An analyst has defined that the latest development within the Bitcoin Coinbase Premium Hole suggests a major change within the asset’s construction.

Bitcoin Coinbase Premium Hole Has Continued To Be Adverse

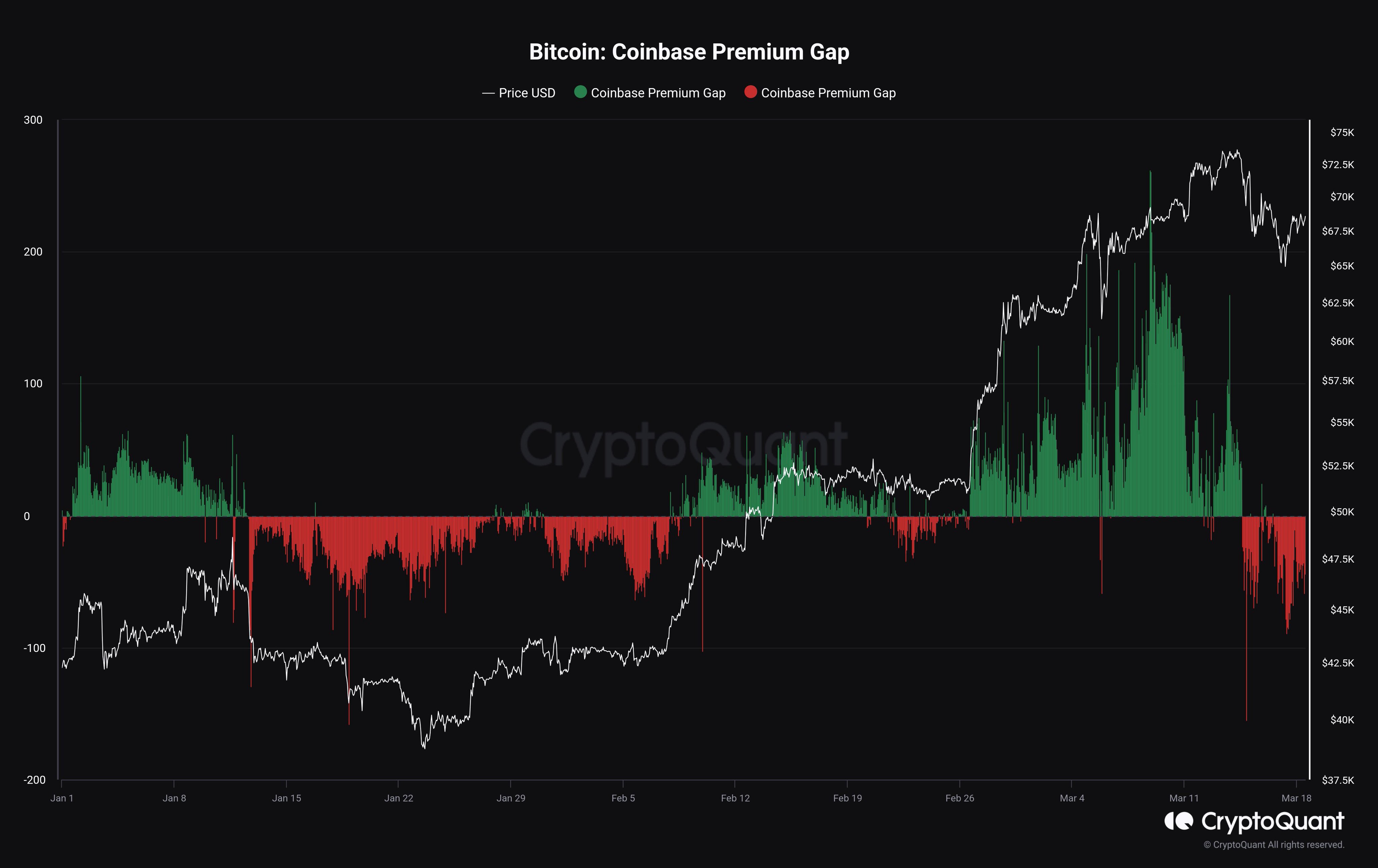

In a brand new publish on X, analyst Maartunn mentioned how the Bitcoin Coinbase Premium Hole remains to be adverse. The “Coinbase Premium Hole” right here refers to a metric that tracks the distinction between the Bitcoin costs listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

This indicator’s worth gives hints about how the habits of the previous’s userbase presently differs from that of the latter platform.

Under is the chart shared by the analyst that reveals the development within the Bitcoin Coinbase Premium Hole because the begin of the 12 months.

The worth of the metric appears to have been fairly crimson in latest days | Supply: @JA_Maartun on X

Because the graph exhibits, the Bitcoin Coinbase Premium Hole had been principally optimistic as Bitcoin had gone by way of its journey from $44,000 to past the $73,000 degree.

This is able to indicate that the worth listed on the change was increased than on Binance throughout this era. Such a development naturally means that the shopping for stress on the previous was better than on the latter.

Coinbase is broadly recognized to be the popular platform of US-based institutional buyers, whereas Binance has international visitors. Thus, the inexperienced optimistic premium values would indicate these massive American entities had been shopping for and supporting the rally.

Lately, nonetheless, the indicator’s worth turned adverse as these buyers took to promoting as an alternative. Since then, the metric has continued to imagine such values. Alongside this selloff, the BTC value has skilled a notable decline.

The Bitcoin Coinbase Premium Hole adopted an analogous sample in the course of the first month or so of the 12 months. Within the first 10 days of January, the metric had been optimistic as shopping for had occurred in anticipation of the spot exchange-traded funds (ETFs). Nonetheless, after the ETFs had been authorised, the indicator had turned adverse.

The crimson premium values had maintained for just a few weeks, throughout which the cryptocurrency value had struggled. Primarily based on this sample and the latest development, it could appear that American institutional merchants have pushed the worth motion this 12 months.

As such, as long as the present bearish construction within the Bitcoin Coinbase Premium Hole exists, it’s potential that the worth could not be capable of amass an excessive amount of upward momentum.

BTC Value

On the finish of the optimistic Coinbase Premium Hole streak, Bitcoin had been capable of obtain a brand new all-time excessive above $73,800, however as merchants have switched to promoting on the platform, the coin has dropped nearly 9%, with its value now buying and selling round $67,300.

Seems like the worth of the coin has been taking place over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site fully at your personal danger.