On-chain information reveals that Bitcoin is forming a sample in its Whole Quantity of Holders, which final proved bullish for the cryptocurrency.

Bitcoin Has Seen A Fall In Its Whole Variety of Holders Not too long ago

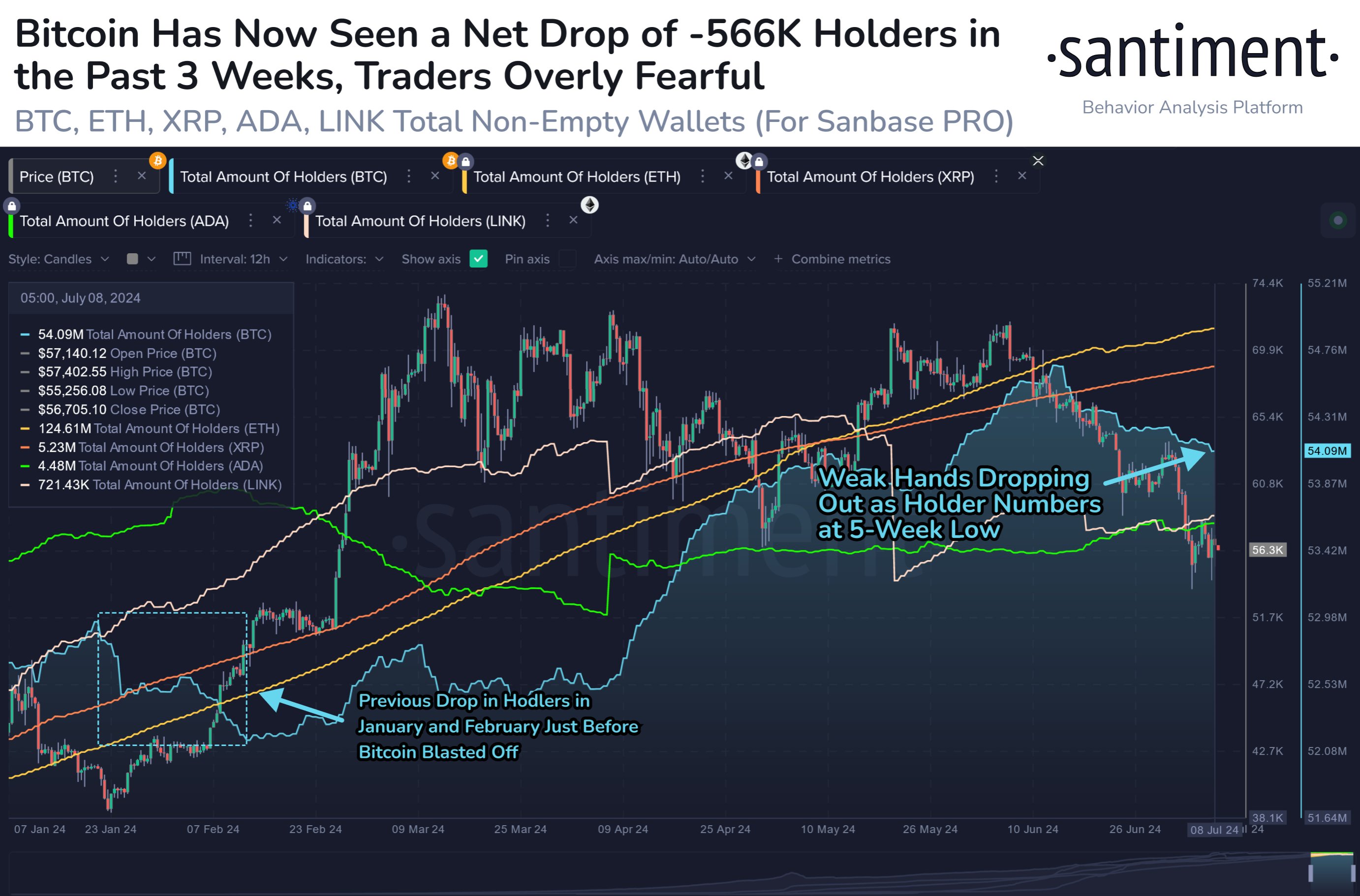

In accordance with information from the on-chain analytics agency Santiment, BTC traders have been liquidating their wallets amid the latest bearish wave within the asset. The indicator of relevance right here is the “Whole Quantity of Holders,” which measures, as its identify suggests, the entire variety of addresses holding some stability on the community.

When the worth of this metric goes up, it means new traders are becoming a member of the community, and outdated ones who had offered earlier are returning. The pattern can even come up resulting from present customers creating new addresses for privateness functions.

Associated Studying

Basically, some web adoption happens when the Whole Quantity of Holders rises. Adoption is a constructive signal for any cryptocurrency in the long run.

Then again, the indicator registering a drop implies some traders have determined to exit from the asset as they’re fully emptying their wallets.

Now, here’s a chart that reveals the pattern within the Whole Quantity of Holders for 5 high cash within the sector: Bitcoin (BTC), Ethereum (ETH), XRP (XRP), Cardano (ADA), and Chainlink (LINK), because the begin of the yr:

As is seen within the above graph, the entire variety of holders has not too long ago gone by way of a drawdown for Bitcoin. This decline within the metric has come as the worth of the asset itself has been transferring down.

In whole, 566,000 BTC wallets have emptied themselves over the past three weeks. The timing would counsel that the bearish market has spooked these traders into exiting.

Apparently, Ethereum, Cardano, and XRP have continued to see a web improve on this indicator, implying that adoption has solely furthered for these altcoins.

Whereas BTC’s lower does suggest that holders are transferring away from the community, the truth that FUD is the explanation behind this departure could play into the cryptocurrency’s favor.

Traditionally, Bitcoin has tended to indicate strikes within the course reverse to what the gang thinks, so the event of FUD has usually led to the coin discovering a reversal in the direction of the upside.

Associated Studying

From the chart, it’s obvious that the entire quantity of holders additionally decreased in January and February, and this pattern adopted a pointy rally for the coin in the direction of a brand new all-time excessive (ATH).

“Affected person bulls needs to be happy with this, as self-liquidating wallets from impatient non-believers is an indication of FUD-causing bottoms, similar to we noticed in January,” notes Santiment.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $57,400, down greater than 7% during the last week.

Featured picture from Dall-E, Santiment.web, chart from TradingView.com