Knowledge reveals the Bitcoin market sentiment has returned to the intense greed territory as BTC has registered its rally past the $71,000 stage.

Bitcoin Worry & Greed Index Now Factors To “Excessive Greed”

The “Worry & Greed Index” is an indicator made by Different that tells us in regards to the normal sentiment among the many buyers within the Bitcoin and wider cryptocurrency market.

This index represents the sentiment as a rating between zero and hundred. To calculate this worth, the indicator takes under consideration the info of those elements: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Traits.

When the indicator has a price of 46 or much less, it implies that the typical investor holds a sentiment of worry proper now. Alternatively, a price of 54 or extra implies the market shares a majority mentality of greed. Naturally, the area in-between these two (47 to 53) corresponds to the impartial sentiment.

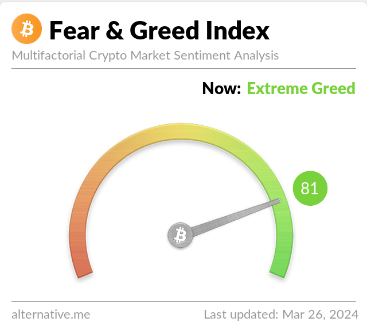

Now, here’s what the newest worth of the Bitcoin Worry & Greed Index appears to be like like:

The index seems to have a price of 81 in the mean time | Supply: Different

As is seen above, the Bitcoin Worry & Greed Index is at 81 proper now, that means that it’s deep into the greed area. In reality, this worth is so deep that it’s inside a territory generally known as “excessive greed.”

Excessive greed happens when the index hits values increased than 75. Worry additionally has its personal excessive area; this one occupying values beneath 25. Traditionally, these two sentiments have confirmed to be significantly important for the market.

BTC and different belongings within the sector have typically tended to maneuver in the wrong way from what the bulk anticipate. Within the territory of the intense sentiments, this expectation is of course the strongest, and therefore, the chance of a opposite transfer going down can also be the very best.

Due to this cause, main tops and bottoms in Bitcoin’s value have sometimes taken form when the cryptocurrency has been contained in the respective excessive zones.

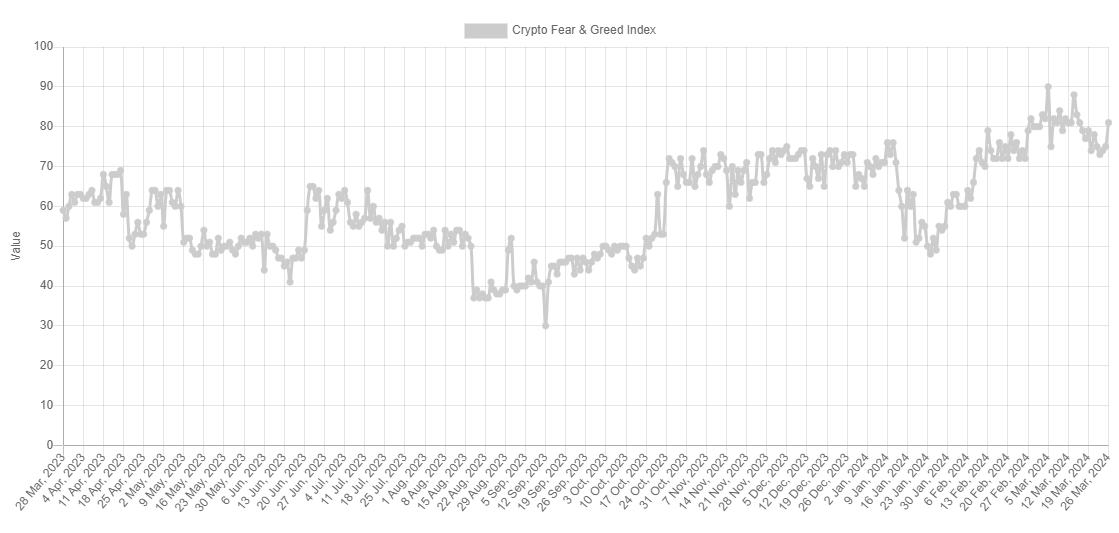

Earlier within the month, the Worry & Greed Index had assumed particularly excessive excessive greed ranges, because the asset’s rally in the direction of new all-time highs (ATHs) had occurred.

Two of the key tops on this interval, together with the present ATH, coincided with peaks within the indicator, implying that the overheated sentiment might have as soon as once more performed a job.

Seems to be like the worth of the metric has rotated prior to now day | Supply: Different

With the current drawdown within the asset, although, the sentiment additionally cooled off and exited out of the intense greed territory, as is seen within the above chart. In bullish durations, the sentiment retreading again to the traditional greed area is usually a optimistic signal for recent upward strikes to start out.

And certainly, this has adopted for the cryptocurrency this time as effectively, as its value has made notable restoration over the previous couple of days. With the coin making a return again in the direction of $71,000, the sentiment has additionally heated up once more, therefore why the index’s newest worth is pointing at excessive greed.

The aforementioned tops from earlier within the month occurred at Worry & Greed Index values of 90 and 88, respectively, suggesting that the present excessive greed worth of 81 is probably not too excessive for an additional peak to be possible.

BTC Value

Bitcoin had damaged above the $71,000 stage earlier within the day, however the digital asset has since registered a little bit of a pullback in the direction of $70,700.

The worth of the coin appears to have sharply risen over the previous two days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, Different.me, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site completely at your individual threat.