Over the previous few days, Bitcoin has seen fairly a notable rebound in its value, rising from as little as the $53,000 degree final week to buying and selling as excessive as above $66,000 within the early hours of Wednesday prior to now retracing to a present buying and selling value of $64,433.

This bullish value efficiency has been the downfall of roughly 50,436 merchants within the crypto market right now. Significantly, in response to knowledge from Coinglass, this variety of merchants has seen large liquidations, bringing the present complete liquidations to $145.58 million.

Bitcoin merchants felt the brunt of this complete liquidation, seeing roughly $46.22 million shared evenly between brief and lengthy positions, indicating the asset’s combined trajectory up to now day alone.

Associated Studying

Bitcoin: Greater Liquidations Incoming

Whereas latest buying and selling actions have triggered tens of millions of {dollars} in liquidations, additional knowledge exhibits that this situation might escalate dramatically, turning into billions if Bitcoin continues its ascent in direction of file highs, breaching a notable mark.

Significantly, as reported by MartyParty, a distinguished crypto fanatic locally, ought to Bitcoin’s value hit $72,400, the market would really feel the influence, with almost $19 billion in Bitcoin brief positions poised for liquidation at this value level.

Marty Celebration reported this on Elon Musk’s social media platform X, citing knowledge from Coinglass. Concluding this disclosure, the crypto fanatic famous: “By no means wager in opposition to know-how.”

How Lengthy For This Liquidation To Happen?

Whereas the $72,400 value mark would possibly look like a protracted stretch from the present market value, BTC may not take that lengthy to get to this mark, given the present fundamentals. For example, the market could be drawn faster to this mark as that is the place the liquidity lies to gasoline its present development.

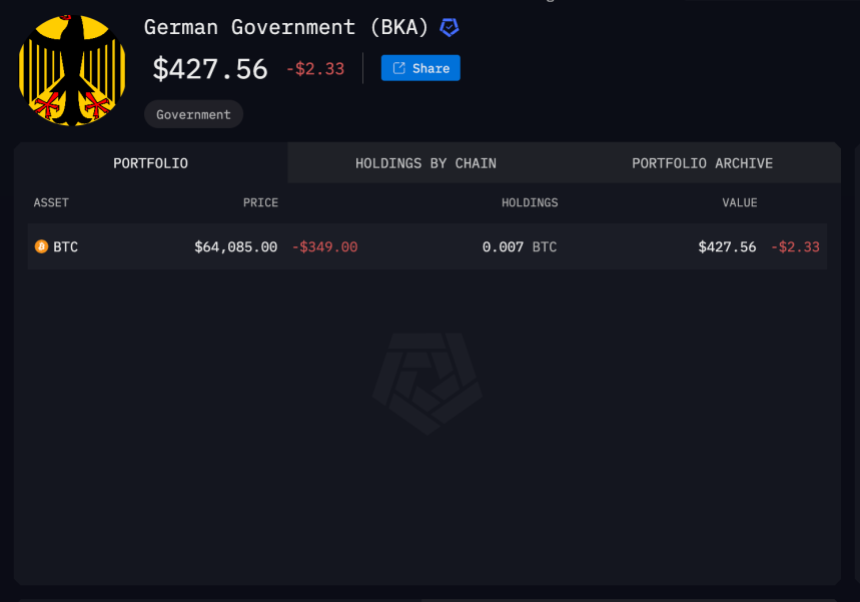

Other than that, no bears are in sight to gradual the asset’s rally from getting there within the brief time period. To begin with, the German authorities has offered off all of its BTC holdings of roughly 49,858 BTC with a present steadiness under $500, in response to knowledge from Arkham Intelligence.

Notably, the present steadiness of roughly $427 price of BTC is the cumulative sats (small models of BTC) donated from totally different pockets addresses. Moreover, in response to latest knowledge from CryptoQuant, 36% of Mt. Gox BTC has been distributed to collectors.

Nevertheless, regardless of this distribution, BTC’s value is but to see any notable correction, which suggests two issues: that the collectors should not promoting, and even when they’re, the Bitcoin market is absorbing it actual rapidly as evident within the slight stabilization of BTC’s value.

Associated Studying

These main sell-offs by the German authorities and Mt. Gox, as soon as thought of main threats to the crypto market, now appear to have minimal influence, indicating that no important bearish obstacles stop Bitcoin from surging to the $72,400 mark, creating a brief squeeze.

Featured picture created with DALL-E, Chart from TradingView