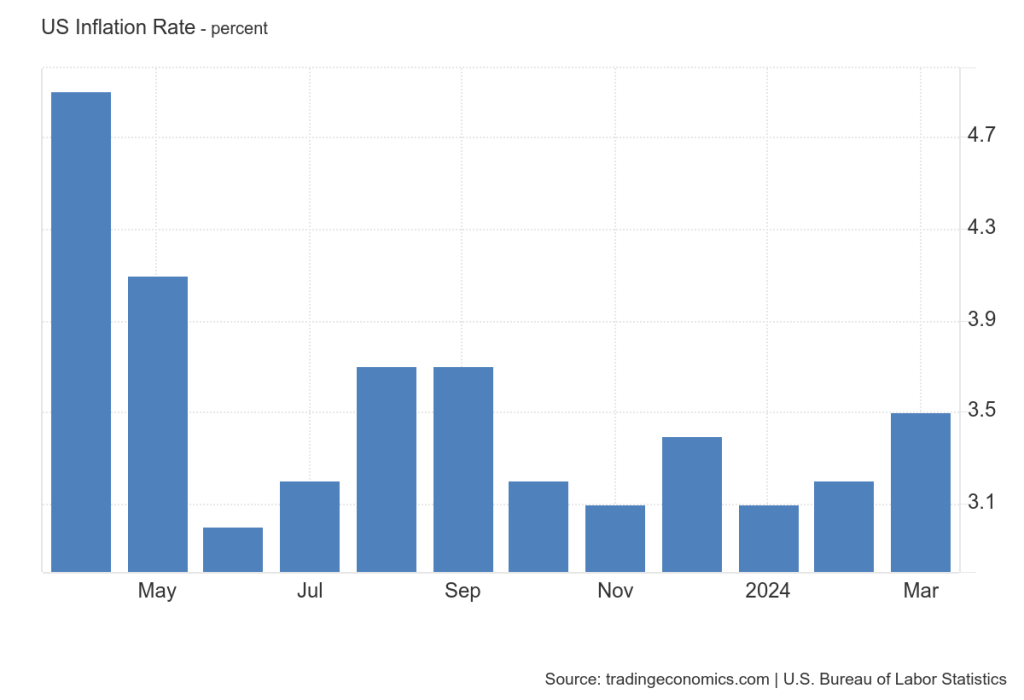

In keeping with Buying and selling Economics information on April 10, CPI, a key financial metric for gauging inflation, rose 0.4% in March, pushing the annual inflation fee to three.5%. Notably, this surpassed economist predictions and, most significantly, dashed hopes for the USA Federal Reserve (Fed) to slash charges aggressively this yr.

Nevertheless, amidst the market jitters, Matt Hougan, the CIO of Bitwise Asset Administration, supplied a contrarian perspective as worry permeated the Bitcoin and crypto market. In a put up on X, Hougan downplayed the affect of the CPI information on Bitcoin’s long-term trajectory.

The manager argues that traders and merchants ought to monitor different market elements like spot Bitcoin exchange-traded fund (ETF) inflows and rising authorities deficits. In Hougan’s evaluation, these can strongly affect value, even lifting Bitcoin larger since they’re at the moment aligned.

Time To Purchase The Bitcoin Dip?

As such, even with the autumn in BTC, the drop might supply potential shopping for alternatives for long-term holders. Some supporters consider the “sizzling” CPI information solely exposes the vulnerabilities of fiat currencies. This might doubtlessly drive traders to make use of Bitcoin as a hedge.

Furthermore, this upbeat sentiment is backed by stable demand for gold, a retailer of worth asset most popular by conventional finance traders. Analysts anticipate Bitcoin will comply with the same path as traders search to guard worth amid rising inflation.

Additional bolstering the bullish sentiment is the opportunity of a spot Bitcoin ETF launch in Hong Kong earlier than the tip of April.

The Hong Kong Securities and Futures Fee (SFC) has been assessing varied functions. Main Chinese language asset managers have submitted some. If the product is authorised, it might additional channel extra capital to BTC, boosting inflows from the United States.

When writing, BTC is regular however below stress. April 9’s losses have been confirmed. The coin would possibly monitor decrease if bulls fail to push costs above all-time highs of round $74,000.

Bitcoin stays in a broader bullish formation, technically shifting inside a rising wedge. This bullish outlook will solely be invalidated if costs tank beneath $61,500 within the periods forward.

Function picture from DALLE, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site completely at your individual threat.