The state of Bitcoin (BTC) worth motion throughout a number of time frames has analysts on the fringe of their seats. As of February 7, varied technical formations recommend that the main crypto seems poised for a important breakout from the present consolidation.

Is Bitcoin Making ready For A Massive Transfer?

Taking to X, Mags thinks Bitcoin is in for a “massive transfer,” contemplating the candlestick association within the weekly chart. The analyst notes that costs have been shifting horizontally prior to now 9 weeks, falling inside the anticipated vary.

The Bitcoin market has ranged between 8 and 30 weeks prior to now. To date, the present consolidation has lasted for 9 weeks. Amid this, Bitcoin costs have examined each side of the vary with notable “fake-outs.”

In mild of the present state of affairs within the Bitcoin market, Mags is assured that the extended consolidation means that the coin, guided by historical past, may edge greater.

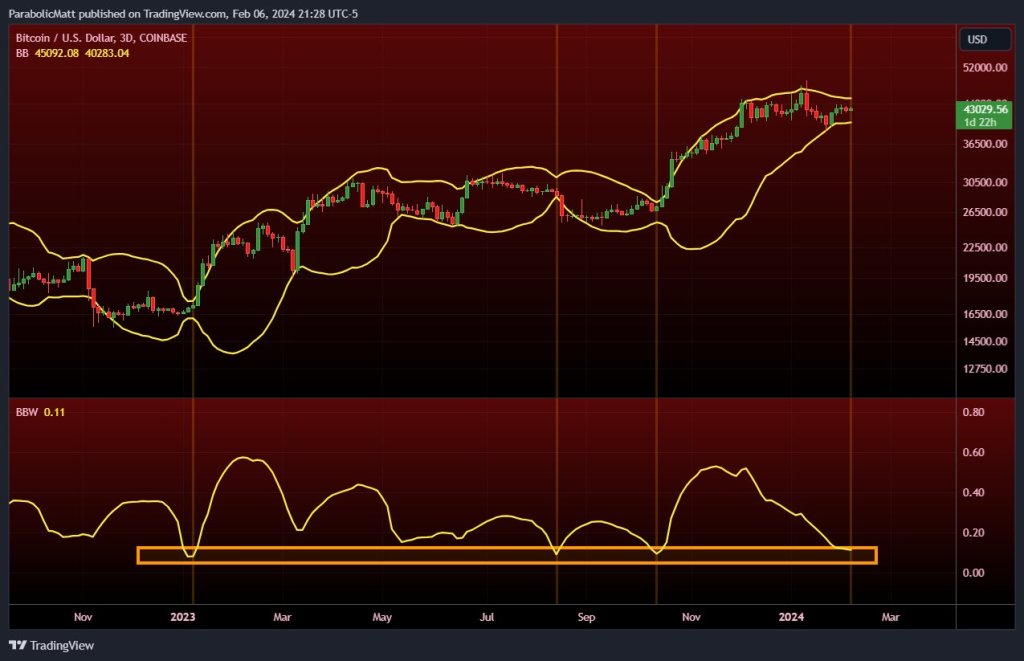

Past the ranging market, one other analyst notes that the Bitcoin 3-day Bollinger Bands, a technical indicator that measures volatility, is narrowing. The squeeze, the dealer notes, is at historic ranges, typically adopted by a breakout. Nevertheless, as it’s, how costs will evolve within the weeks and months forward stays unsure.

Including to the intrigue, Jason Goepfert on X factors out that the S&P 500, a inventory market index, is at the moment inside 0.35% of its 3-year excessive. The uptrend is obvious despite the fact that lower than half of all shares constituting the index are buying and selling above their 10-day shifting common.

On the identical time, lower than 60% are above their 50-day shifting common, and fewer than 70% are above their 200-day shifting common. This uncommon confluence means that the monetary market may very well be at a important turning level, presumably impacting crypto.

Eyes On Spot ETF Issuers And United States Federal Reserve

Solely time will inform whether or not Bitcoin will rally or tank from spot charges. Nevertheless, what’s evident is that the Bitcoin uptrend stays clear, with fundamentals aligning to assist optimistic bulls. As an instance, spot Bitcoin ETF issuers are shopping for extra cash from the market. On the identical time, the thrill across the upcoming Bitcoin halving occasion is including gasoline to the optimism.

The broader market can be watching the US Federal Reserve. Market consensus is that the central financial institution will slash rates of interest in March 2024 and embark on quantitative easing. With more cash circulating, some will discover their strategy to Bitcoin, driving costs to document highs of $69,000 or past within the coming months.