The CEO of the on-chain analytics agency CryptoQuant defined that Bitcoin’s value isn’t at present overvalued based mostly on its community fundamentals.

Bitcoin Value Might Not Be Overvalued But Primarily based On Thermo Cap Ratio

In a brand new submit on X, CryptoQuant CEO and founder Ki Younger Ju has mentioned about how the latest pattern within the Bitcoin Thermo Cap Ratio has been like. The “Thermo Cap” is a capitalization mannequin for BTC that calculates the overall worth of the asset by taking every token’s worth as the identical because the spot value when it was mined on the community.

Associated Studying

Put one other manner, this mannequin calculates the cumulative worth of the cash mined by the miners because the inception of the blockchain. That is fairly totally different from what, for instance, the standard market cap does. Available in the market cap’s case, the present spot value is taken as the worth of all cash in circulation.

Because the cash that miners mine are the one strategy to improve the cryptocurrency’s provide, the Thermo Cap could also be thought-about a measure of the “true” capital inflows coming into the community.

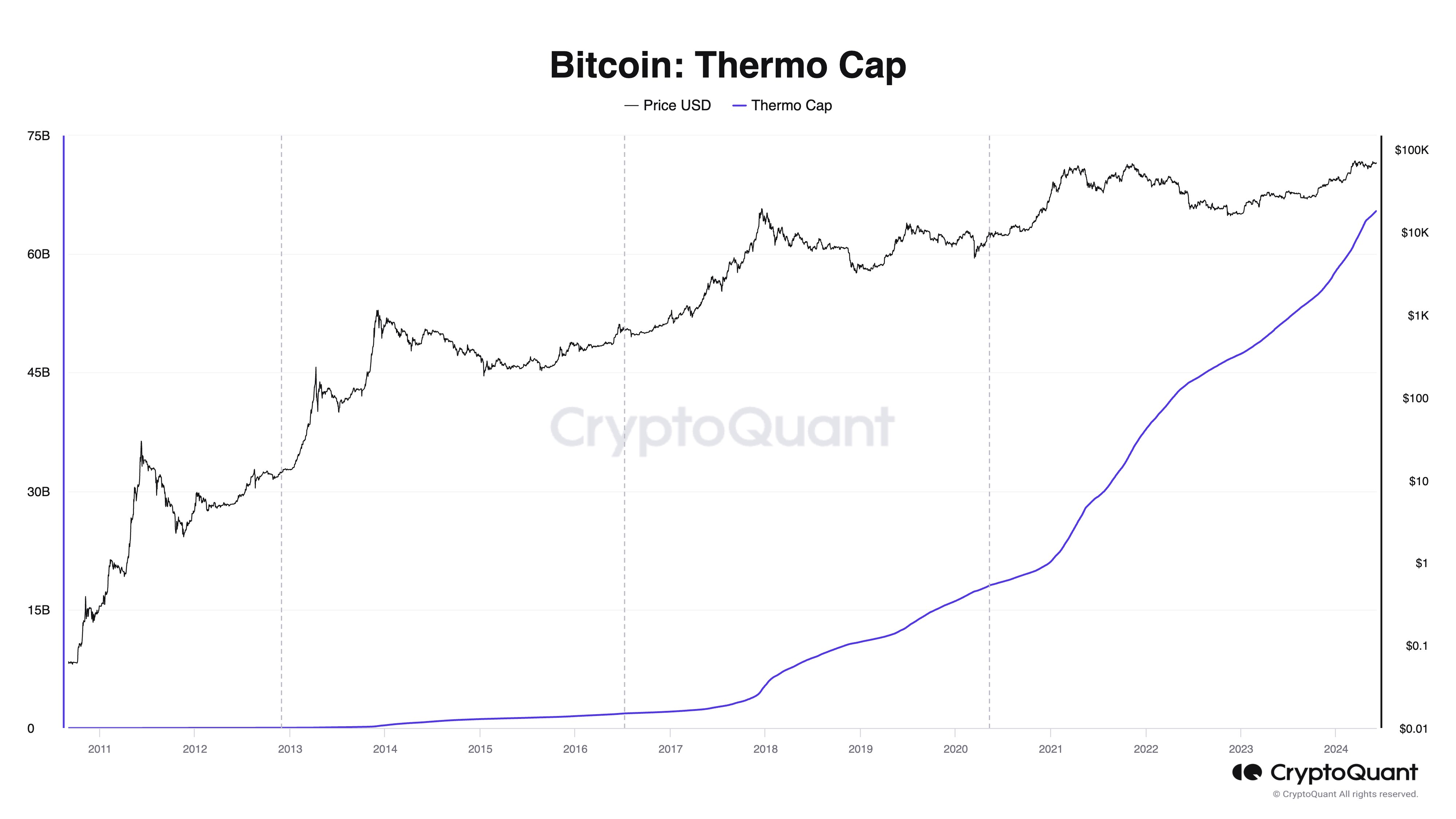

Here’s a chart that shows how the Bitcoin Thermo Cap has modified over its historical past:

Because the above graph reveals, the Thermo Cap has seen an accelerating development curve. This naturally displays the rising quantity of capital flowing into the asset over time.

Within the context of the present matter, although, the indicator of curiosity isn’t the Thermo Cap itself however relatively the Thermo Cap Ratio. This metric tracks the ratio between the Bitcoin market cap and the Thermo Cap.

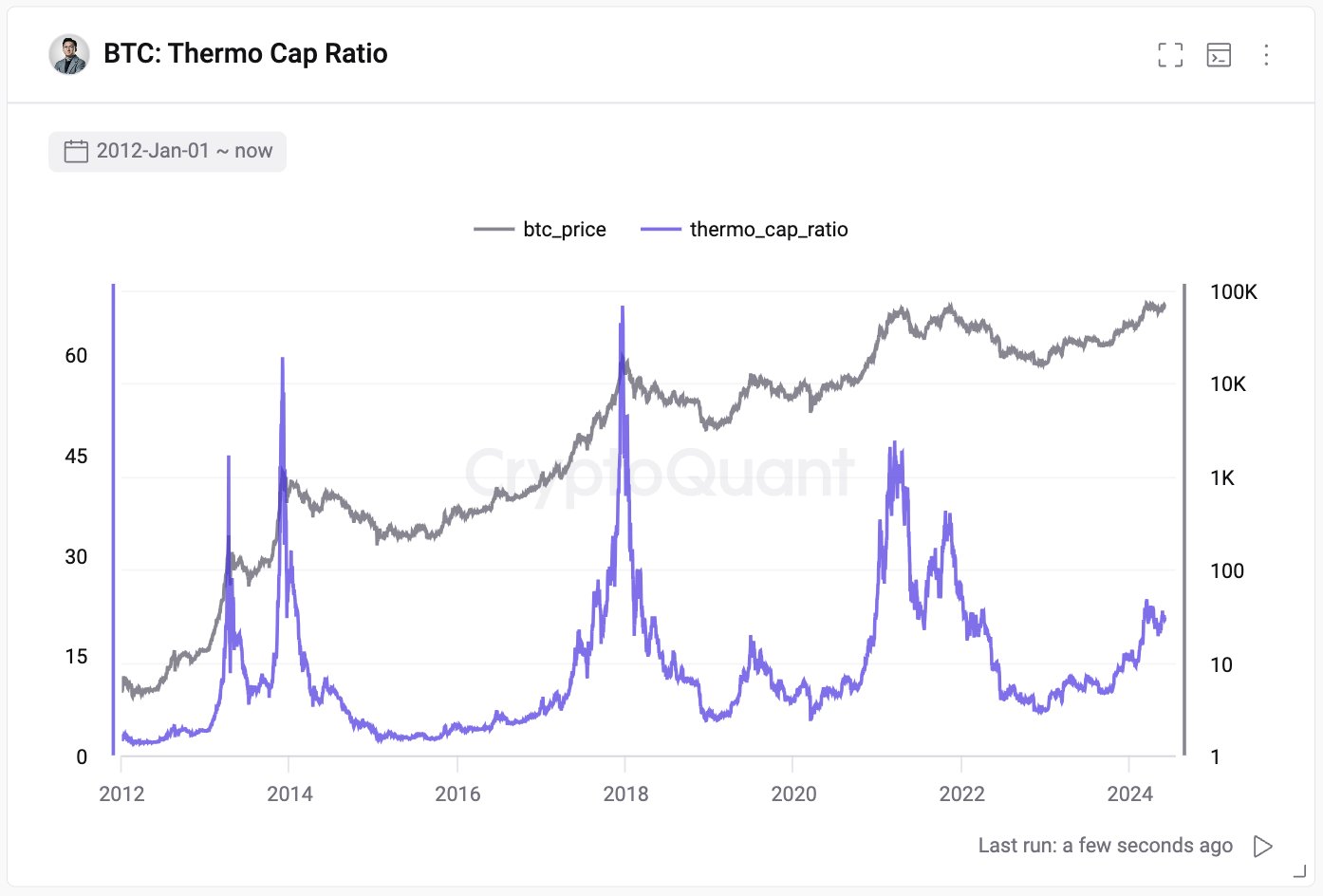

The chart under reveals the pattern within the Thermo Cap Ratio over the asset’s historical past.

An attention-grabbing sample is seen within the graph. It seems that very excessive values of the Thermo Cap Ratio have coincided with highs within the cryptocurrency’s value.

Associated Studying

At excessive values, the Bitcoin market cap is sort of massive in comparison with the Thermo Cap, which means that cash are buying and selling at a a lot increased fee than they have been mined at.

It’s additionally obvious that bottoms in BTC happen when the ratio assumes low values. The latest pattern within the indicator has been that of an increase, however its worth has not touched the degrees the place bull run tops would have occurred up to now. “Bitcoin isn’t at present overvalued based mostly on community fundamentals,” notes the CryptoQuant founder.

BTC Value

Bitcoin has been unable to interrupt out of its vary lately as its value has stored up the pattern of sideways motion. At current, BTC is buying and selling at round $68,900.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com