With Bitcoin ripping greater and shutting in on breaking all-time highs, one analyst on X thinks $150,000 post-halving is “programmed.” The analyst stays upbeat in a publish, highlighting a number of elementary developments that might drive the world’s Most worthy coin to new valuation and greater than 2X from spot charges.

At present, the trail of least resistance stays northward. Consumers have shaken off the bears of the previous buying and selling month, discovering anchor from the March 20 bull bar.

On April 8, the coin soared above the important thing liquidation stage at round $71,800. Bitcoin has since cooled off, however the leg up stays, and it might kind the premise of one other breakout above $74,000.

For bulls to be firmly in management and align with the analyst’s outlook, there ought to be a follow-through of the April 8 surge, ideally with rising buying and selling volumes. This might catalyze demand, even putting Bitcoin above $74,000 and contemporary 2024 highs earlier than the extremely anticipated Halving occasion.

Eyes On Bitcoin Halving: A Provide Squeeze In The Making?

Because the analyst explains, the “Halving” occasion is a vital catalyst for this potential surge. Lower than ten days away, this occasion is a protocol-driven prevalence that can see the community cut back block rewards to three.125 BTC, down from the present 6.25 BTC.

This discount, mixed with sustained demand, will doubtless create a shortage of Bitcoin, doubtlessly driving up its worth.

Forward of Bitcoin’s Halving, the analyst stated the quantity of BTC held by exchanges is dwindling. As an example, Coinbase’s holdings stand at a six-year low. Nonetheless, this isn’t an remoted occasion; information reveals that main exchanges like Binance are seeing lowering provide.

On the identical time, over-the-counter (OTC) desks, which deal with massive, personal cryptocurrency transactions, are reportedly working low on Bitcoin, indicating sturdy institutional demand. This means a possible provide squeeze set to solely worsen within the coming months.

Affect Of Spot BTC ETFs: London, Hong Kong In The Image

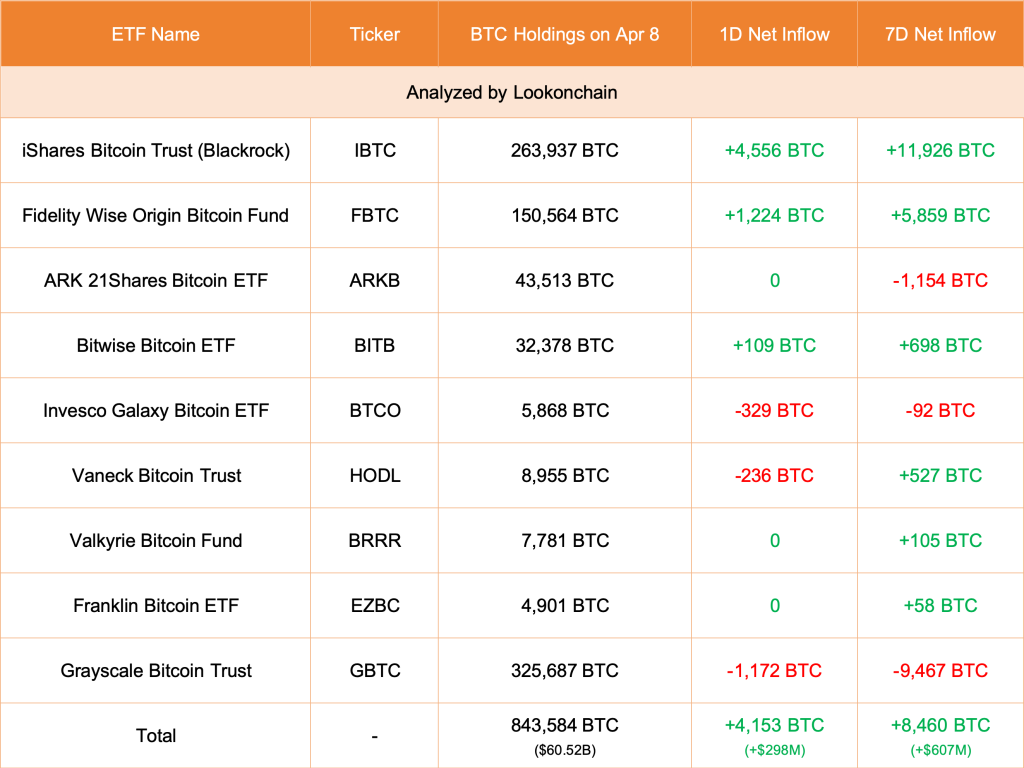

Already, spot Bitcoin exchange-traded funds (ETF) issuers, the analyst added, are on a shopping for spree, gobbling up over $300 million of BTC day by day. Since these issuers are performing on behalf of traders, each retail and establishments, they’re actively infusing capital into the market, an enormous increase for costs.

It ought to be famous that the surge from This autumn 2023 to early January was primarily due to the anticipated spot Bitcoin ETFs. The spillover impact and the billions flowing into the asset make BTC extra liquid and resilient towards aggressive sellers.

Moreover, the London Inventory Change plans to checklist exchange-traded notes (ETNs) backed by Bitcoin in Q2 2024. Just like the spot ETFs in the US, this product will inject liquidity into the market and legitimize the coin as a worthy asset class, much like gold.

In Asia, the Securities and Futures Fee (SFC) of Hong Kong will doubtless approve a number of spot Bitcoin ETFs. A few of the noteworthy candidates embrace main Chinese language asset managers.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site solely at your individual threat.