Bitcoin has made a restoration again in direction of the $61,000 stage through the previous day. Listed here are the components that may very well be behind this surge.

Bitcoin Has Made Some Restoration Throughout The Final 24 Hours

After displaying lackluster value motion underneath $60,000 through the previous few days, Bitcoin has lastly proven some momentum within the final 24 hours, with its value surging by greater than 4%.

Associated Studying

The chart under reveals how the cryptocurrency’s current trajectory has appeared like.

On the peak of this rally, BTC had damaged above $61,400, however the asset has since seen a pullback. Nonetheless, even after the drawdown, BTC remains to be buying and selling round $60,800, which is a notable enchancment over yesterday.

As for what may very well be behind this surge, maybe on-chain information can present some hints.

BTC Has Seen A number of Optimistic On-Chain Developments Not too long ago

There are a few developments which have occurred within the cryptocurrency house lately that may very well be optimistic for Bitcoin. First, in line with information from the on-chain analytics agency Santiment, BTC traders carrying between 100 and 1,000 BTC have made a substantial shopping for push over the past six weeks.

On the time Santiment had shared the chart (which was yesterday), the Bitcoin traders with 100 to 1,000 BTC had held a mixed 3.97 million tokens. Out of this, 94,700 cash have been purchased by them throughout the previous six weeks.

The cohort with wallets on this vary is popularly often called the “sharks.” Together with the whales, the sharks are thought-about the important thing traders out there, because of the appreciable scale of cash that they maintain.

Thus, the truth that these massive traders have been accumulating whereas BTC had been struggling earlier reveals that large cash was assured that the cryptocurrency would flip itself round.

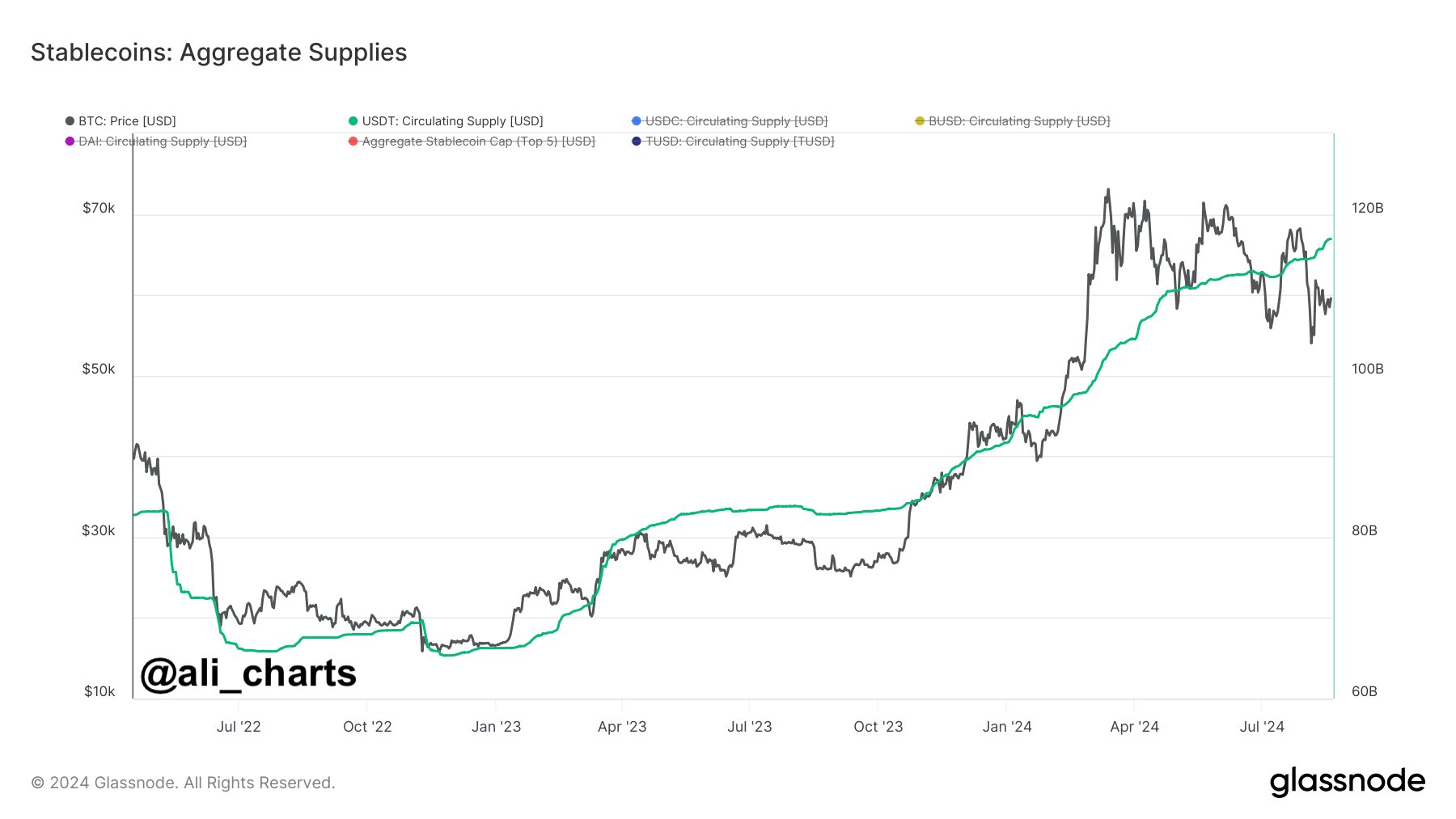

The opposite optimistic improvement has been the uptrend that the availability of Tether (USDT) has been displaying lately, as analyst Ali Martinez has identified in an X submit.

Traders usually use stablecoins like Tether each time they wish to escape the volatility related to property like Bitcoin. Such traders who retailer their capital like this, nevertheless, ultimately plan to enterprise again into the unstable cash, so the availability of the stablecoins could act as a retailer of dry powder accessible for deploying into BTC and others.

Associated Studying

Naturally, when traders do swap their stables for these property, their costs observe a bullish enhance. With Tether’s provide having seen a pointy soar lately, the traders’ potential buying energy may very well be thought-about to have gone up.

This might have occurred by means of two processes: a rotation of capital from Bitcoin and different cryptocurrencies, and contemporary capital inflows. The previous would suggest traders have bought their unstable cash for now, however as talked about earlier than, these traders could purchase again into the market sooner or later.

The latter can be fully bullish, as it might imply there may be contemporary curiosity coming into into the house. In actuality, each of those seemingly occurred to a point and as Bitcoin has managed to discover a rebound, it’s doable new capital inflows have made up for extra of the rise.

Featured picture from Dall-E, Glassnode.com, Santiment.internet, chart from TradingView.com