An on-chain analyst has defined how Bitcoin is sitting like a coiled spring proper now, a state the asset doesn’t often keep in for too lengthy.

Bitcoin Brief-Time period Holder Promote-Aspect Danger Ratio Has Declined Lately

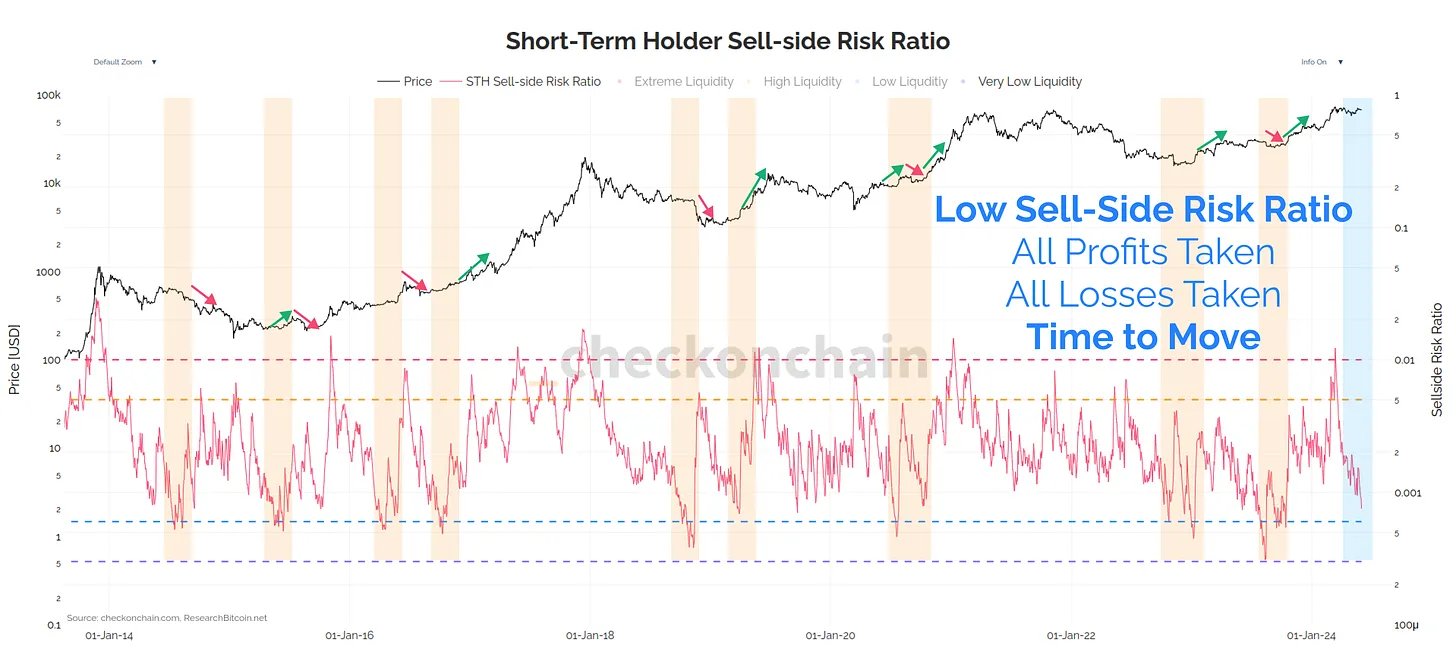

In a brand new submit on X, analyst Checkmate has mentioned the current development occurring within the Promote-Aspect Danger Ratio for the Bitcoin short-term holders. The Promote-Aspect Danger Ratio right here refers to an indicator that tells us about how absolutely the revenue and loss being locked in by the traders compares in opposition to the BTC Realized Cap.

The Realized Cap is mainly a measure of the whole quantity of capital that holders as a complete have used to buy their cash, as decided by on-chain knowledge.

Associated Studying

Thus, the Promote-Aspect Danger Ratio, which takes the ratio between the sum of revenue and loss with this preliminary funding, supplies information about how the revenue or loss-taking from the traders seems like relative to their price foundation. When the worth of the indicator is excessive, it means the holders are realizing a big revenue or loss proper now. Such a development might observe some sharp volatility within the asset’s worth.

Alternatively, the metric being low implies that traders are solely promoting cash near their break-even stage. This sort of development might counsel revenue or loss-takers available in the market have develop into exhausted.

Within the context of the present subject, your complete market’s Promote-Aspect Danger Ratio isn’t of curiosity, however moderately that of solely a selected section of it: the short-term holders (STHs). These traders are usually outlined as those that acquired their cash throughout the previous 155 days.

The beneath chart exhibits the development within the metric for this cohort over the previous decade:

As is seen within the graph, the Promote-Aspect Danger Ratio for the Bitcoin STHs had shot as much as a really excessive stage when the rally in the direction of the brand new all-time excessive (ATH) had occurred earlier within the yr. Traditionally, the STHs have proven to be the fickle-minded palms of the market, who promote simply on the sight of any FOMO or FUD within the sector. As such, it’s not shocking to see that these traders had ramped up their revenue realization alongside the rally.

Associated Studying

Since this peak, although, the indicator has gone by way of a steep decline as the worth of the cryptocurrency has been caught in countless consolidation. Following the drawdown, the metric has now returned to comparatively low ranges.

It could seem that because the tight sideways motion has occurred, sellers among the many STHs have seen exhaustion. “Bitcoin is coiled like a spring, and it often doesn’t sit nonetheless like this for lengthy,” notes the analyst. With the asset’s worth surging to $71,000 up to now day, it’s potential that this unwinding might already be right here.

BTC Worth

Bitcoin has loved a rise of round 3% up to now 24 hours, which has now taken its worth to $70,900.

Featured picture from Dall-E, checkonchain.com, chart from TradingView.com