Analyzing Bitcoin and fiat buying and selling pairs on centralized exchanges usually reveals efficiency disparities that stay invisible when specializing in international or common costs. It exhibits how liquidity, geopolitical and financial issues, and market sentiment have an effect on efficiency.

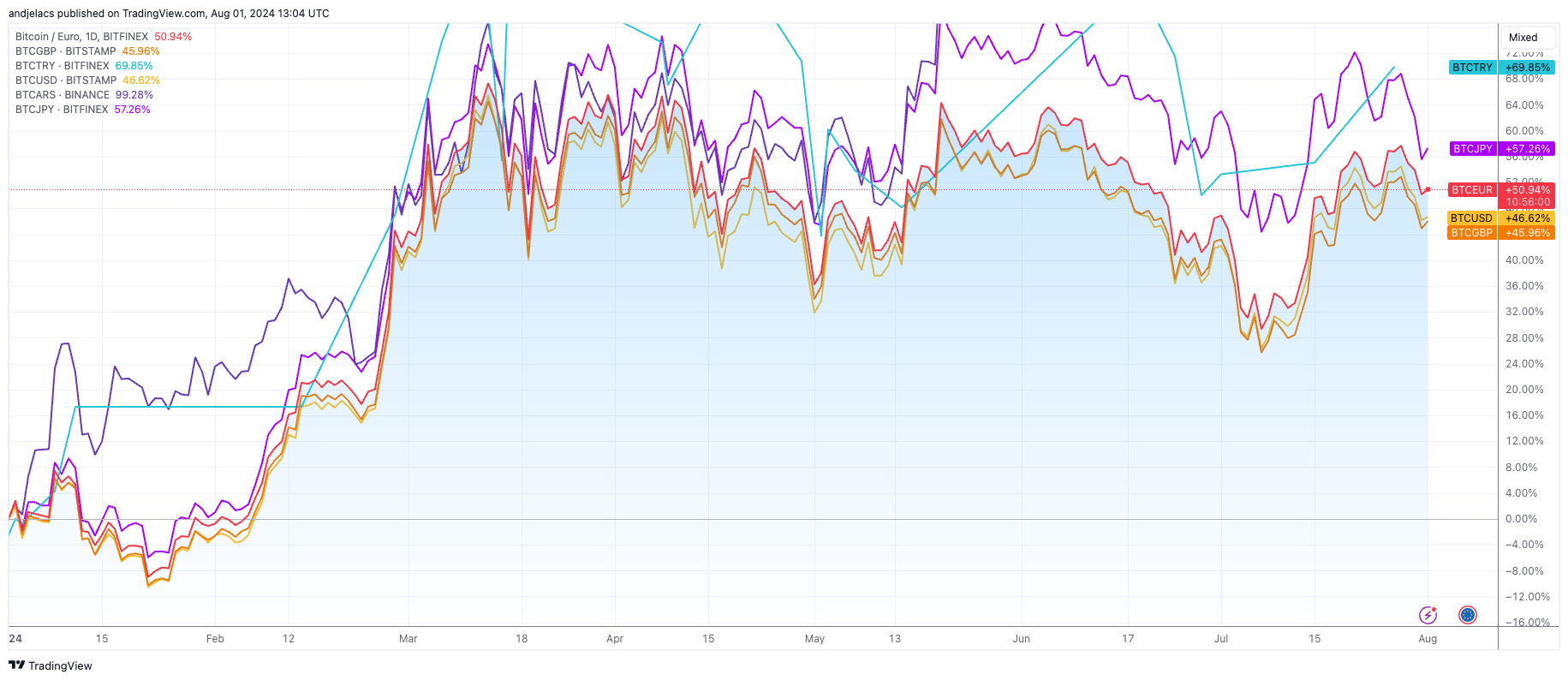

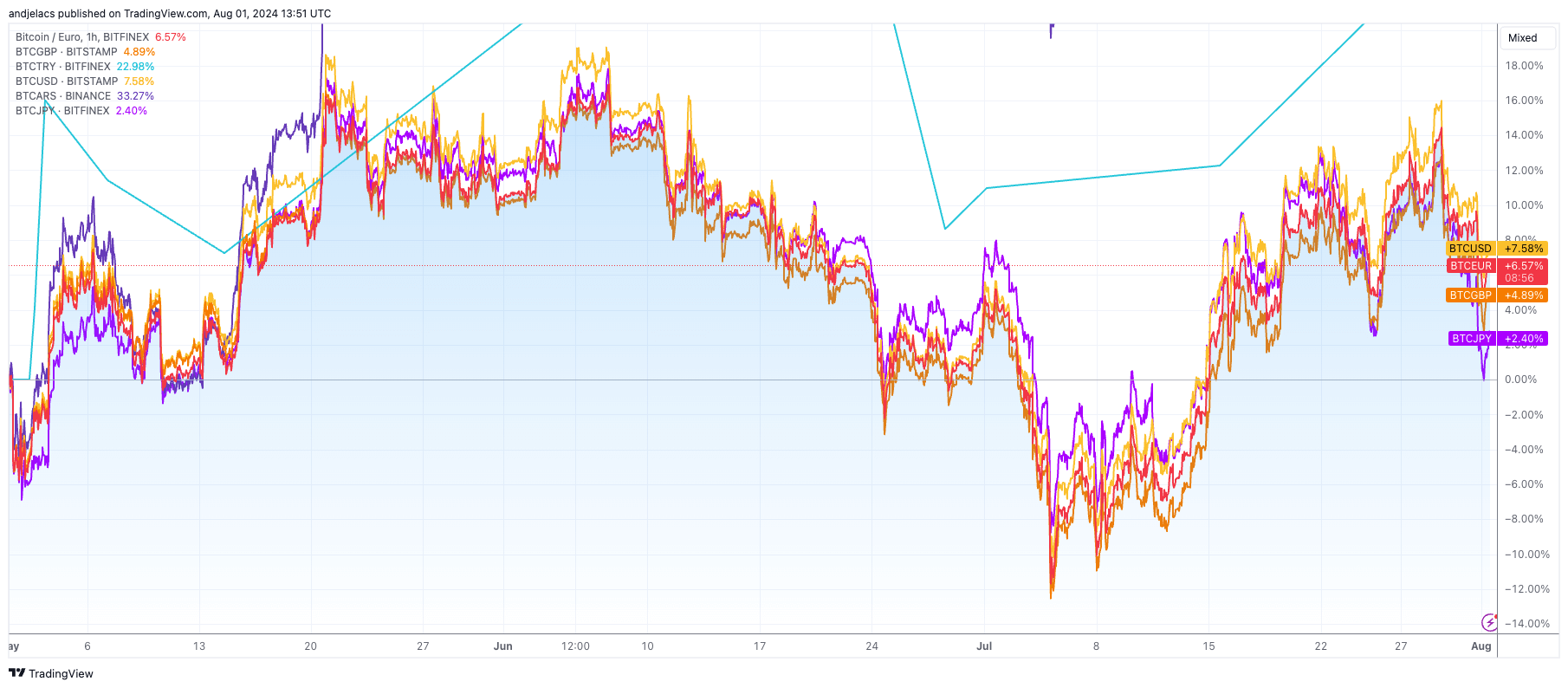

Trying on the year-to-date (YTD) efficiency of dominant fiat pairs, we are able to see that BTCARS has seen a powerful 98.27% enhance. BTCTRY has gained 69.85%, BTCJPY is up 55.01%, BTCEUR has grown by 49.85%, BTCUSD by 45.62%, and BTCGBP by 45.07%.

In distinction, the three-month efficiency exhibits BTCARS main with a 19.64% enhance, whereas BTCEUR, BTCUSD, BTCGBP, BTCJPY, and BTCTRY have all posted destructive returns, starting from -1.16% to -6.50%.

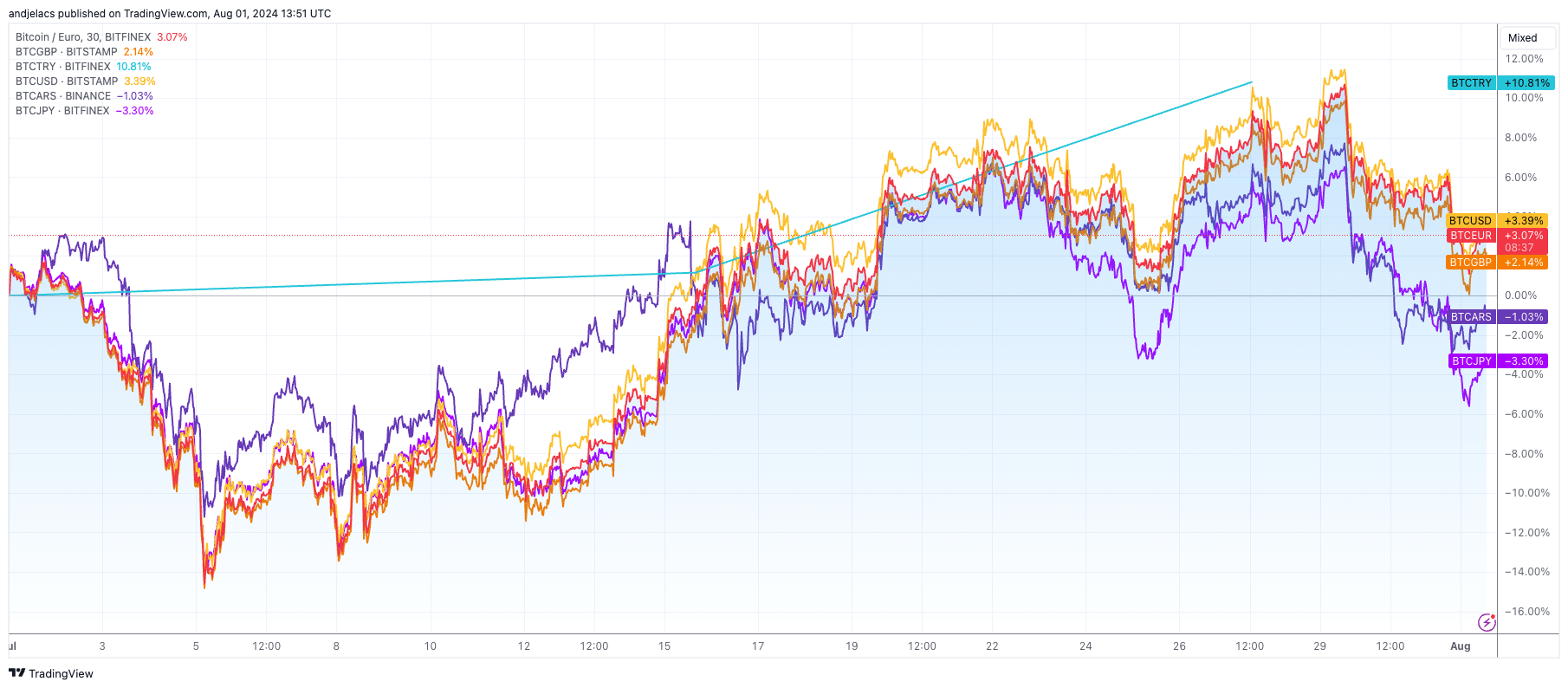

The one-month efficiency presents a blended image, with BTCTRY up by 10.81%, BTCUSD up by 2.97%, BTCEUR up by 2.72%, and BTCGBP up by 2.03%, whereas BTCARS and BTCJPY have declined by -0.85% and -3.89%, respectively.

The standout efficiency of Bitcoin in opposition to the Argentine peso, particularly year-to-date, might be attributed to the nation’s extreme inflation. With inflation charges exceeding 100% yearly, the Argentine peso’s speedy devaluation has pushed traders to hunt refuge in Bitcoin.

This conduct is in step with historic tendencies the place residents of nations experiencing hyperinflation or financial instability flip to crypto as a hedge in opposition to their native foreign money’s depreciation. Whereas the financial and political insurance policies of Argentina’s newly elected president, Javier Milei, have slowed inflation, the demand for Bitcoin stays robust.

Equally, BTCTRY’s robust YTD efficiency comes from Turkey’s financial challenges. Turkey has been grappling with excessive inflation, with current studies indicating inflation charges surpassing 75%. The Turkish lira’s depreciation has led to elevated adoption of Bitcoin amongst Turkish traders seeking to protect their wealth.

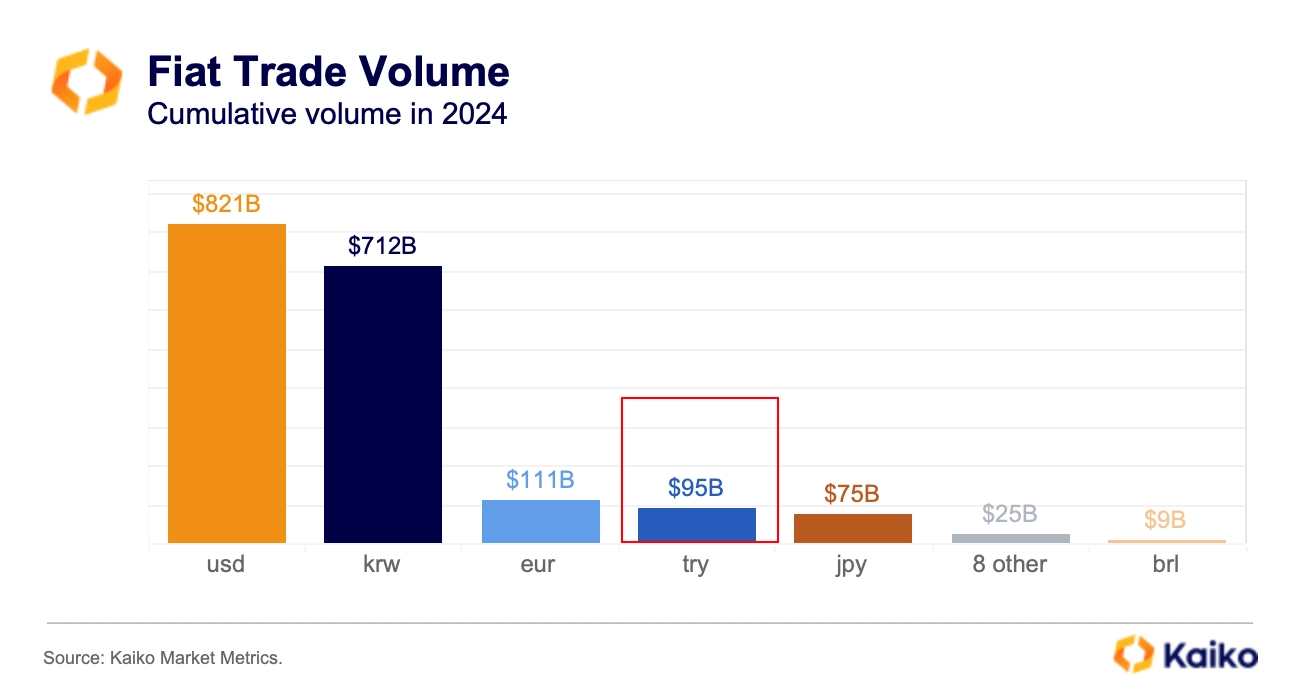

This pattern is additional supported by the truth that Turkey has one of many world’s highest charges of crypto adoption. Knowledge from Kaiko confirmed that the Turkish lira commerce quantity exceeded $10 billion for eight consecutive months, with the cumulative Lira quantity reaching $95 billion throughout seven exchanges.

The yen’s weakening in opposition to the greenback, pushed by a dovish stance from the Financial institution of Japan, has affected the BTCJPY pair. Japan’s intervention within the foreign money market to stabilize the yen has additionally contributed to the fluctuations noticed in Bitcoin’s worth relative to the yen. The destructive 3M and 1M efficiency point out short-term volatility and the influence of those interventions.

The euro, the US greenback, and the British pound’s extra modest YTD good points and blended shorter-term performances might be linked to the comparatively secure financial circumstances and strong monetary infrastructures within the Eurozone, the US, and the UK.

The US greenback’s current power has affected the BTCUSD pair, resulting in its subdued efficiency over the shorter time period. The euro and pound appear to have skilled barely extra strain from financial challenges and central financial institution insurance policies, resulting in their greater efficiency when in comparison with the greenback.

Liquidity additionally performs a vital function within the efficiency of fiat buying and selling pairs. Extremely liquid markets like BTCUSD and BTCEUR are inclined to exhibit decrease volatility and extra secure pricing. It’s because excessive liquidity permits bigger transactions to be executed with out considerably impacting the market worth.

Conversely, pairs with decrease liquidity, equivalent to BTCARS, are extra prone to giant worth swings and higher volatility. This greater volatility can result in bigger good points in periods of excessive demand, as seen within the YTD efficiency of BTCARS and BTCTRY.

The submit Bitcoin fiat pair efficiency highlights financial and political challenges appeared first on CryptoSlate.