Analyzing the momentum of latest and lively addresses is essential for gauging market well being and investor sentiment.

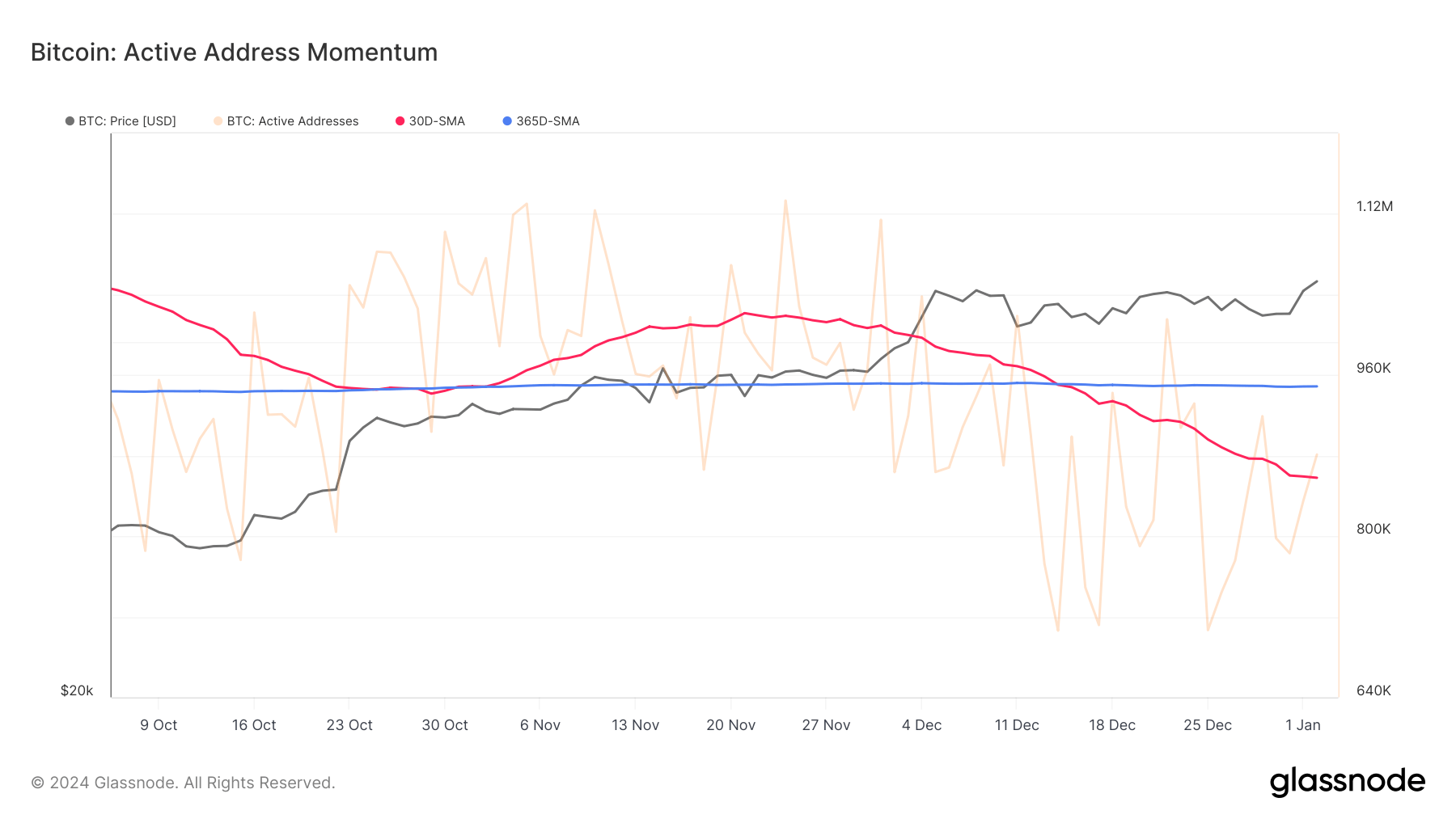

Energetic tackle momentum, a measure of the variety of distinctive Bitcoin addresses actively transacting on the community, signifies consumer engagement and community utilization. On Nov. 2, 2023, the month-to-month common of lively addresses crossed above the yearly common, sustaining this development till Dec. 14.

After this era, a speedy decline ensued, falling to ranges seen in June 2023. This decline, notably after a sustained interval above the yearly common, suggests a contraction in market participation and will sign a brewing change.

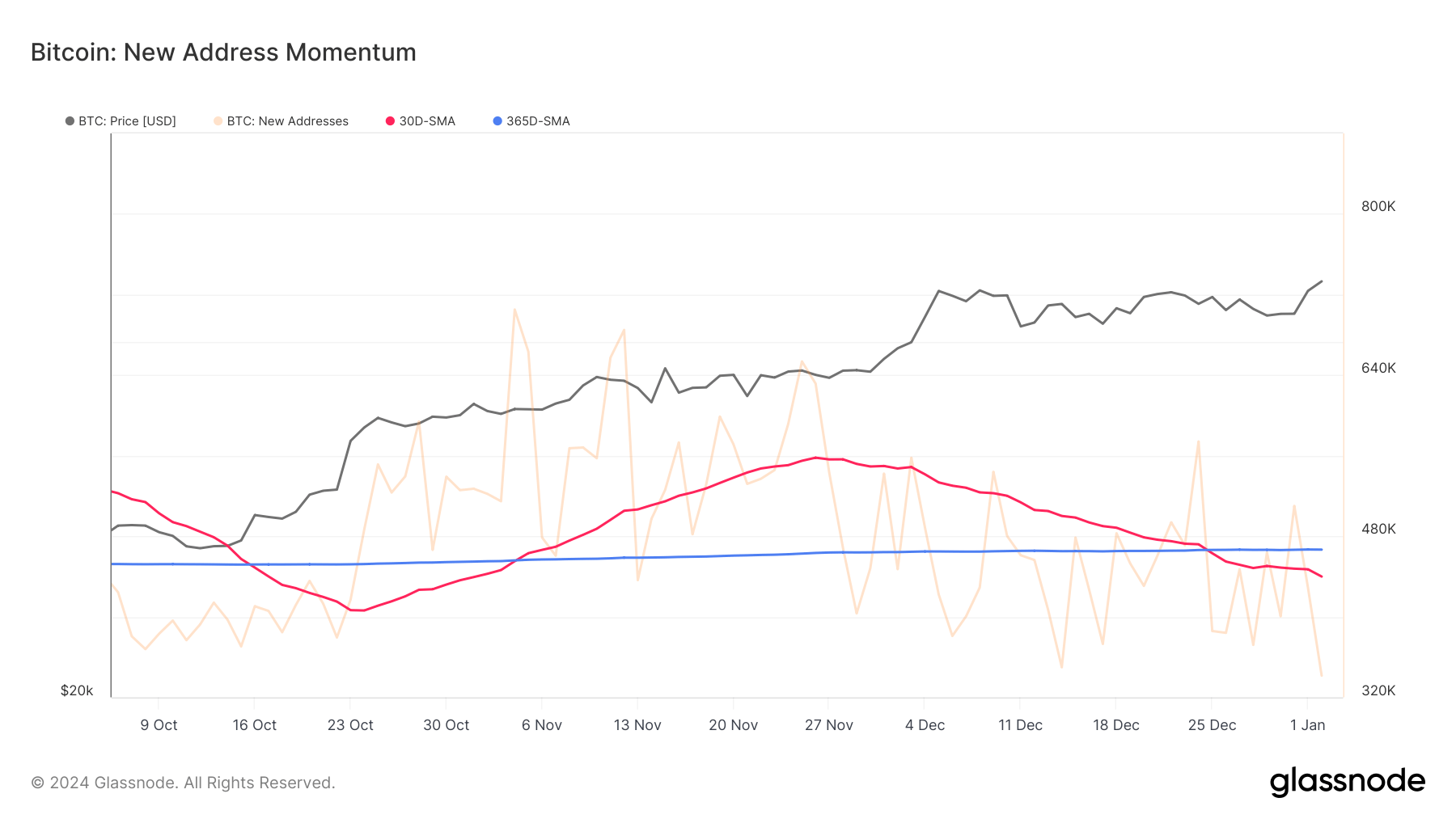

New tackle momentum, indicative of latest market individuals, adopted an identical sample. After surpassing the yearly common on Nov. 5, it remained above it till Dec. 25 earlier than experiencing a slight decline to October 2023 ranges. This sample usually displays investor confidence and market growth, however its latest decline might suggest a waning curiosity or a wait-and-see strategy amongst potential new market entrants.

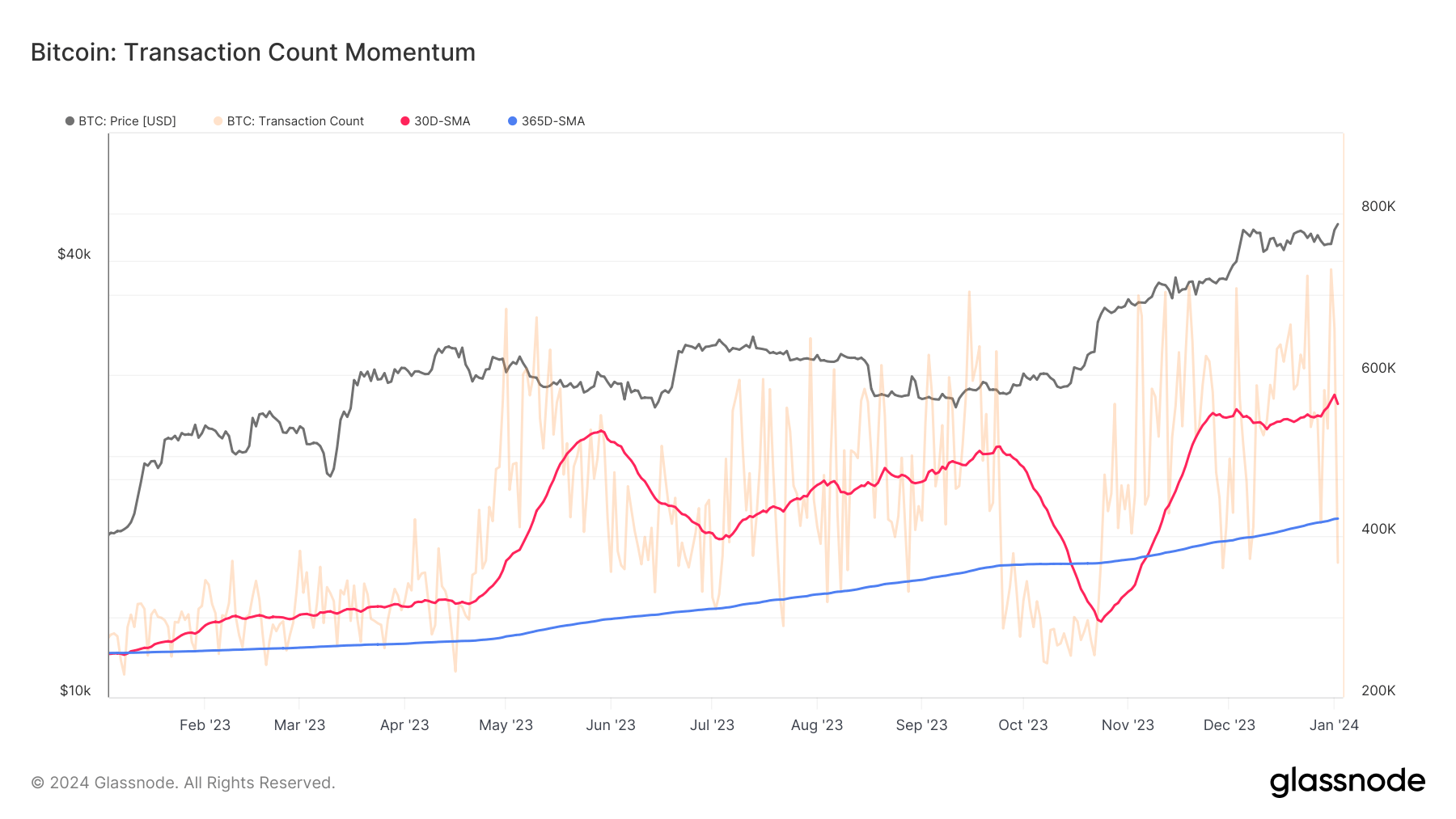

Transaction momentum represents the so-called vibrancy of the community. It refers back to the charge of transactions occurring on the community. It serves as the important thing indicator of Bitcoin’s exercise stage, with greater momentum suggesting elevated switch and buying and selling actions amongst customers.

he common month-to-month variety of transactions stayed above the yearly common for many of 2023. It dipped beneath the yearly common on Oct. 15, solely to rise once more on Nov.6, peaking at an all-time excessive of 575,575 transactions on Jan. 1, 2024. This resilience in transaction momentum, even amidst fluctuating lively and new addresses, is noteworthy.

The decline in new and lively addresses’ momentum might be interpreted because the calm earlier than the storm. These reductions may very well be attributed to the anticipated approval of a spot Bitcoin ETF within the U.S. The preliminary pleasure surrounding the ETF’s potential approval seems to have diminished by November, as evidenced by the decline in analyzed momentum.

Since then, the subdued exercise within the addresses area seemingly signifies a market in anticipate important actions triggered by the ETF approval. In concept, a rising Bitcoin worth would correlate with elevated tackle momentum; nevertheless, Bitcoin’s surge previous $40,000 didn’t catalyze modifications in tackle momentum.

The sustained excessive transaction momentum, pushed partly by the rising recognition of inscriptions, underscores the community’s robustness and continued use regardless of variations in tackle exercise. Towards declining tackle momentums, this sustained transaction exercise paints a posh image of the present Bitcoin market.

Whereas tackle momentum suggests a market in anticipation or holding sample, the excessive transaction quantity displays ongoing community engagement. These contrasting indicators spotlight the market’s complexity and the necessity for buyers to stay vigilant, as the present calm may very well be a precursor to important market actions.

The put up Bitcoin tackle momentum drops as market eyes ETF prospects appeared first on CryptoSlate.