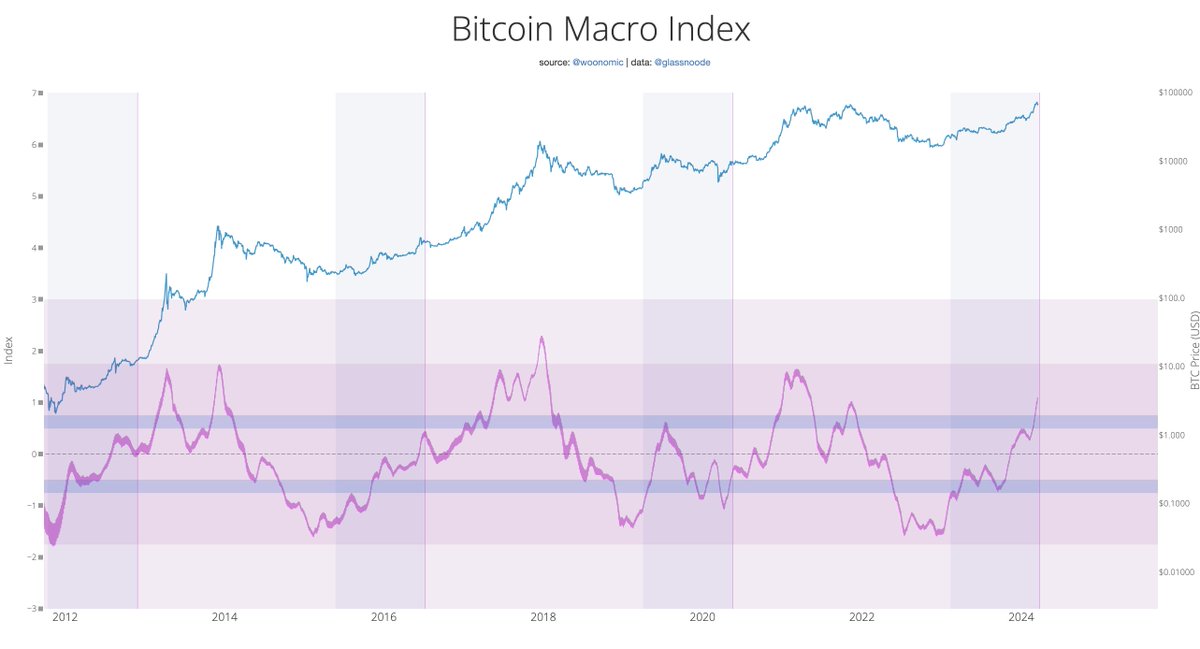

Bitcoin’s current downturn has prompted famend crypto analyst Willy Woo to supply a contemporary perspective on the cryptocurrency’s future trajectory. Woo’s evaluation, primarily based on the surge in Bitcoin’s Macro Index, suggests an optimistic outlook for the main digital foreign money, doubtlessly indicating a pivotal shift in market dynamics.

Unveiling Bitcoin Double Pump Prediction

Willy Woo, a determine well-respected within the cryptocurrency evaluation sphere, has just lately shared insights that paint an intriguing future for Bitcoin.

In line with Woo, the notable enhance within the Bitcoin Macro Index might sign greater than only a restoration; it is perhaps the precursor to a uncommon “double pump” cycle.

Drawing parallels with the market patterns 2013, Woo’s forecast factors in direction of two important value surges for Bitcoin within the coming years. He anticipates the primary peak by mid-2024 and a second, much more substantial high in 2025.

This twin surge situation, although traditionally unusual, aligns with Woo’s evaluation of present market circumstances and Bitcoin’s intrinsic development potential.

On the price the #Bitcoin Macro Index is pumping, I wouldn’t be shocked if we get a high by mid-2024, which might trace at a double pump cycle like 2013… a second high in 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Navigating By way of The Bearish Terrain

In the meantime, the previous week has not been form to BTC, with the asset experiencing a roughly 10% decline. This downward development prolonged over the previous 24 hours, seeing Bitcoin’s worth dip by 4.9%, bringing its value to round $65,000—a pointy fall from its current peak above $73,000.

Amid this bearish value motion, IntoTheBlock, a notable crypto analytics agency, suggests the $61,000 stage as a crucial demand zone, highlighted by the numerous quantity of Bitcoin bought at this value level.

This space is deemed enticing for accumulation by institutional buyers and large-scale merchants, suggesting a attainable restoration within the close to future.

Bitcoin is searching for assist. However the place will it discover it?

The $61k vary might be a key space to control. 805k addresses acquired over 466k BTC at this stage, indicating a wholesome urge for food for $BTC round that stage. pic.twitter.com/XYw7LSC6Ji— IntoTheBlock (@intotheblock) March 19, 2024

Moreover, as Bitcoin navigates its present market challenges, cryptocurrency analyst Charles Edwards factors out {that a} typical pullback throughout a Bitcoin bull run quantities to about 30%.

With BTC having skilled its longest successful streak in historical past, a corrective dip to $59,000 and even $51,000, as per some predictions, stays throughout the realm of chance.

A traditional Bitcoin bullrun pullback is 30%. Again in December, we had been already within the longest successful streak in Bitcoin’s historical past. A 20% pullback right here takes us to $59K. A 30% pullback can be $51K. These are all ranges we needs to be comfy anticipating as prospects.

— Charles Edwards (@caprioleio) March 19, 2024

These ranges characterize potential shopping for alternatives for buyers trying to capitalize on Bitcoin’s cyclical nature and its anticipated ascension post-pullback.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual threat.