Bitcoin is lastly exhibiting a sustained bullish push because it has now damaged above $47,300, however overly constructive sentiment will be an impediment to this rally.

Bitcoin Concern & Greed Index Suggests Market Is Nearing Excessive Greed

The “Concern & Greed Index” is an indicator that tells us concerning the common sentiment among the many traders within the Bitcoin and wider cryptocurrency sector. In response to Different, its creator, the index takes under consideration 5 components to calculate this sentiment.

These are volatility, market quantity, social media sentiment, market cap dominance, and Google Tendencies. The index outputs the sentiment as a quantity mendacity between zero to hundred.

All values of 46 and underneath suggest the traders are fearful, whereas these of 54 or over recommend the presence of greed out there. The area between 47 and 53 corresponds to the area of impartial sentiment.

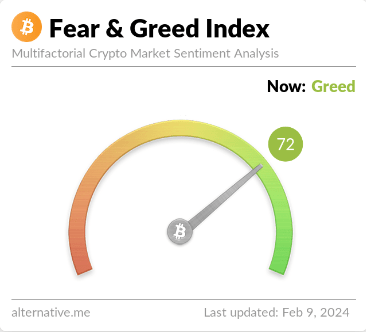

Now, here’s what the Concern & Greed Index appears like for Bitcoin proper now to see which of those areas the market stands in at current:

The present worth of the sentiment in line with this index | Supply: Different

As is seen above, the Bitcoin Concern & Greed Index has a price of 72 in the intervening time, implying that almost all of the traders within the house share a grasping mentality.

In addition to the three core sentiments talked about earlier, there are additionally two excessive ones: the acute worry and excessive greed. The previous of those happens at values of 25 and underneath, whereas the latter takes place at 75 and above.

Traditionally, these two sentiments, specifically, have held nice significance for the cryptocurrency’s trajectory. Typically, at any level, the asset is extra more likely to transfer in opposition to the expectations of the bulk, and in these excessive areas, this expectation turns into the strongest.

As such, these sentiments have been the place main reversals within the asset have been the almost certainly to happen. Followers of a buying and selling philosophy known as “contrarian investing” exploit this reality to time their shopping for and promoting strikes. Warren Buffet‘s well-known quote sums up the thought, “Be fearful when others are grasping, and grasping when others are fearful.”

At a price of 72, the Bitcoin market is sort of near coming into into the acute greed area proper now. Simply yesterday, the metric had a price of 66, which suggests there was some leap in simply the previous 24 hours.

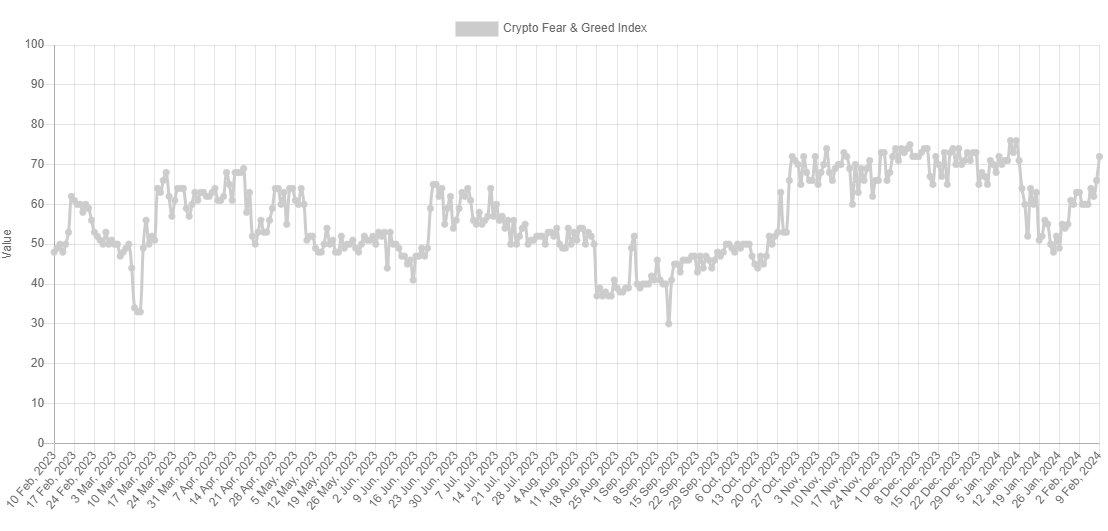

Appears like the worth of the metric has shot up over the previous day | Supply: Different

This enhance within the index has naturally come due to the bullish momentum that the asset has loved up to now day. Any additional enhancements in sentiment, nonetheless, could also be alarming, because the metric would then enter into the acute greed territory.

The final time that the Bitcoin Concern & Greed Index surged into excessive greed values was across the time of the approval of the spot exchange-traded funds (ETFs). Because it occurred, the coin hit its high, coinciding with this overly bullish mentality.

Thus, if this priority is something to go by, any go to into the territory within the coming days could function a warning {that a} high is close to for the cryptocurrency.

BTC Value

Bitcoin has loved an uplift of over 6% in the course of the previous 24 hours as its value has cleared the $47,300 degree.

The value of the coin seems to have been going up over the past couple of days | Supply: BTCUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, charts from TradingView.com, Different.me

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site fully at your individual threat.