Bitcoin Spot ETFs are gunning for a brand new report after an unimaginable begin to the brand new week. The worth of BTC has risen 8% within the final day, and this has brought about euphoria available in the market. There may very well be various components behind this; nevertheless, institutional buyers appear to be taking part in a giant function as day by day inflows proceed to rise.

Spot Bitcoin ETF Inflows Cross $400 Million

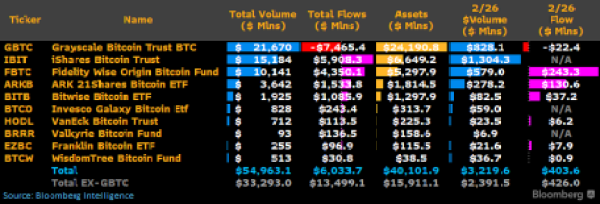

In response to Bloomberg analyst James Seyffart, the Spot BTC ETF inflows are usually not slowing down. In a screenshot shared by the analyst on Tuesday, Seyffart reveals that inflows into Spot BTC ETFs climbed above $400 million.

The picture reveals that the Constancy Clever Origin Bitcoin Fund is main the cost with $243.3 million in inflows, which accounts for greater than 50% of the overall influx. The ARK 21Shares Bitcoin ETF follows behind with important inflows of $130.6 million. The third-largest influx to a single fund for the day was recorded within the Bitwise Bitcoin ETF, which noticed $37.2 million in inflows.

Supply: X

Different funds, together with the Franklin Bitcoin ETF, VanEck Bitcoin Belief, and the WisdomTree Bitcoin Fund, all noticed minor inflows of $7.9 million, $6.2 million, and $0.9 million, respectively. In complete, the inflows to all six funds got here out to $426 million.

Nonetheless, the Grayscale Bitcoin Belief (GBTC) continues to bleed throughout this time, with outflows of $22.4 million within the 24-hour interval. This introduced the overall internet flows to $403.6 million. On the similar time, funds such because the iShares Bitcoin Belief, the Invesco Galaxy Bitcoin ETF, and The Valkyrie Bitcoin Fund all noticed negligible inflows throughout this timeframe.

Gunning For A New File

The inflows into the Bitcoin Spot ETFs over the past day are a testomony to the demand that these merchandise are getting from the market. With institutional buyers gaining extra publicity to BitBTCcoin, demand is predicted to rise, particularly because the BTC value continues to do nicely.

The influx volumes, whereas not the biggest single-day inflows to this point, are important when measured as much as others. For instance, Seyffart factors out that the day by day report was from the primary day of buying and selling when inflows climbed as excessive as $655 million. The second-largest single-day internet move was then recorded earlier within the month on February 13 with $631 million. “A giant day from $IBIT may push us past that Day 1 report,” Seyffart declared.

On the time of writing, the BTC value is experiencing a retracement after reaching a brand new 2-year excessive of $57,000. It has seen 8.58% features within the final 24 hours to commerce at $55.900, in keeping with knowledge from CoinMarketCap.

BTC value establishes assist above $56,000 | Supply: BTCUSD on Tradingview.com

Featured picture from U.Right this moment, chart from Tradingview.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual danger.