The crypto analytics agency Glassnode believes Bitcoin (BTC) is now getting into a interval of market correction and worth volatility after a large rally this yr.

In a brand new YouTube video, the analytics agency says key indicators recommend Bitcoin is “taking a breather” as holders are promoting off for income after the crypto king soared 175% this yr and put in a brand new all-time excessive this month.

“After I take a look at the general market construction in these completely different phases, while we don’t know whether or not the highest is in, we shouldn’t be stunned that the market hit some type of a correction right here. It does make sense as a result of we’ve acquired sufficient inexperienced in everybody’s portfolio that individuals traditionally talking have began to take income.

We are able to then see that within the long-term holder provide, which is actually taking income at a reasonably substantial fee. Over seven days, we’ve seen long-term holder provide declining, and realized income have hit a brand new all-time excessive, $3.5 billion per day.

So that basically signifies that we’d like $3.5 billion price of inflows into the asset to accumulate these new cash. Now, these are pretty substantial numbers, however we’re additionally speaking a couple of post-ETF [Bitcoin exchange-traded fund] world. We’re speaking about a whole lot of hundreds of thousands to billions of {dollars} in the mean time.”

The agency says two key indicators level to a Bitcoin correction.

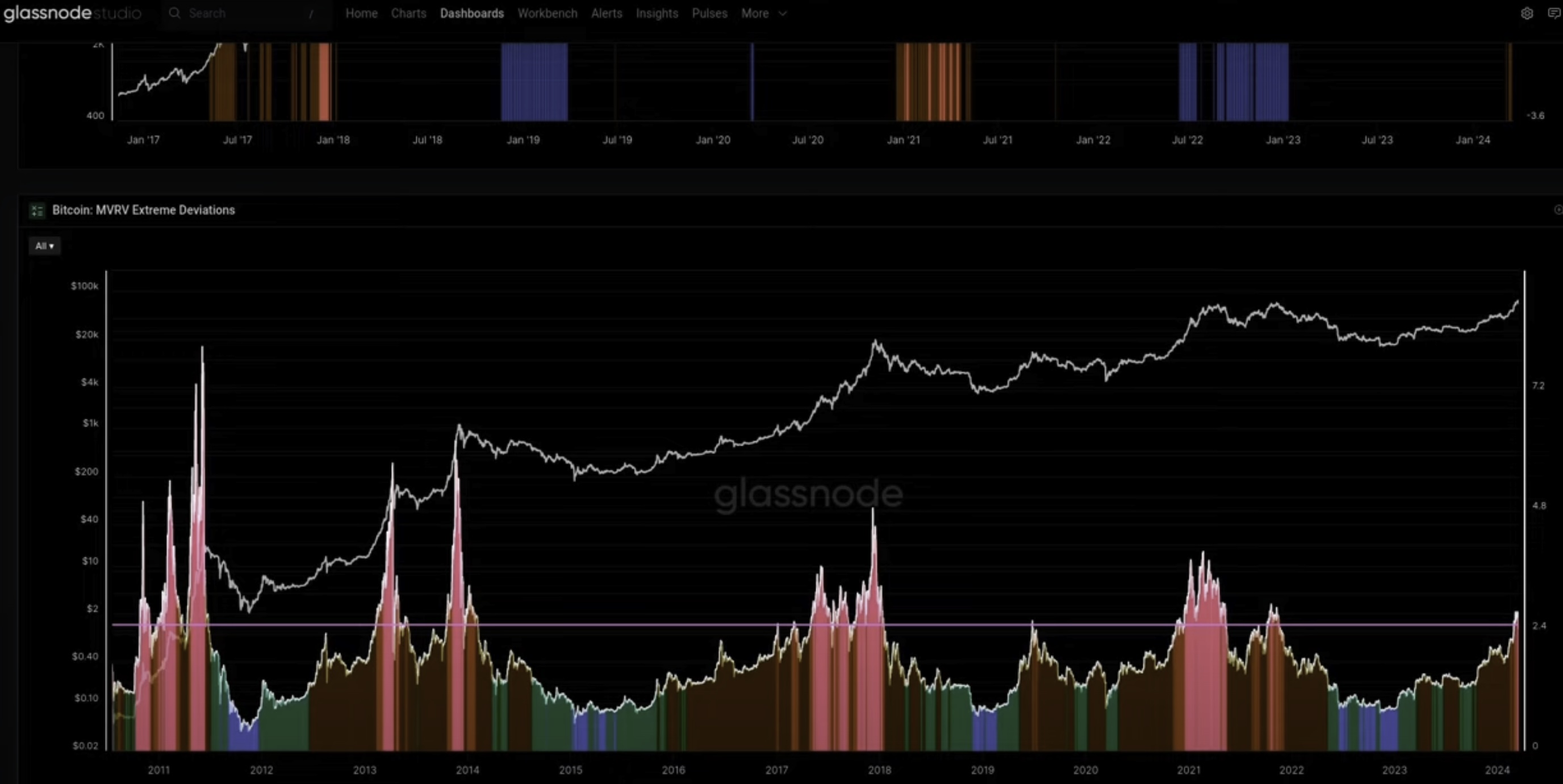

In keeping with the agency, Bitcoin’s market-value-to-realized-value (MVRV) indicator, which is the ratio of Bitcoin’s market capitalization relative to its realized capitalization (the worth of all BTC on the worth they have been purchased at), is flashing doable overvalued market circumstances.

The agency additionally makes use of the Energetic-Worth-to-Investor-Worth (AVIV) Ratio, which is analogous to the realized worth however excludes inactive cash resembling these misplaced. When Bitcoin’s worth motion takes strikes far off the metric’s mid-point it signifies a correction is probably going.

“It is sensible for us to bump our head at this level and we’re additionally transferring into as you may see within the AVIV ratio a extra unstable interval. Traditionally talking, the market can go up fairly sharply, however then additionally appropriate virtually as sharply as we noticed… in our MVRV and AVIV ratio. So simply one thing to remember and utilizing that to type of body up the place we’re within the cycle after we can begin to count on resistance to kick in.”

Bitcoin is buying and selling for $67,672 at time of writing, up 7.5% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: DALLE3