Onchain Highlights

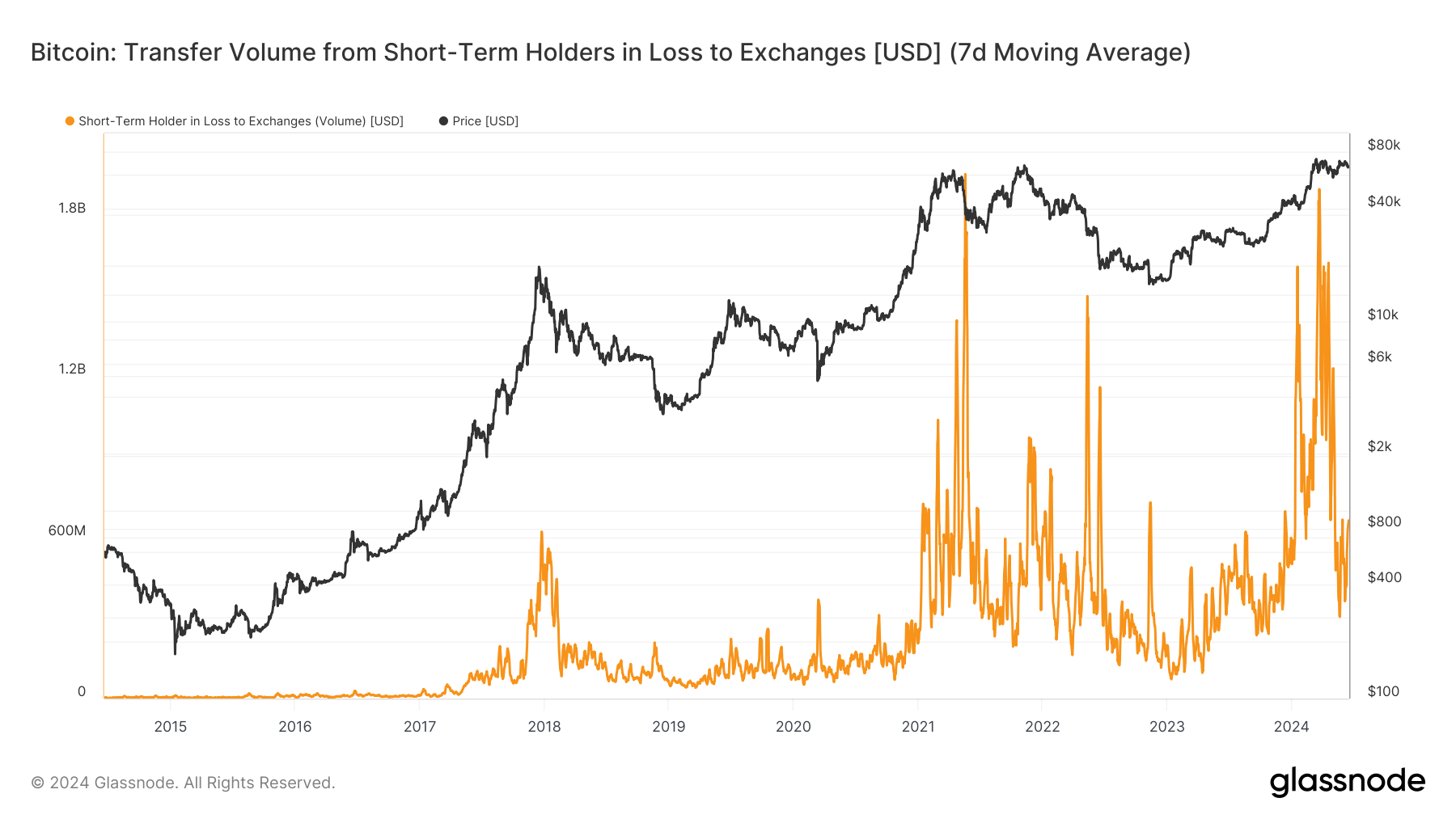

DEFINITION: The whole quantity of cash (USD Worth) transferred from short-term holders in loss to alternate wallets. Solely direct transfers are counted. Cash are thought-about to be in loss when the value on the time the cash are spent is decrease than the entity’s common on-chain acquisition worth for the tokens.

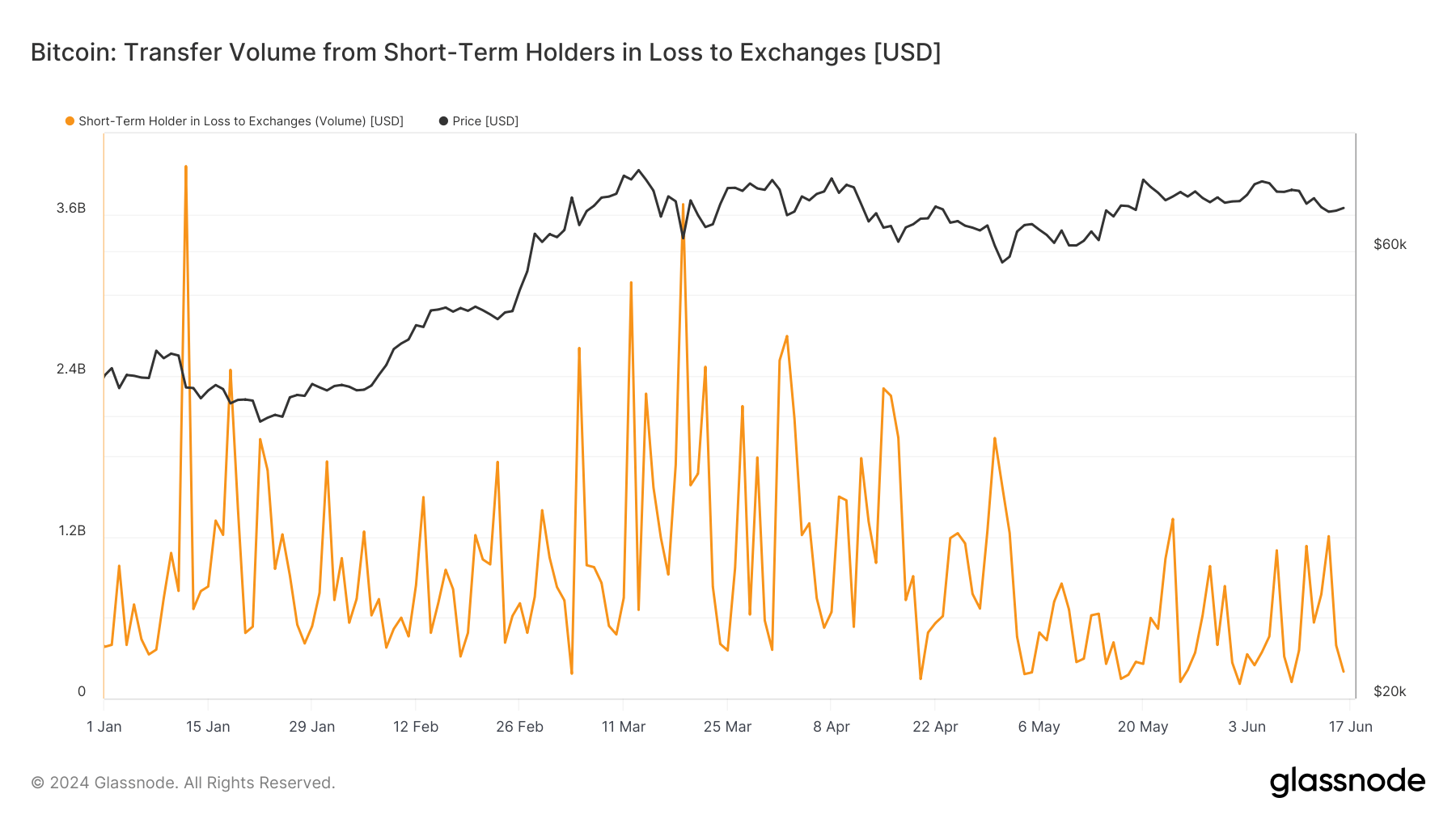

Bitcoin’s switch quantity from short-term holders to exchanges has proven notable fluctuations in 2024. In line with Glassnode knowledge, the primary half of the yr witnessed vital exercise, notably amongst holders who acquired Bitcoin lower than 155 days in the past. This cohort repeatedly reacted to market volatility by offloading their holdings at a loss.

On a number of events, sharp worth declines triggered giant sell-offs by these short-term holders. A major spike occurred on Might 23, when over $1 billion price of Bitcoin was despatched to exchanges at a loss, the best since early March. This exercise signifies a sample of heightened sensitivity amongst short-term traders to sudden worth drops.

Nonetheless, there are indicators of fixing habits amongst these holders. Regardless of the heavy sell-offs, subsequent knowledge suggests a lower in promoting strain throughout related market situations. This pattern factors to a potential maturation amongst short-term holders as they develop into extra accustomed to Bitcoin’s inherent volatility.

A current evaluation highlights that even amid substantial worth drops, the amount of Bitcoin despatched to exchanges by short-term holders was decrease in comparison with earlier dips, suggesting a rising resilience.