A latest Quicktake evaluation on the on-chain analytics platform CryptoQuant highlighted how Bitcoin’s short-term holders’ (STH) behaviour is much like that of 2019. This evaluation comes as Bitcoin stays under $60,000, persevering with the bearish September development.

Peak In Bitcoin’s Quick-Time period Holders Comparable To 2019 Construction

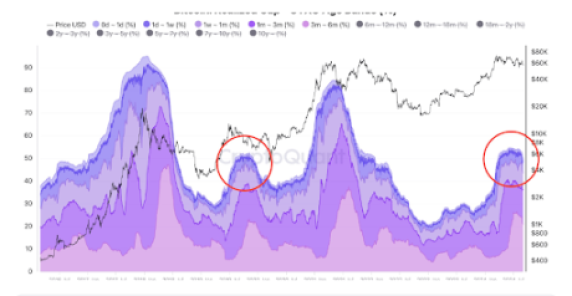

CryptoQuant contributor Avocado_onchain famous that there had been a “small peak” in Unspent Transaction Outputs (UXTOs) beneath six months, which resembles an identical construction noticed in 2019. The analyst defined that these UXTOs beneath six months are new buyers (or short-term holders) who entered the market round March of this 12 months when Bitcoin’s value hit a new all-time excessive (ATH).

In response to the analyst, the declining proportion of those UXTOs means that these buyers have both exited the market as a consequence of Bitcoin’s uneven value motion since March or have held and now transitioned to long-term holders (UTXOs of six months and above).

The accompanying chart confirmed {that a} comparable construction occurred across the halving occasion in 2019 when Bitcoin additionally reached a neighborhood excessive. After that, Bitcoin’s value cooled off and took nearly 490 days to hit a brand new ATH, though Avocado_onchain famous that there was additionally the affect of the COVID-19 pandemic.

This improvement undoubtedly offers insights into what Bitcoin buyers might anticipate from the flagship crypto in the long run, though its value stays uneven. Avocado_onchain remarked that he’s assured about Bitcoin’s long-term upward development. Nonetheless, within the quick time period, he believes will probably be clever for buyers to “mood expectations and intently monitor the market.”

In the meantime, though the analyst admitted that there is no such thing as a clear set off for a Bitcoin breakout, he famous that the inflow of capital from new buyers has traditionally been important for Bitcoin’s value will increase. Bitcoin hit a brand new ATH in March following the launch of the Spot Bitcoin ETFs, which launched new cash into the Bitcoin ecosystem.

Bitcoin Appears to be like To Proceed Bearish September Pattern

Bitcoin appears to proceed its bearish September development this 12 months, with the flagship crypto already down by over 4% because the month started. Traditionally, September is thought to be a bearish month, as information from Coinglass reveals that Bitcoin has suffered a month-to-month loss in six out of the final seven September, courting again to 2017.

Associated Studying

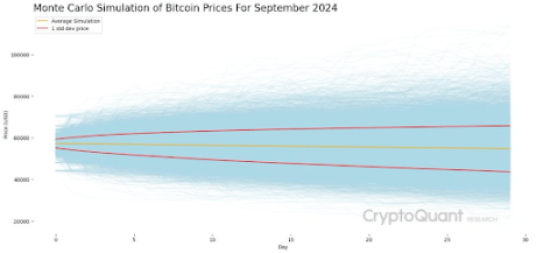

Following his simulation of Bitcoin’s value for this month, CryptoQuant’s Head of Analysis, Julio Moreno, talked about that, on common, the flagship crypto might finish the month at $55,000. Moreno had earlier talked about {that a} drop under $56,000 for Bitcoin places the crypto susceptible to a deeper value correction and getting into a chronic bearish part.

For now, the crypto group hopes that the US Federal Reserve will reduce charges at its subsequent FOMC assembly, which is scheduled for September 17 and 18. A price reduce is believed to be one that might set off Bitcoin’s value and result in a profitable breakout above $60,000.

On the time of writing, Bitcoin is buying and selling at round $56,400, down over 4% within the final 24 hours, in accordance with information from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com