After a two-month breather close to its all-time excessive, Bitcoin (BTC) seems able to unleash one other haymaker, based on crypto analyst Axel Adler. Adler predicts a 300-day bull run fueled by wholesome short-term holder income and a market with loads of combat left in it.

Associated Studying

Worthwhile Punches And Room For Extra

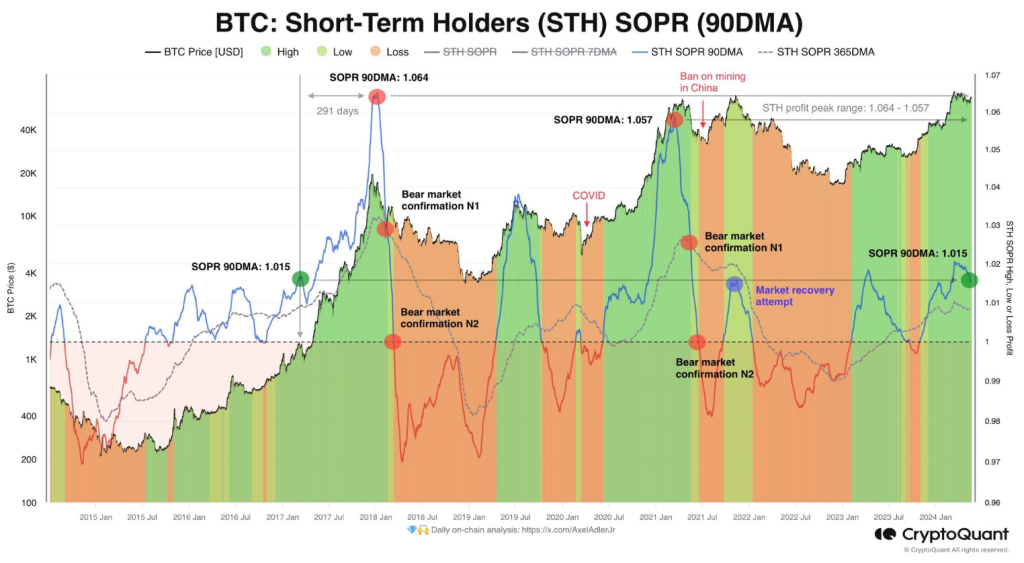

Adler throws down the gauntlet with information on Quick-Time period Holder Spent Output Revenue Ratio (STH SOPR). This metric reveals if short-term holders are cashing out at a revenue.

Presently, the 90-day transferring common for STH SOPR sits at 1.015, indicating short-term holders are within the inexperienced however haven’t reached the knockout blow ranges seen in earlier bull runs (round 1.06). This means there’s room for extra profit-taking punches earlier than the bulls develop weary.

I’ve already talked about that the bull market is in full swing. Barring any unexpected Black Swan occasions, it may final for about one other +/- 300 days.

That is primarily based on the P&L evaluation of Quick-Time period Holders with a 90-day transferring common. pic.twitter.com/30OgsruvOi

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) Could 21, 2024

Open Curiosity: The Untapped Reserve Of Energy

One other weapon within the bull’s arsenal is Open Curiosity (OI), a metric reflecting the full quantity of excellent by-product contracts (futures and choices) held by merchants.

Whereas the current worth surge has been spectacular, the 7-day transferring common for OI hasn’t witnessed the dramatic rise seen in prior bull runs. This, based on Adler, signifies a hidden reserve of energy available in the market, with extra firepower ready to be unleashed.

Technical Edge: Bulls Have Momentum On Their Facet

However technical evaluation isn’t nearly fancy ratios and cryptic charts. Adler identifies a number of technical indicators that paint a bullish image. The Relative Energy Index (RSI), a gauge of momentum, hasn’t damaged previous 70, a stage usually related to overbought situations.

This means the present rally is wholesome and sustainable. Moreover, the Chaikin Cash Circulate (CMF) has surged previous optimistic 0.05 territory, indicating important capital influx and a rising urge for food for Bitcoin amongst buyers.

Associated Studying

Can The Bulls KO Resistance Ranges?

Whereas the bulls appear to have the higher hand, there are nonetheless hurdles to beat. Key resistance ranges loom at $79k, $88k, and $97k, recognized utilizing Fibonacci extension ranges. These worth factors may act as roadblocks for the surging Bitcoin worth.

Nonetheless, if the present momentum continues, these resistance ranges could possibly be shattered, paving the way in which for a possible retest of the all-time excessive at $73,700 and a potential upward movement past.

Featured picture from Display Rant, chart from TradingView