Bitcoin miners have struck a proverbial goldmine, reaping an astonishing $107 million in earnings, in response to knowledge from Glassnode, a number one analytics platform. This unprecedented windfall, amassed on April twentieth, underscores a big shift within the income dynamics of Bitcoin mining operations.

The meteoric rise in transaction charges serves as a bellwether for the evolving financial panorama of Bitcoin mining. Because the community adapts to new market calls for and technological developments, transaction charges have emerged as a vital income stream for miners. This pattern is especially noteworthy given the scheduled reductions in block rewards, highlighting the resilience and adaptableness of Bitcoin’s financial mannequin.

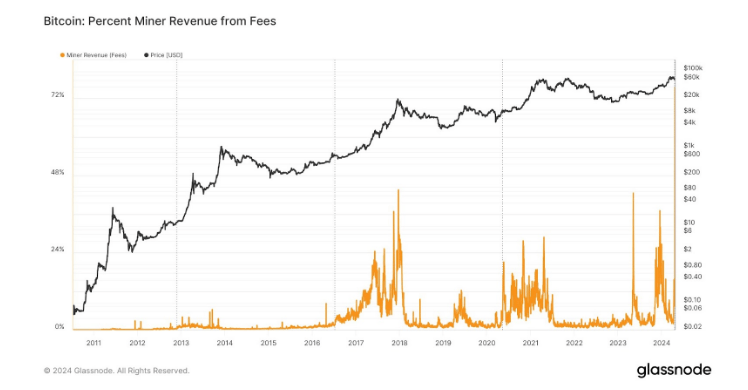

In line with glassnode, affected by the Runes minting exercise, on April 20, Bitcoin miner income reached US$106.7 million, of which 75.444% got here from community transaction charges, each reaching file highs. https://t.co/lVSyqn1UaE pic.twitter.com/xjkkTor2I9

— Wu Blockchain (@WuBlockchain) April 21, 2024

Runes-Fueled Minting Spree Boosts Miner Income

Driving this surge in profitability is a current minting spree centered on Runes, a pivotal growth that has left a tangible mark on the community’s dynamics. Studies point out {that a} staggering 75% of the overall earnings stemmed from transaction charges, marking a brand new pinnacle within the distribution of income amongst BTC miners.

Runes is much like Ordinals; they each let customers completely retailer knowledge instantly on the Bitcoin blockchain, like an inscription etched in stone. However there’s a key distinction in what they retailer: Ordinals are one-of-a-kind digital collectibles, much like fancy buying and selling playing cards.

Runes, however, are designed to behave extra like meme cash, these broadly tradable and sometimes humorous tokens which have been a current craze within the crypto world.

BTCUSD buying and selling at $66,144 on the weekly chart: TradingView.com

This paradigm shift in earnings composition underscores the rising significance of transaction charges as an important earnings supply, particularly as block rewards face deliberate reductions within the context of Bitcoin’s halving system.

This monetary triumph comes amidst ongoing debates surrounding the sustainability and profitability of mining actions. With escalating power calls for and mounting regulatory scrutiny, the viability of mining operations has been referred to as into query. Nevertheless, the current knowledge paints a reassuring image of the financial vitality of Bitcoin mining, demonstrating its resilience within the face of exterior pressures.

Implications For Bitcoin’s Future

Past the instant monetary beneficial properties, the surge in transaction charges holds profound implications for the long run trajectory of Bitcoin. The unprecedented assortment of charges signifies sturdy community exercise and consumer engagement, indicating robust demand and utilization of the Bitcoin blockchain.

This bodes effectively for the long-term sustainability and growth of Bitcoin as a distinguished digital foreign money, bolstering confidence amongst stakeholders and fans alike.

Featured picture from VistaCreate, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal threat.