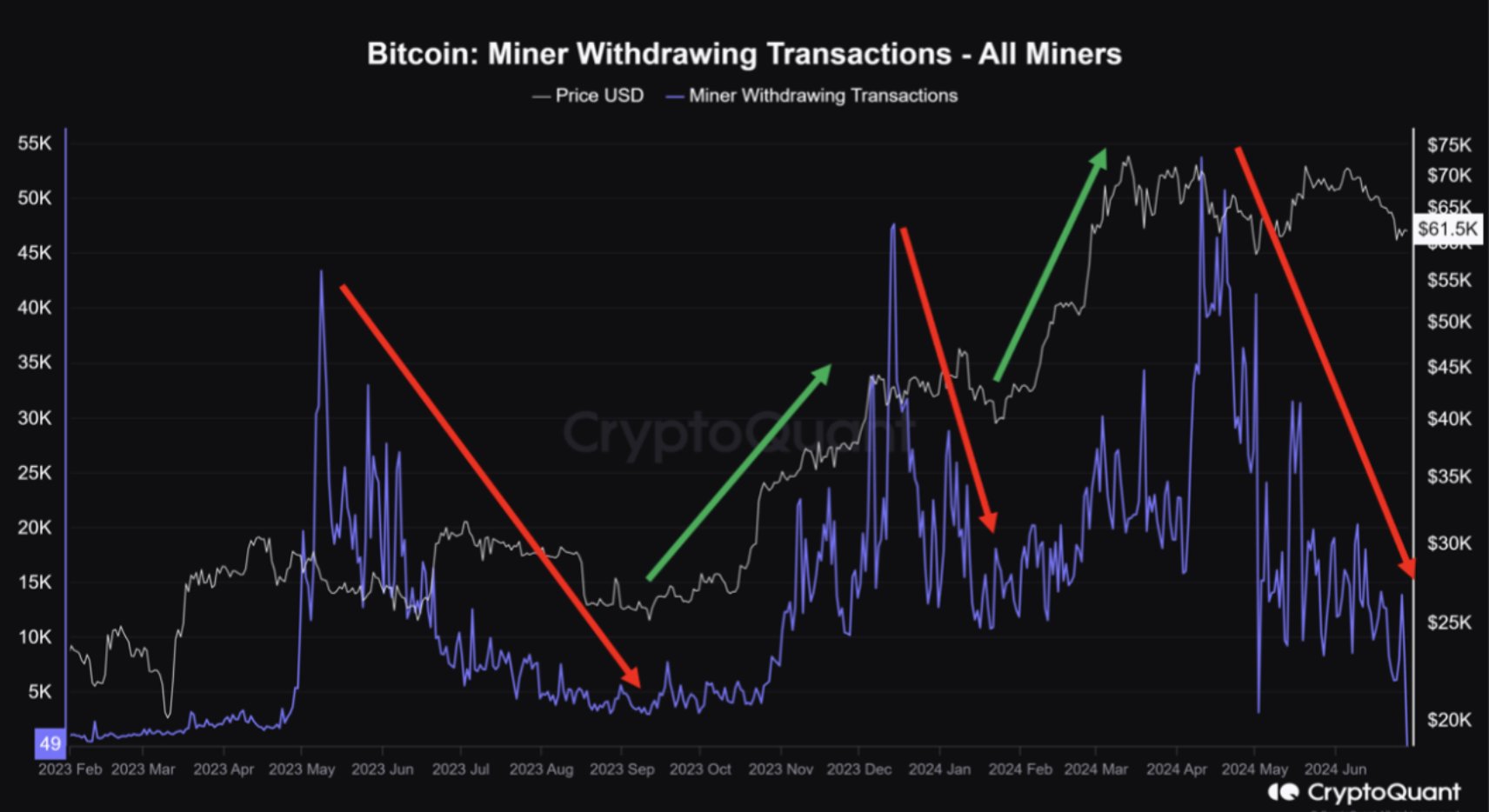

In an evaluation offered by CryptoQuant, a major change in Bitcoin miner conduct has been famous, probably indicating a turning level. CryptoQuant analyst, referred to as Crypto Dan, outlined a discount in miners’ promoting strain, which has traditionally been a pivotal issue affecting Bitcoin’s value trajectory.

Bitcoin Mining Promoting Stress Decreases

In line with Crypto Dan, “Miners’ promoting strain decreases. One of many whales which have precipitated the cryptocurrency market to fall just lately have been miners.” He defined that the BTC halving, which halved mining rewards, led to a lower in the usage of older, much less environment friendly mining rigs, subsequently lowering general mining exercise. This transformation compelled miners to promote Bitcoin in over-the-counter (OTC) transactions to maintain their operations.

The evaluation means that the market is at present absorbing the sell-off, with a notable decline within the quantity and frequency of Bitcoin being transferred out of miners’ wallets. “The present market may be seen as being within the technique of digesting this sell-off, and fortuitously, the amount and variety of Bitcoins miners are sending out of their wallets has been quickly lowering just lately,” Crypto Dan said.

Associated Studying

The implications of this shift are important. Crypto Dan added, “In different phrases, the promoting strain of miners is weakening, and if all of their promoting quantity is absorbed, a scenario could also be created the place the upward rally can proceed once more.” He projected optimism for the market, predicting constructive actions within the third quarter of 2024.

Historic information from CryptoQuant corroborates the evaluation. BTC has beforehand proven an analogous sample the place miner promoting exercise exerted a powerful affect on market costs, notably famous from Might to September 2023 and from December 2023 to January 2024. Throughout these durations, extended sideways motion in BTC costs was noticed, aligning with peaks in miner promoting. Notably, when these promoting actions diminished, Bitcoin costs resumed an upward pattern.

This sample means that the current lower in miner promoting may very well be the precursor to a different important bullish section for Bitcoin, as market circumstances seem ripe for the same reversal of fortunes.

Key Value Degree For A Bullish Breakout

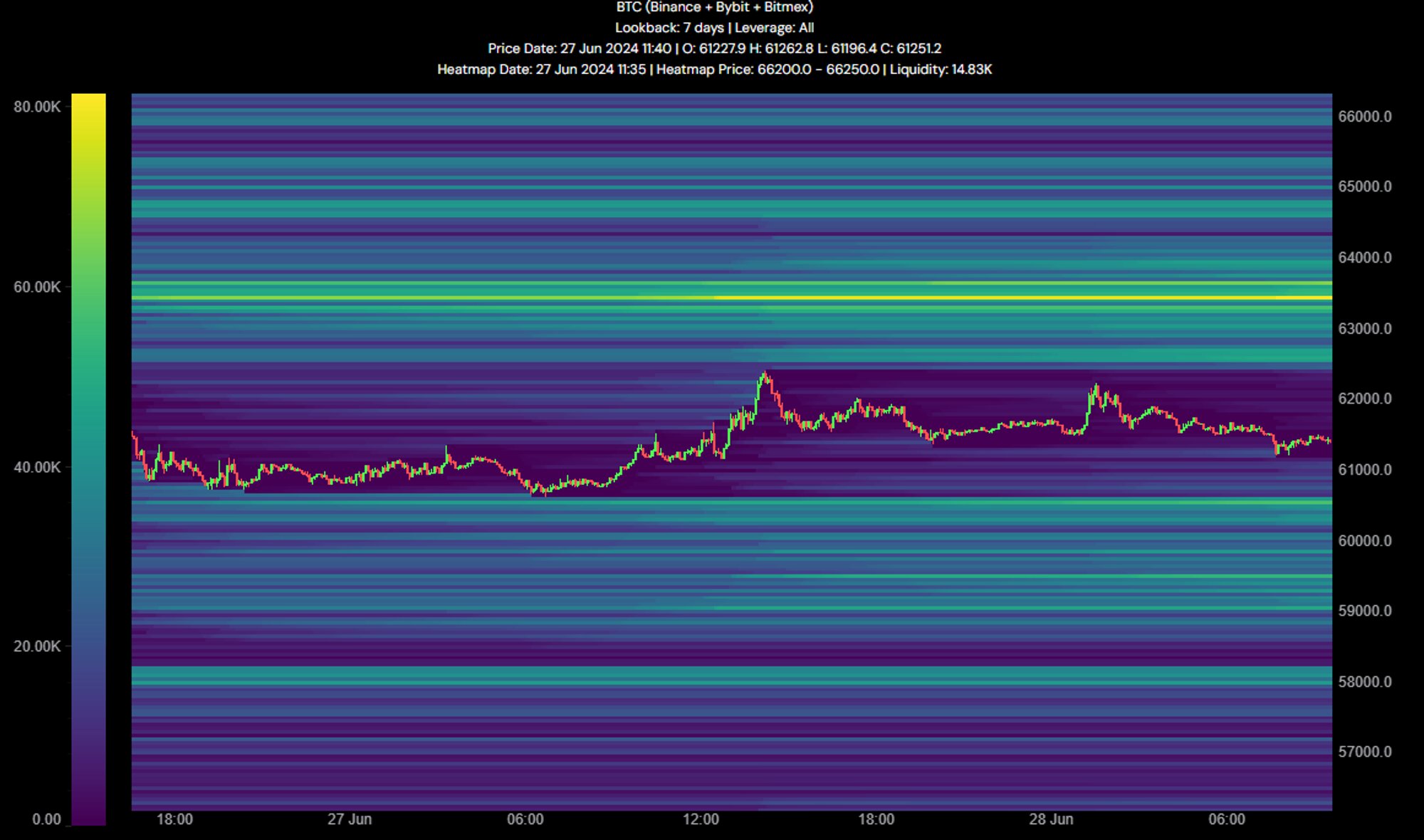

Additional insights from technical analysts at alpha dōjō present a granular view of the market circumstances. Their every day replace on Bitcoin by X underscores the present market indecision, characterised by Bitcoin “chopping round” with out clear directional motion. Nevertheless, the analysts have recognized vital value ranges which might point out future market actions: “If BTC reclaims the $63.5k space, it could be bullish; if it loses the $60k stage, it could be bearish.”

Associated Studying

The technical evaluation additionally reveals that the liquidity within the Bitcoin market is at present dispersed, with few substantial clusters of orders. Probably the most notable focus of orders is across the $63.5k stage, suggesting that this value level is pivotal for market sentiment and potential bullish momentum.

The order e book information offered by alpha dōjō highlights a present dominance of promote orders, indicating a bearish sentiment amongst merchants. Conversely, the bid facet is described as weak, with fewer purchase orders supporting upward value actions. This imbalance means that the market is at present cautious, probably awaiting extra definitive alerts earlier than committing to extra substantial positions.

At press time, BTC traded at $61,704.

Featured picture created with DALL·E, chart from TradingView.com