On-chain information exhibits the Bitcoin “Liquid Stock Ratio” has dropped to an all-time low. Right here’s what this might imply for the asset.

Bitcoin Promote Facet Liquidity Is Low Relative To Demand Proper Now

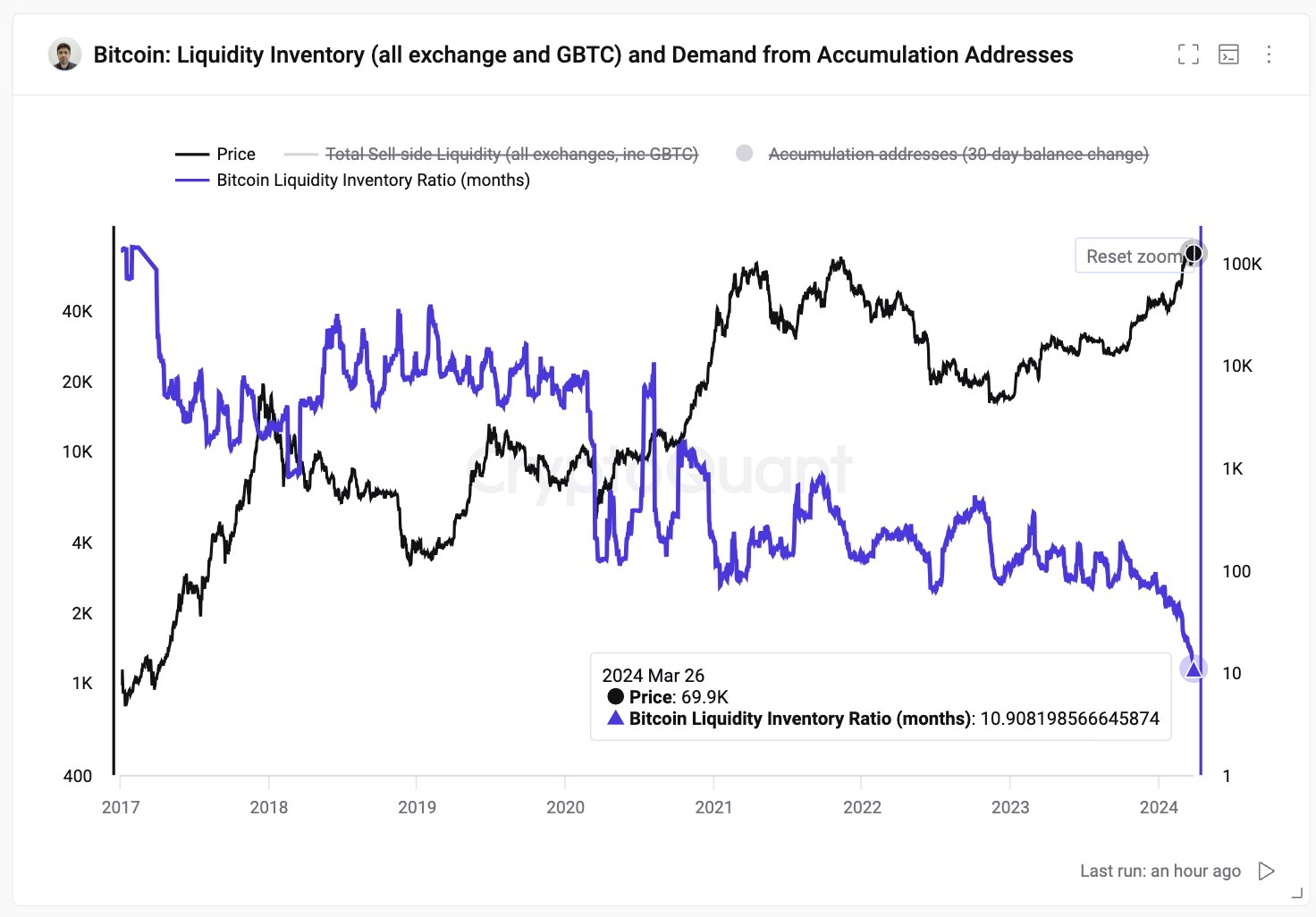

In a put up on X, CryptoQuant founder and CEO Ki Younger Ju mentioned the latest development within the Liquid Stock Ratio for Bitcoin. The Liquid Stock Ratio is an on-chain indicator that tells us about how the full sell-side liquidity stock of the asset compares in opposition to its demand.

The sell-side liquidity stock of the asset is gauged utilizing 4 components: the full alternate reserve, miner holdings, OTC desk holdings, and US government-seized BTC.

Out of those, the alternate reserve (that’s, the full quantity sitting within the wallets of centralized exchanges) is the biggest potential supply of sell-side liquidity.

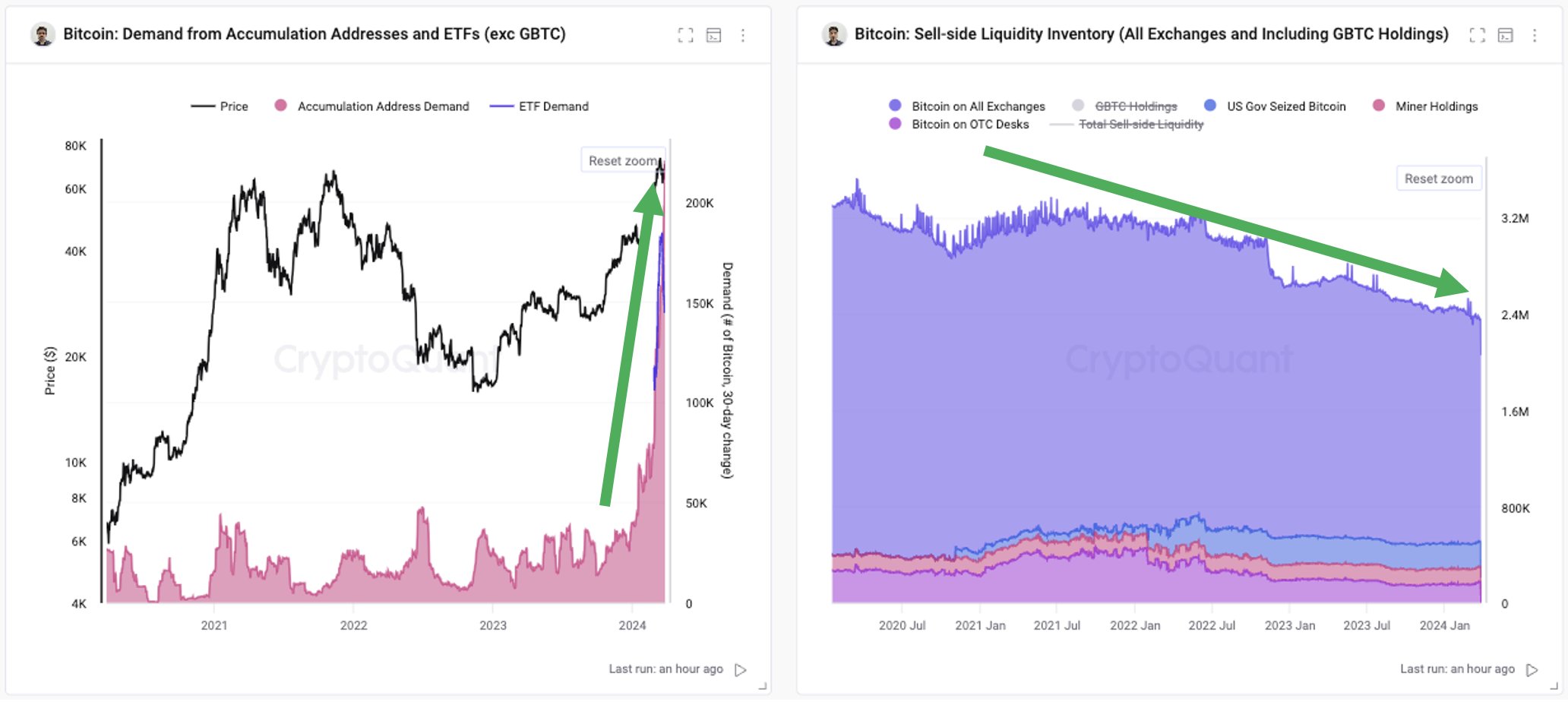

The chart on the appropriate under exhibits how the sell-side liquidity stock of the coin has modified over the previous few years:

The worth of the metric seems to have been taking place lately | Supply: ki_young_ju on X

From the graph, it’s seen that the sell-side liquidity of the cryptocurrency has been heading down for some time now. This decline is generally pushed by the depletion of alternate reserves, as traders have been repeatedly pushing in direction of self-custody, presumably preferring to carry onto their Bitcoin for prolonged durations.

The chart on the left shows the development within the complete demand for the asset. Right here, the demand is measured utilizing the 30-day stability adjustments of “accumulation addresses.”

The buildup addresses are those who have a historical past of solely shopping for BTC and no historical past of promoting. Exchanges and miner entities are excluded from this cohort, after all, as they depend underneath the sell-side liquidity as an alternative, no matter whether or not they fulfill the situation for accumulation addresses or not.

Clearly, the demand for Bitcoin has exploded lately as new gamers like exchange-traded funds (ETFs) have entered into the world. All this BTC is doubtlessly going out of circulation and being locked into the wallets recognized for internet hosting a one-way visitors.

Given these two developments within the sell-side liquidity stock and demand, it’s not shocking to see that the Liquid Stock Ratio, which measures the ratio between the 2, has plunged lately.

The development within the Liquid Stock Ratio for the asset over the previous few years | Supply: ki_young_ju on X

Following the most recent decline within the indicator, its worth has, in truth, dropped to a brand new all-time low. Because of this the sell-side liquidity has by no means been this low when in comparison with the demand for Bitcoin.

Given this development, it is going to be attention-grabbing to see how the BTC rally performs out from right here, as the availability available for purchase is just persevering with to tighten.

BTC Value

Bitcoin had seen some drawdown earlier, however bullish winds have seemingly returned for the coin as its value has now recovered again above $70,200.

Seems to be like the value of the asset has loved a pointy surge over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this web site completely at your individual danger.