Bitcoin Money’s hash fee soared to a yearly excessive this week after an unknown miner captured round 90% of its blocks inside two days.

This surge comes because the community’s native BCH token hit a four-month low following a broader market crash and the defunct Mt. Gox BCH compensation plans.

Phoenix mines 90% of BCH blocks

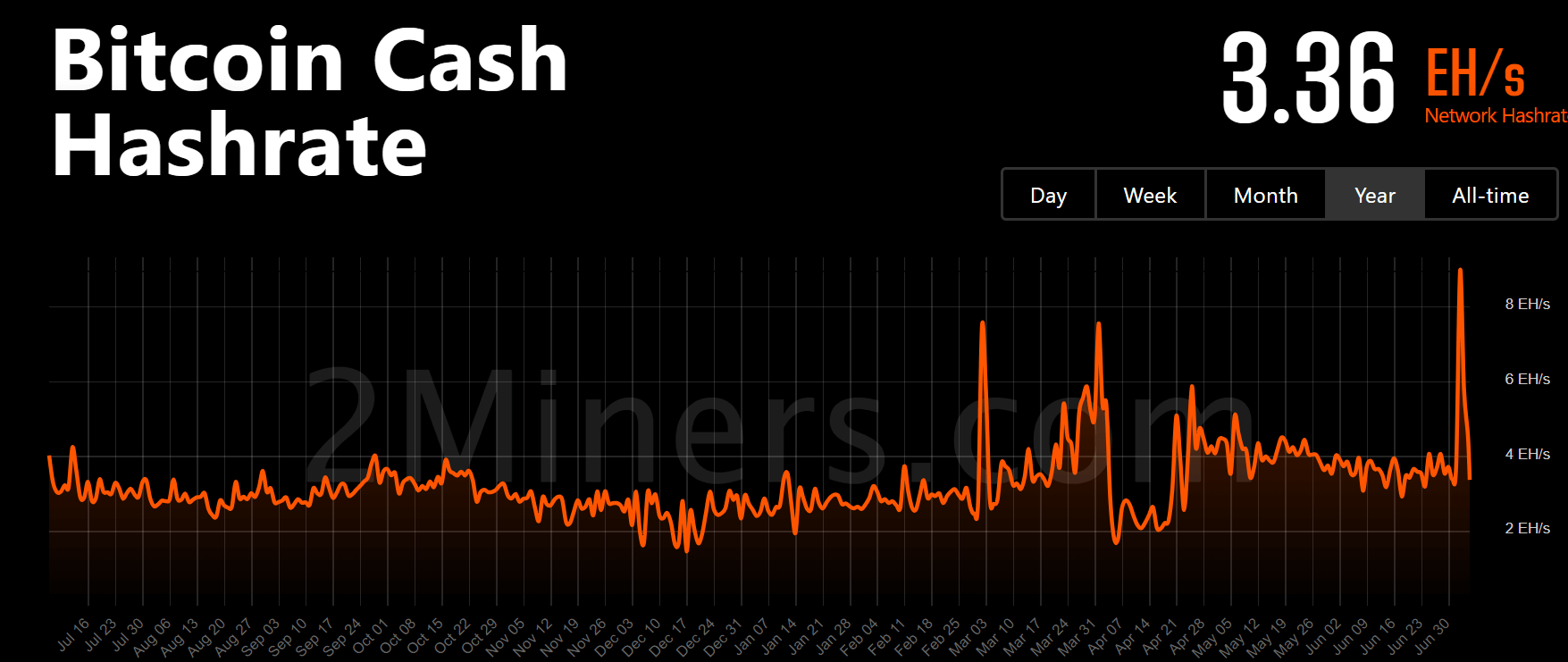

Based on 2miners knowledge, the Bitcoin Money community noticed a large hash fee surge between July 2 and July 4, rising from 3.6 EH/s to a yearly excessive of 9.4 EH/s earlier than declining again to the weekly common of three.3 EH/s as of press time.

The hash fee is a vital measure of a blockchain community’s well being. It measures the computational energy used to mine and course of transactions. A better hash fee means a safer community, requiring extra computational energy to change the blockchain and making it extra proof against assaults.

Conversely, a decrease hash fee signifies much less computational energy for mining and processing transactions, lowering the community’s general safety.

So, whereas BCH’s dramatic soar in hash fee excited the crypto group, it additionally sparked hypothesis about its causes and implications for the community.

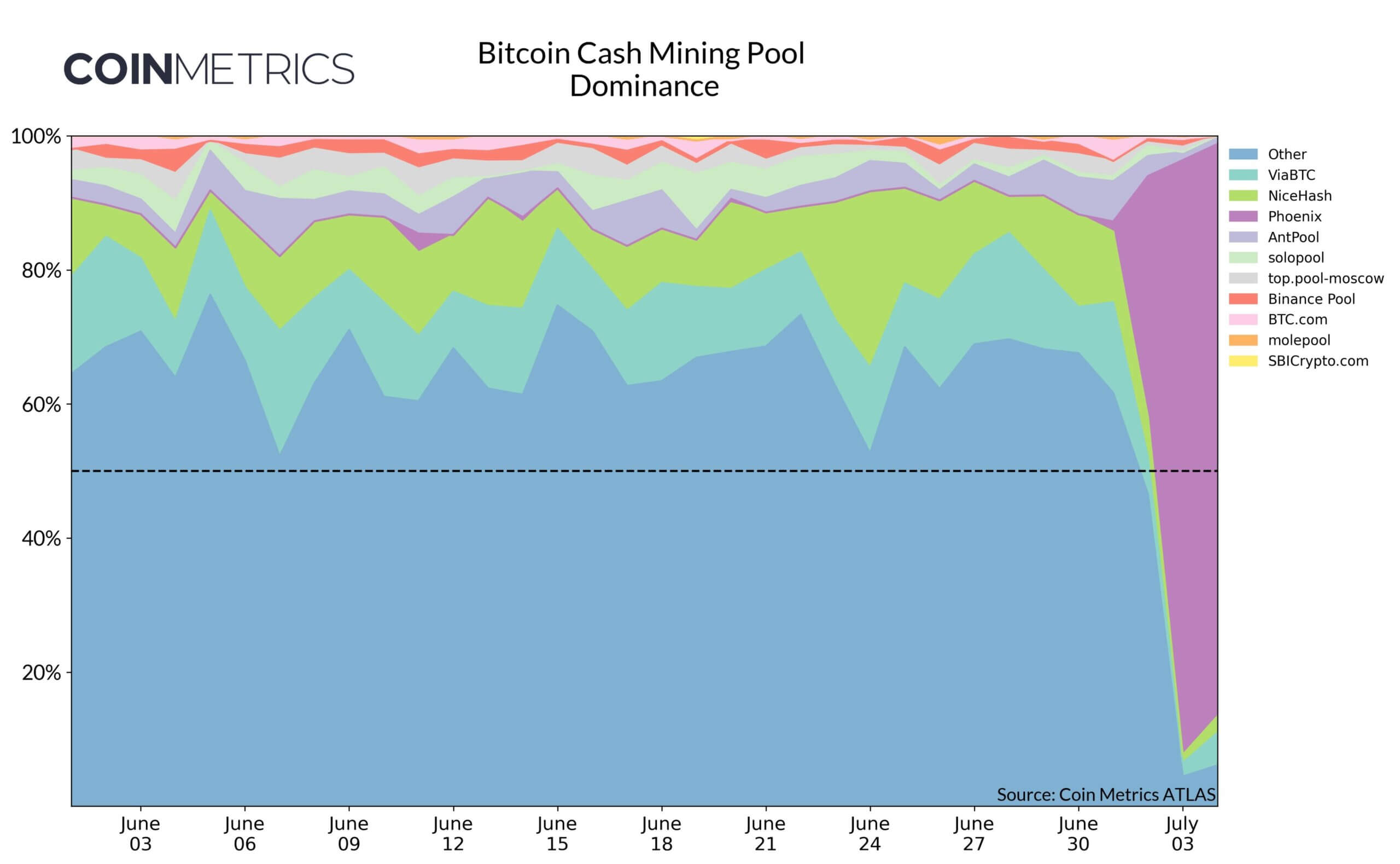

The Bitcoin Money Podcast attributed the surge to a brand new miner named “Phoenix, ” which captured a lot of the new BCH provides. Knowledge reveals this miner produced about 90% of the blocks throughout these two days, although its dominance has fallen to 29% at press time.

Parker Merritt, a researcher at CoinMetrics, supported this view. He recommended the miner was linked to the Phoenix Group, an Abu Dhabi-listed Bitcoin mining firm that just lately launched a mining pool service for BTC and BCH networks.

Additional, Merritt famous that Phoenix’s actions could be an try to focus on the “dangers of mining centralization.”

Value declines to 4-month low

Bitcoin Money mining points surfaced when the community’s native BCH token plunged to a four-month low of $305.

Market observers attributed the decline to the broader market decline that noticed main digital belongings like Bitcoin fall by round 7% previously day to beneath $55,000. On the identical time, Ethereum additionally misplaced the $3,000 mark in the course of the reporting interval.

Moreover, Merrit identified that BCH’s worth would possibly face heavy promoting exercise as Phoenix won’t HODL their earnings.