New analysis from VanEck reveals that Bitcoin (BTC) miners are shifting to synthetic intelligence (AI) and high-performance computing.

In a thread on the social media platform X, Matthew Sigel, the top of digital belongings analysis at VanEck, says that BTC miners are using know-how to earn income by way of strategic arbitrage.

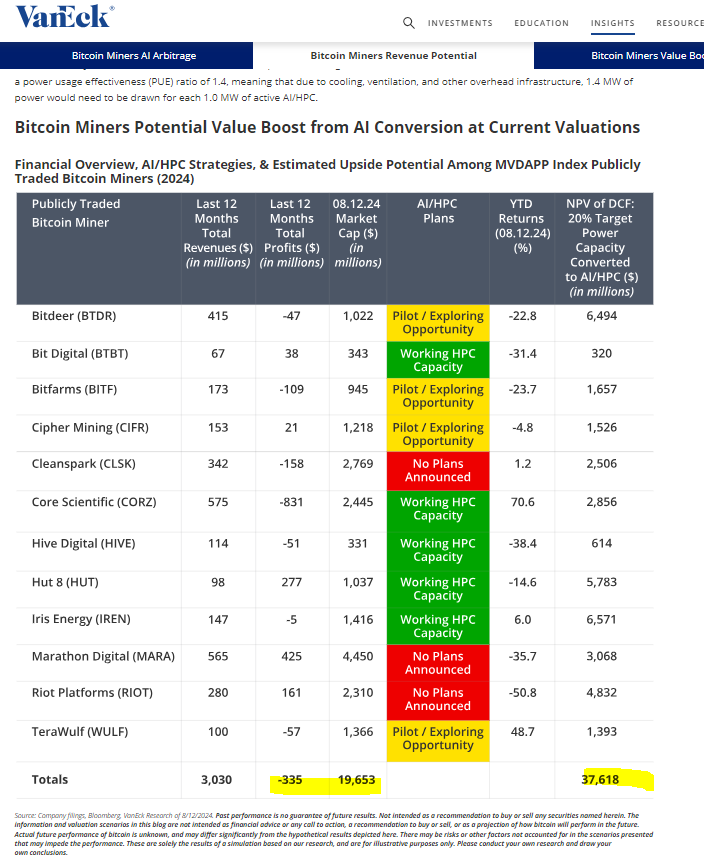

“Bitcoin miners are shifting to AI and high-powered computing (AI/HPC), unlocking new income by way of strategic arbitrage. We estimate a $38 billion web current worth alternative by changing 20% of their collective capability by 2027. (For context, the mixed market cap of the shares we checked out is $19 billion).”

In keeping with VanEck, AI initiatives are energy-intensive endeavors and Bitcoin miners are well-positioned to handle the problem and generate a brand new revenue stream.

“The synergy is straightforward: AI firms want vitality, and Bitcoin miners have it. Because the market values the rising AI/HPC knowledge middle market, entry to energy – particularly within the close to time period – is commanding a premium… Current Bitcoin miners are uniquely geared up to help AI/HPC instantly.”

In keeping with VanEck’s knowledge, publicly traded BTC miners presently management a document share of Bitcoin’s hashrate whereas their general market cap hit all-time highs in July.

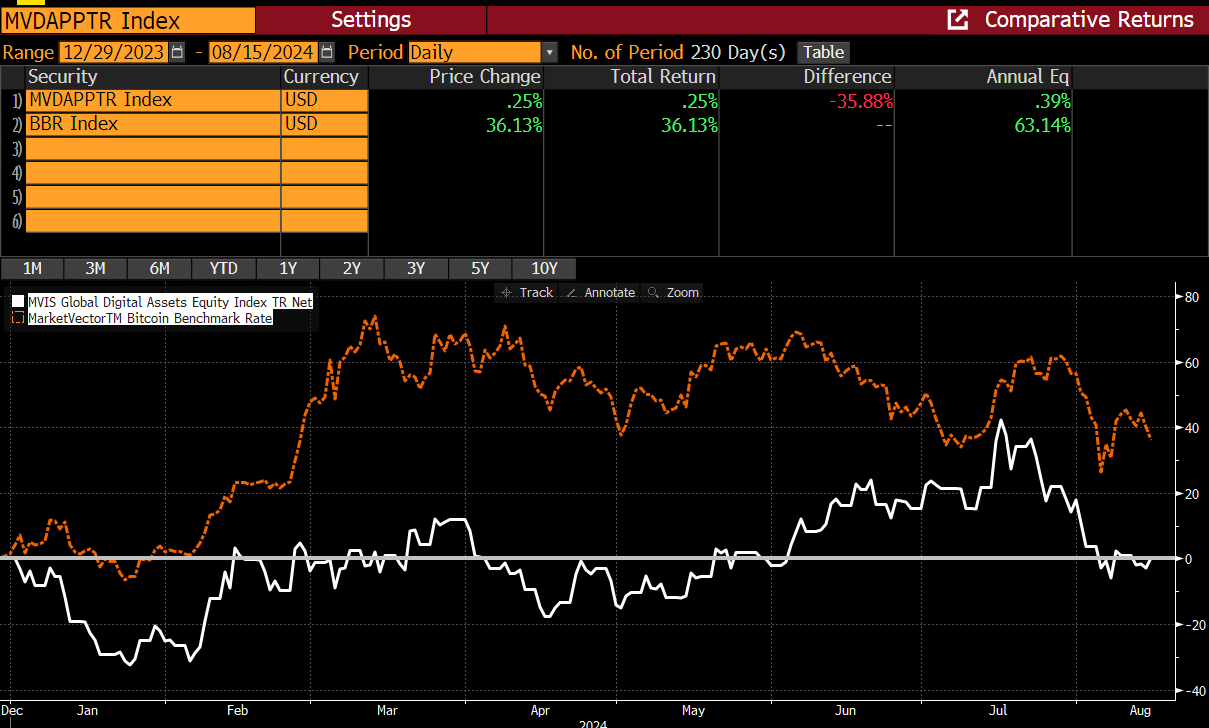

Nonetheless, Sigel says that when crypto markets corrected in August, the MarketVector Digital Asset Fairness Index – which retains observe of the efficiency of the most important and most liquid firms within the digital belongings business – began closely underperforming in opposition to Bitcoin.

“After the current correction, nevertheless, the MarketVector Digital Asset Fairness Index, monitoring these shares, is flat year-to-date, underperforming the Bitcoin value by 3,800 foundation factors. At these ranges, we consider traders are lacking a narrative that would double the market cap of the shares, even with no change in Bitcoin mining income.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney