An analyst has defined how Bitcoin appears to be displaying setup to succeed in escape velocity based mostly on the development on this indicator.

Bitcoin VWAP Oscillator Has Been Displaying A Bullish Divergence

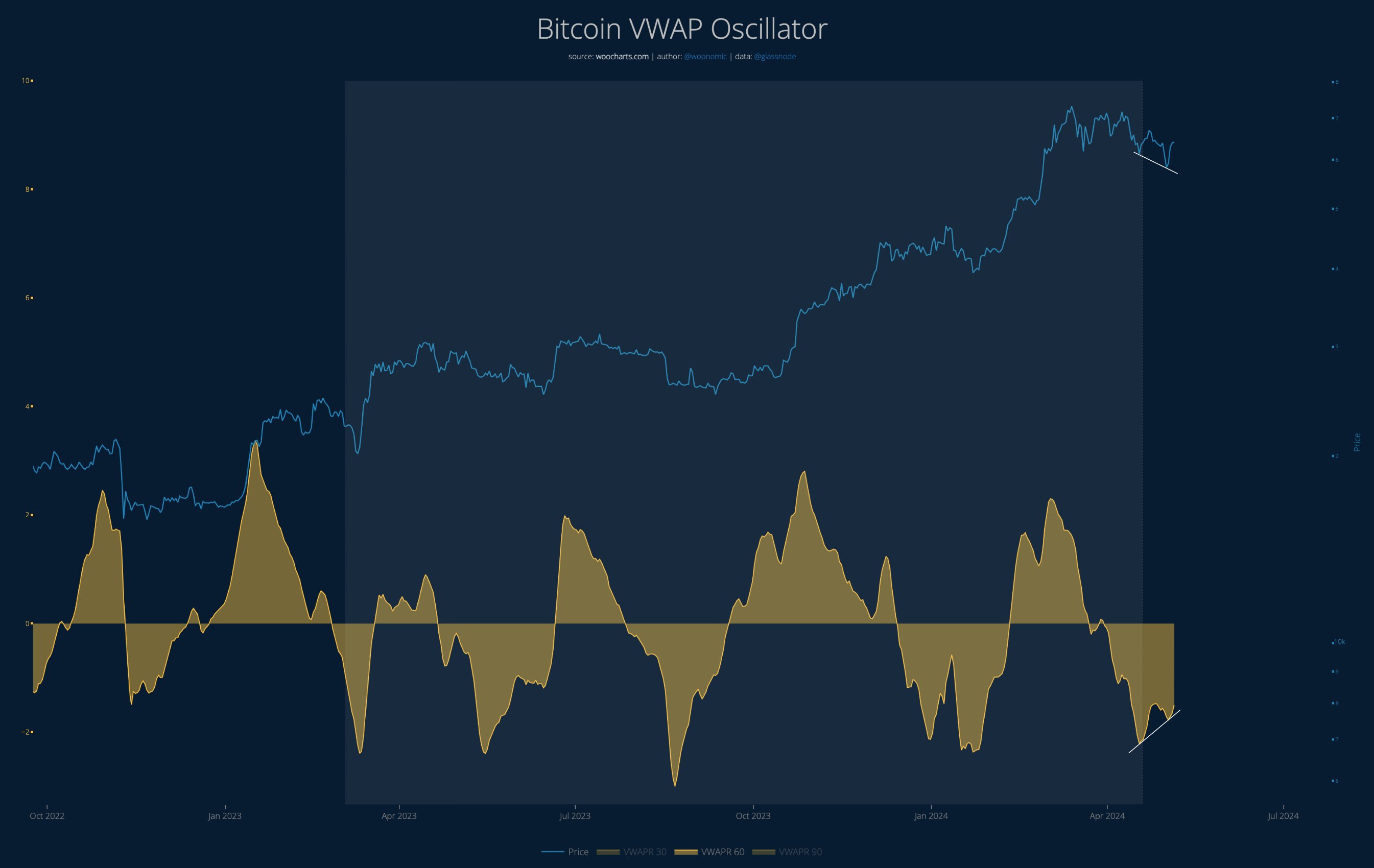

As defined by analyst Willy Woo in a brand new put up on X, a bullish divergence has gave the impression to be forming within the Quantity-Weighted Common Worth (VWAP) oscillator of the cryptocurrency.

The VWAP is an indicator that calculates a mean value for any given asset, taking into consideration not solely the value but additionally the amount. Extra formally, it’s calculated because the cumulative value sum multiplied by the amount divided by the cumulative quantity.

This metric places the next weight on the value at which extra quantity is traded. Normally, the exchange-reported quantity is used to seek out the metric, however for a cryptocurrency like Bitcoin, the complete transaction historical past is seen to the general public because of blockchain information. Woo has used on-chain quantity as a substitute to calculate the VWAP for BTC.

The VWAP oscillator, the precise indicator of curiosity right here, is a ratio between the asset’s spot value and VWAP. Right here is the chart shared by the analyst that reveals the development on this metric over the previous couple of years:

The worth of the metric appears to have been on the decline in latest days | Supply: @woonomic on X

As displayed within the above graph, the Bitcoin VWAP oscillator has been within the unfavorable territory for the previous month however has not too long ago proven a turnaround.

Though the metric is heading up, it’s nonetheless very a lot contained contained in the crimson zone. Concurrently this rise, the cryptocurrency’s value has been heading down as a substitute.

In accordance with Woo, it is a bullish divergence forming for the asset and it’s additionally one which has a “lot of room to run,” since tops within the coin have typically occurred when the oscillator has reached some extent of reversal at comparatively excessive ranges contained in the constructive zone, which ought to nonetheless be fairly distant.

“Looks like setup for BTC to succeed in escape velocity,” notes the analyst. It stays to be seen whether or not the bullish divergence will find yourself bearing fruits for the asset.

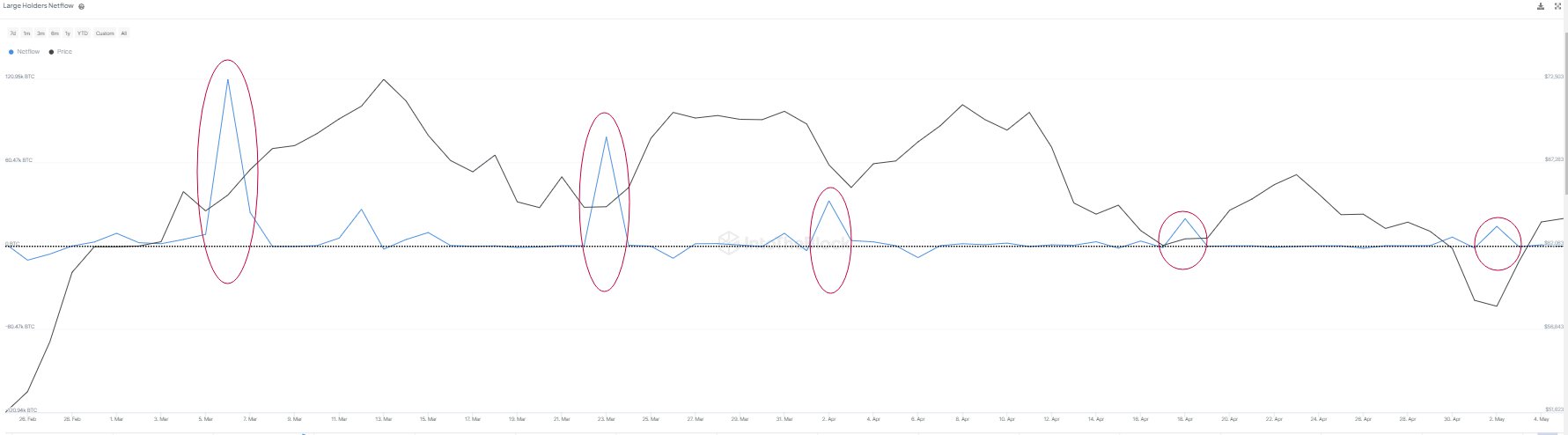

In another information, the Bitcoin whales (traders carrying 1,000 BTC or extra) participated in shopping for across the latest lows of the asset. Nonetheless, market intelligence platform IntoTheBlock has revealed that the buildup sprees from these massive traders have been displaying an total downtrend.

The development within the netflow of the BTC whales over the previous couple of months | Supply: IntoTheBlock on X

From the chart, it’s seen that the Bitcoin whales have been shopping for at every of the dips in the previous few months, nevertheless it’s additionally seen that the size of this shopping for has been diminishing with each.

This could possibly be an indication that the urge for food for purchasing amongst these traders, though nonetheless current, is getting smaller with every dip.

BTC Worth

When writing, Bitcoin is buying and selling at round $63,500, up over 1% within the final seven days.

Appears like the value of the asset has been going up over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site fully at your individual danger.