On-chain information exhibits the subsequent main Bitcoin demand zone is round $56,000, a degree BTC would possibly find yourself revisiting if the decline continues.

Bitcoin Has Subsequent Main On-Chain Assist Round $56,000

Based on information from the market intelligence platform IntoTheBlock, BTC’s current drawdown has meant that it could find yourself having to depend on the value vary round $56,000 for assist.

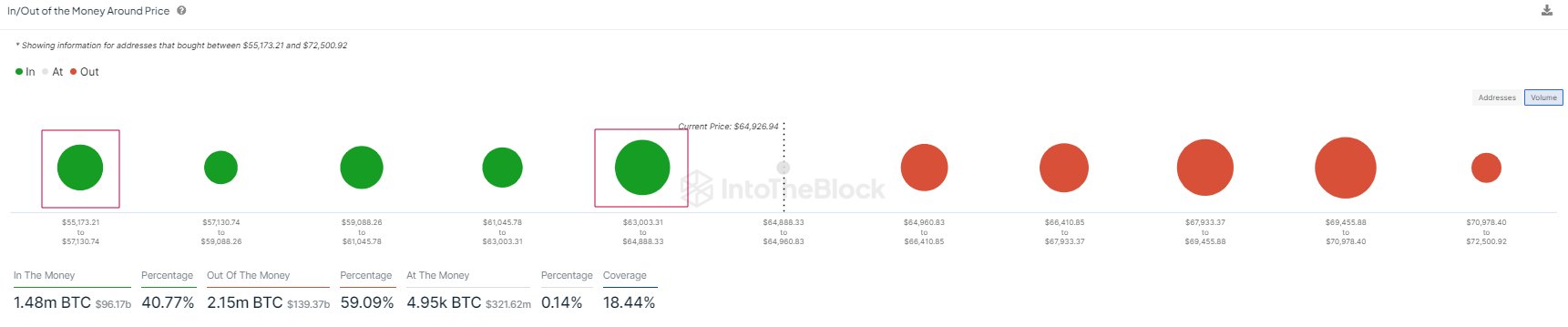

In on-chain evaluation, a degree’s potential as assist or resistance is predicated on the overall variety of cash that the buyers final acquired there. Under is a chart that exhibits what the varied value ranges across the present spot value of the cryptocurrency appear to be by way of this cost-basis distribution.

The information for the BTC acquisition distribution throughout the varied value ranges | Supply: IntoTheBlock on X

Within the graph, the scale of the dot represents the quantity of Bitcoin that was bought contained in the corresponding value vary. It could seem that the $63,000 to $64,890 degree is presently thick with buyers. To be extra explicit, 1 million buyers acquired 530,000 BTC inside this vary.

Usually, at any time when the asset retests the fee foundation of any investor, they could change into extra prone to make some form of transfer, as a result of significance the extent holds for them.

Traders who have been in income simply previous to the retest could also be keen to make additional bets, believing that if this degree was worthwhile previously it could be so once more sooner or later.

Naturally, this shopping for impact would solely be related for the market if a considerable amount of buyers acquired cash inside a good value vary. The $63,000 to $64,890 vary qualifies for this.

The vary ought to have acted as a assist level for the coin, however BTC has lately slipped underneath it, presumably suggesting that this assist degree might have damaged down.

As IntoTheBlock has highlighted within the chart, the subsequent main vary of potential assist is the $55,200 to $57,100 vary. Thus, ought to the present drawdown proceed, this can be the subsequent related vary.

“Whereas this doesn’t imply that Bitcoin has to go this low, it’s good to maintain this vary in thoughts whereas value is exploring current lows,” notes the analytics agency. A decline to the typical value of this vary ($56,000) would imply a drawdown of virtually 10% from the present spot worth of the coin.

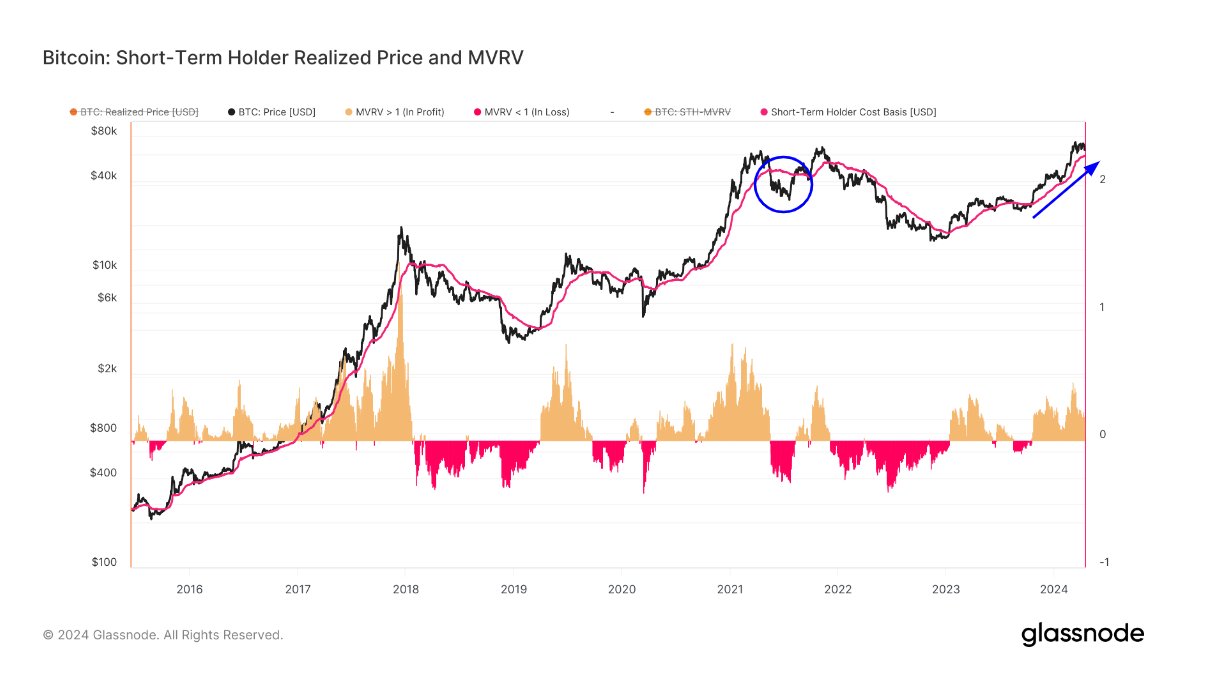

Earlier than this degree, although, there may be one other attention-grabbing on-chain degree that BTC might find yourself revisiting. As analyst James Van Straten has identified in an X submit, the Realized Value (the typical price foundation) of the short-term holders is round $58,800 proper now.

Seems to be like the worth of the metric has been going up since some time now | Supply: @jvs_btc on X

The short-term holders (STHs) right here confer with the buyers who purchased throughout the previous 155 days. This group’s Realized Value has been at an essential degree traditionally throughout bull runs, because the asset has usually discovered assist at it.

Breaks underneath it have, the truth is, normally led to bearish transitions previously. “If we drop beneath this, I’ll concede to a bear market just like Could 2021,” says Straten.

BTC Value

Bitcoin has registered a decline of virtually 7% over the previous 24 hours and within the course of, has misplaced any restoration it had made earlier. Now, BTC is buying and selling round $62,100.

The value of the asset seems to have been taking place lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal threat.