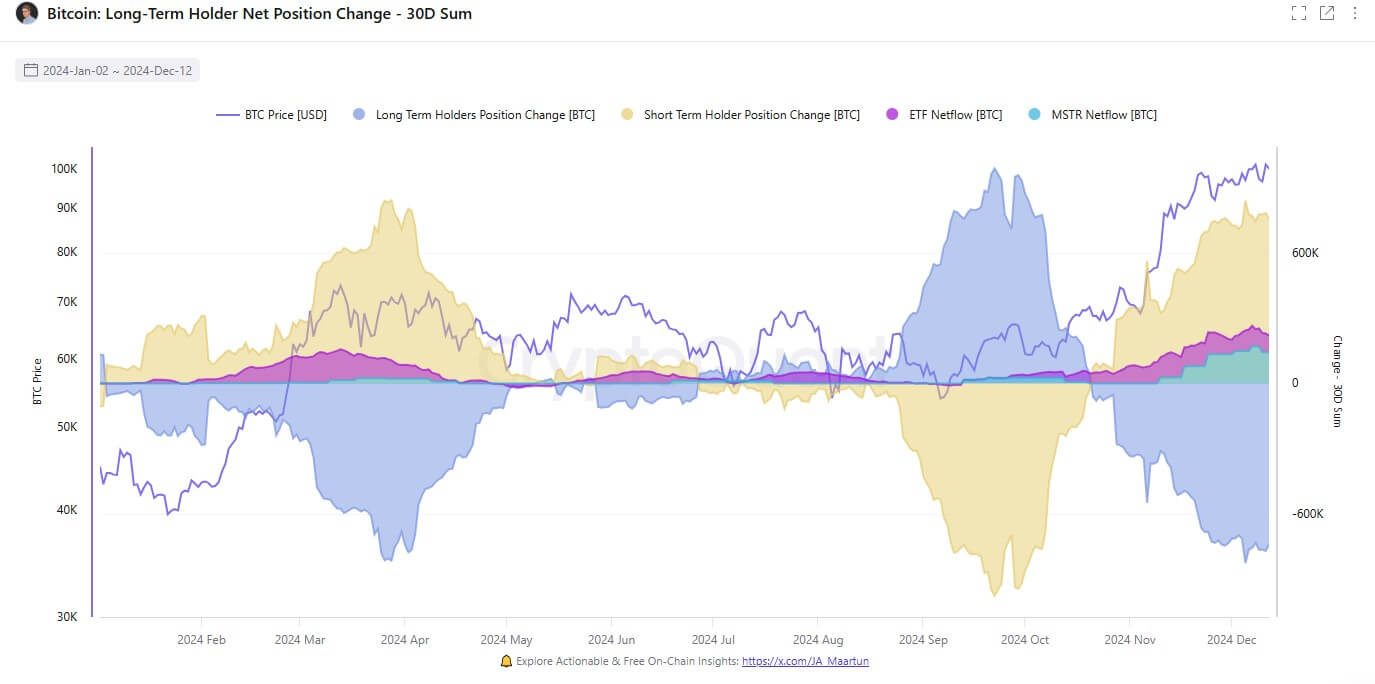

On-chain knowledge reveals rising promoting exercise amongst long-term Bitcoin holders, whose collective holdings have hit their lowest ranges this 12 months.

Outstanding crypto analyst James Examine, also called Checkmate, emphasised the size of this pattern, noting that the promoting stress from these holders far outweighs the demand from ETFs and institutional gamers like MicroStrategy.

Information from CryptoQuant exhibits that long-term holders (LTHs) — traders who retain Bitcoin for over 155 days — have offloaded round 800,000 BTC over the previous month.

In the meantime, institutional entities equivalent to MicroStrategy added 149,880 BTC, and Bitcoin ETFs acquired 84,193 BTC. This nonetheless left 487,000 BTC to be absorbed by short-term holders, primarily retail traders.

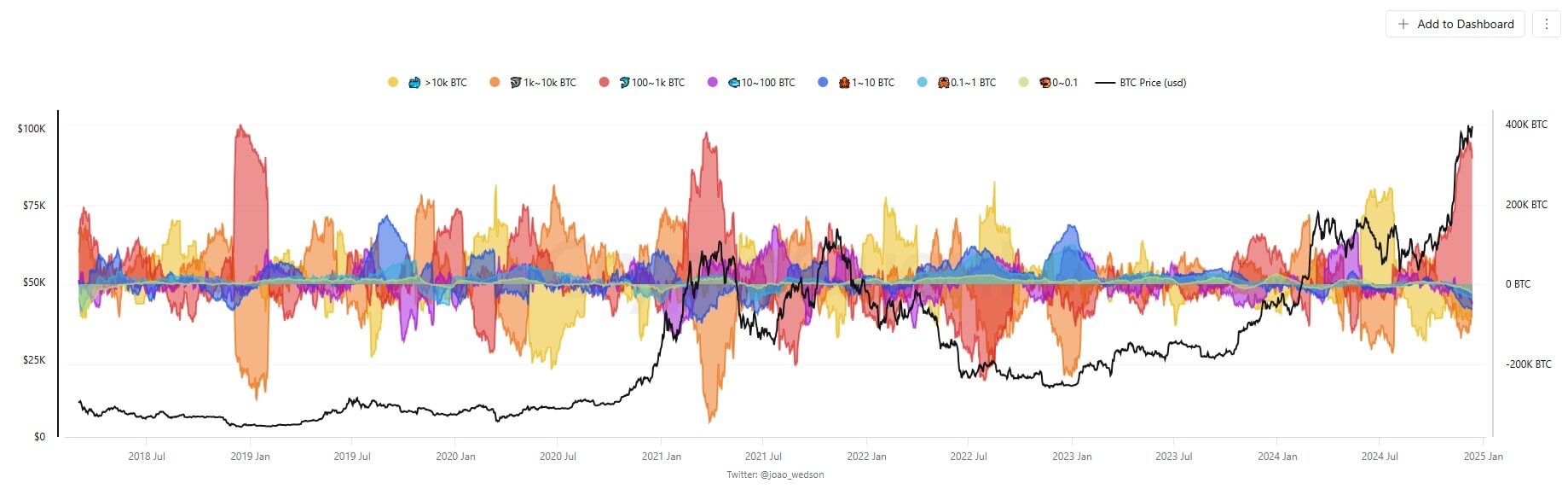

Curiously, dolphins — wallets holding between 100 and 500 BTC — have emerged as vital patrons throughout this era, accumulating over 350,000 BTC. This shift highlights a notable change in provide traits and market sentiment.

Whereas institutional and ETF-driven demand has not instantly translated into sharp value actions, it indicators evolving participant profiles and their rising affect on Bitcoin’s market traits.