Bitcoin has noticed a pullback all the way down to the $58,000 stage in the course of the previous day. Right here’s what might be the trigger behind it, in line with on-chain knowledge.

Exchanges Have Seen A Massive Quantity Of Tether Withdrawals Just lately

In keeping with knowledge from the market intelligence platform IntoTheBlock, centralized exchanges have just lately seen a Tether (USDT) outflow spree exceeding $1 billion.

Associated Studying

Buyers often preserve their cash in exchanges once they need to commerce them within the close to future, so them making the transfer to withdraw their tokens probably implies that they’re enthusiastic about holding into the long-term.

For unstable belongings like Bitcoin, trade outflows can naturally be a bullish signal for that reason. Within the context of the present matter, although, the asset being withdrawn is a stablecoin, so the implication for the market is a bit completely different.

Typically, traders retailer their capital within the type of fiat-tied tokens like Tether once they need to escape the volatility related to cash like BTC. Such holders do ultimately plan to enterprise again into the opposite facet of the market and so they could use exchanges for doing so.

When holders purchase into belongings like Bitcoin utilizing their stablecoin, they naturally find yourself boosting their costs. As such, trade inflows of stables could be a bullish signal for the sector.

Withdrawals of USDT and others into self-custody as an alternative, nevertheless, could be a bearish signal for the market, because it exhibits the traders don’t consider they might be making a swap into the unstable facet within the close to future.

The newest Tether withdrawals could, subsequently, be why the Bitcoin value has tumbled. This USDT exiting exchanges might even have represented recent BTC sells, as many traders like to maneuver into self-custody as quickly as they’ve swapped between belongings.

As IntoTheBlock has identified within the chart, the final two massive USDT trade outflows additionally had a bearish impact on BTC.

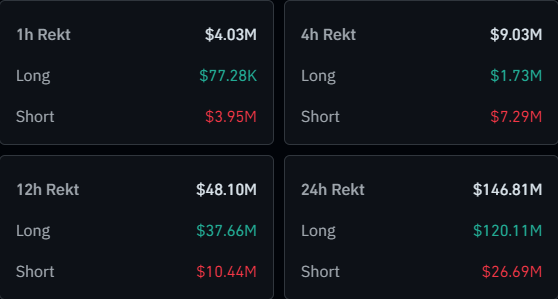

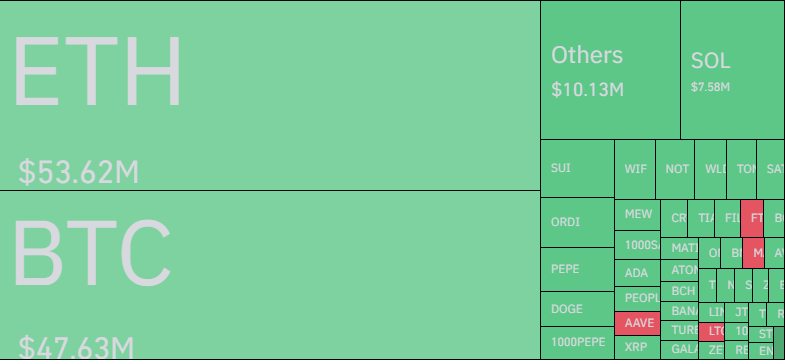

In another information, the cryptocurrency derivatives market as an entire has seen a considerable amount of liquidations on account of the volatility that Bitcoin and different cash have displayed in the course of the previous day.

Under is a desk from CoinGlass that sums up the liquidations which have occurred within the newest unstable market section.

As is seen above, round $146 million in cryptocurrency liquidations have occurred over the previous day, with $120 million coming from the lengthy contracts alone, representing greater than 80% of the full.

Associated Studying

Apparently, Ethereum (ETH) is the image that has contributed probably the most in the direction of this derivatives flush and never Bitcoin like is often the case. That stated, ETH has solely $6 million extra liquidations than BTC.

BTC Value

On the time of writing, Bitcoin is buying and selling round $58,800, down 4% during the last 24 hours.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com