A well-liked crypto analyst is updating his outlook on Bitcoin (BTC) as a key occasion approaches.

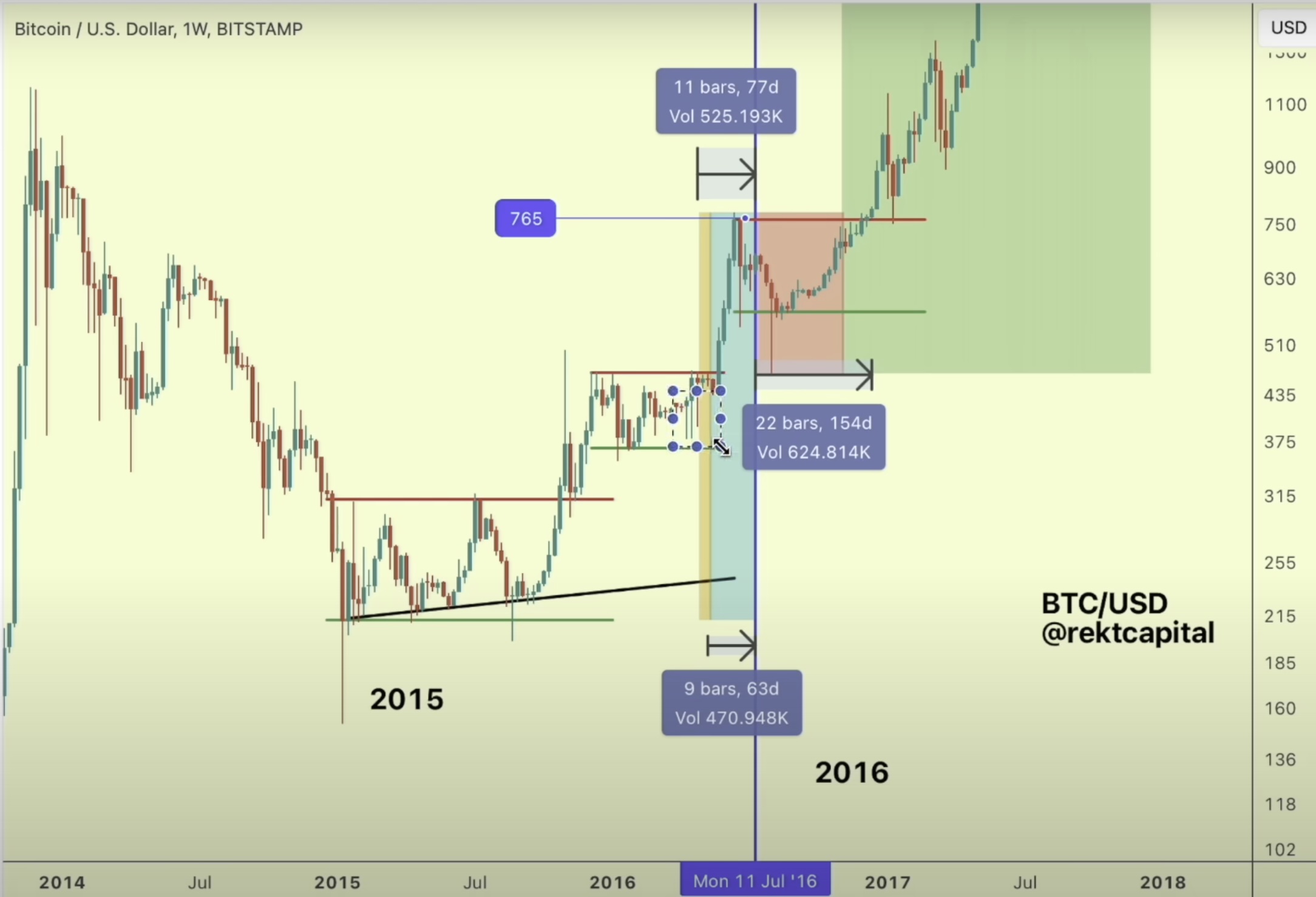

Pseudonymous crypto dealer Rekt Capital tells his 53,700 YouTube subscribers that Bitcoin is probably going going to repeat a 2016 sample and rally heading into the mid-April BTC halving, when miners’ rewards are minimize in half.

Nevertheless, the dealer warns Bitcoin may nosedive within the close to time period because the crypto king stays in a re-accumulation vary.

“So you’ll be able to see that we’re right here within the re-accumulation vary as soon as once more, similar to 2016. And in 2016 we noticed draw back deviation wicking inside the re-accumulation vary.

What we’re seeing on this cycle can also be draw back wicking, however beneath the re-accumulation vary, not inside it, however slightly below it. Nonetheless, nonetheless, although, pulling again in retracement inside this total re-accumulation vary and holding that re-accumulation vary as we method the halving occasion.

So if historical past have been to repeat based mostly on 2016 we must always see some kind of upside going into the pre-halving rally.”

Taking a look at his chart, the dealer suggests Bitcoin could rally to across the $50,000 stage heading into the halving.

The dealer additionally believes that within the subsequent two weeks, Bitcoin may dip and revisit the $38,000 stage.

“However the subsequent two weeks are going to be fairly attention-grabbing as a result of they’re opening up for potential nonetheless draw back wicking beneath this re-accumulation vary like we noticed in 2016. In 2016, you’ll be able to see [in chart below] that there have been a number of weeks of draw back wicking inside the re-accumulation vary.

So if that is any indication, what if we get some persistent draw back wicking nonetheless even on this cycle inside the re-accumulation vary, perhaps nonetheless draw back deviating beneath that re-accumulation vary.”

The dealer additionally thinks there stays a small probability that the re-accumulation vary will break down, sending Bitcoin beneath $38,000.

“Any draw back deviation beneath this vary on this present cycle is a risk…

There are very particular circumstances that Bitcoin would want to easily meet to interrupt beneath $38,000…

However so long as that re-accumulation vary holds, then we’re solely going to complete on a 21% retrace from the highs and historical past is suggesting to us that we’re in all probability going to see this re-accumulation vary proceed to carry going into the halving.”

The dealer suggests a “worst case situation” for a Bitcoin dip this cycle could be across the $32,000 stage.

Bitcoin is buying and selling at $42,938 at time of writing.

I

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: DALLE3