On-chain knowledge reveals that Bitcoin short-term holders have deposited $2 billion in BTC to exchanges, the fourth largest quantity within the final two years.

Bitcoin Quick-Time period Holder Alternate Inflows Have Spiked Up

As analyst James V. Straten defined in a brand new put up on X, the BTC short-term holders have doubtlessly participated in a really sizeable selloff lately. The “short-term holders” (STHs) are the Bitcoin buyers who purchased their cash inside the final 155 days.

The STHs comprise one of many two predominant divisions of the BTC market based mostly on holding time; the opposite phase is named the “long-term holder” (LTH) cohort and consists of the holders who mature previous the 155-day cutoff.

Statistically, the chance {that a} holder would promote or transfer their cash on the blockchain drops the longer they preserve them dormant. As such, the STHs usually tend to take part in promoting at any level than the LTHs.

This conduct of the STHs is normally particularly obvious each time the cryptocurrency observes a pointy rally or crash, as these fickle-minded buyers can’t assist however fall prey to the FOMO or FUD of the scenario.

One technique to monitor whether or not the STHs are promoting or not is thru their alternate inflows. Traders might deposit to those central entities once they wish to promote, so the quantity going to those platforms can naturally present some measure of the diploma of promoting strain the holders are at the moment exerting.

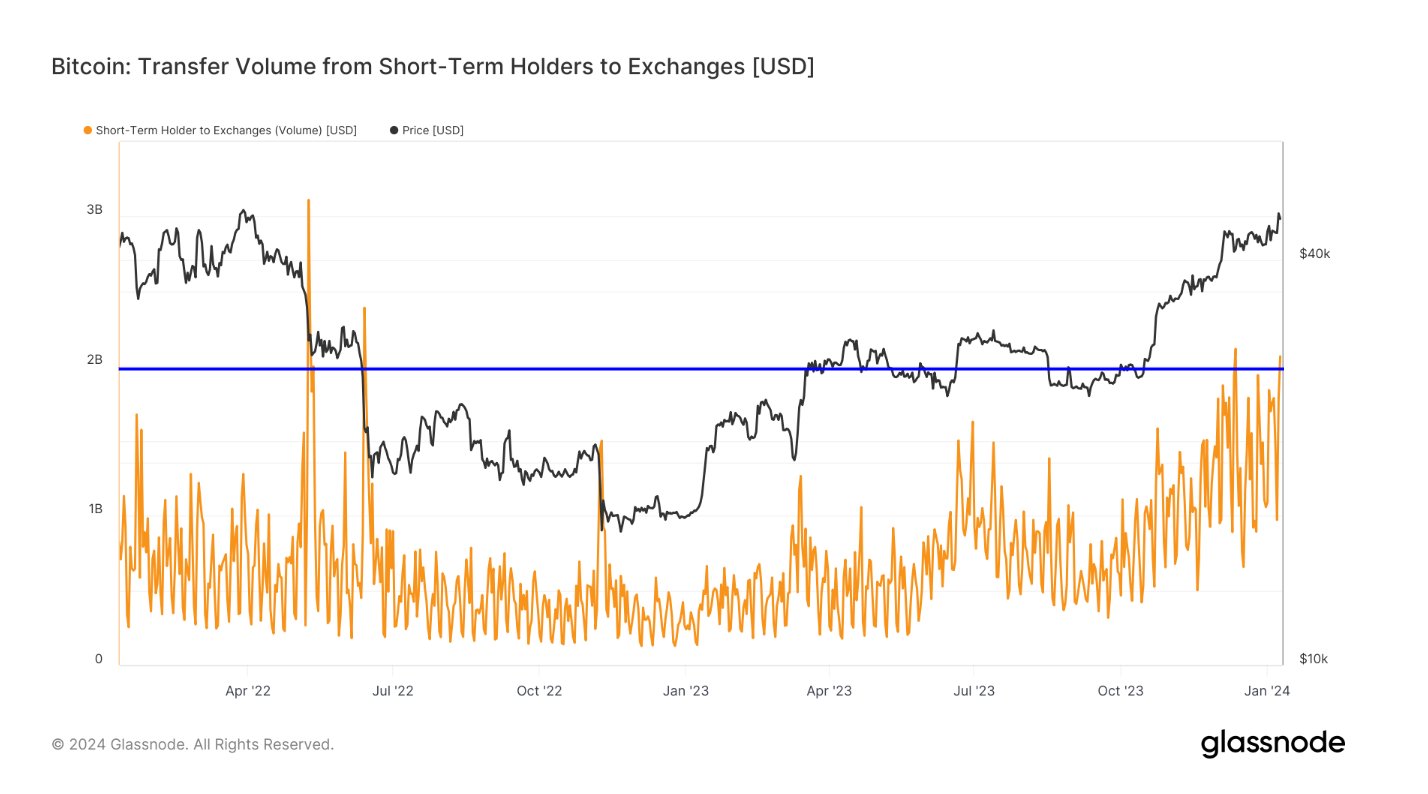

Now, here’s a chart that reveals the development within the Bitcoin STH switch quantity going in direction of exchanges (in USD) over the previous couple of years:

Seems just like the metric has noticed a big spike in current days | Supply: @jimmyvs24 on X

As displayed within the above graph, the Bitcoin quantity going from the wallets held by the STHs towards the exchanges has registered a spike lately. “Yesterday, over $2B value of Bitcoin received despatched to exchanges from STHs,” notes Straten.

From the chart, it’s obvious that over the past couple of years, there have solely been three cases the place the market noticed these weak palms switch extra vital quantities to those platforms.

In accordance with the analyst, $1.3 billion of the full $2 billion influx quantity from the STHs concerned cash carrying some earnings. Whereas the remainder, $750 million, moved at a loss.

If these inflows had been certainly for promoting, it might seem that each varieties of sellers had been available in the market throughout the spike: these capitulating at a loss and people harvesting their earnings. Straten remarks that the profitability ratio of this influx quantity is a bit suspicious, because the asset principally moved flat or detrimental throughout this era.

This potential selloff from the STHs has come because the Bitcoin spot ETF is just not removed from being determined by the US SEC. The fee’s X account was additionally compromised earlier, and somebody posted a pretend approval announcement utilizing it, to which the market reacted strongly.

Given the timing of the inflows, it might seem that the BTC STHs anticipate the occasion to be a sell-the-news kind of deal, so as soon as the choice is made, extra inflows might observe.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $45,200, up greater than 4% prior to now week.

The asset's worth seems to have gone down over the previous day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site fully at your personal danger.