Fast Take

On Could 23, the SEC authorized the Ethereum (ETH) exchange-traded funds (ETF).

In January, industrial litigator Joe Carlasare steered that approving a spot Bitcoin ETF indicated that an ETH ETF was practically sure. Carlasare’s assertion was primarily based on a number of key factors:

ETH futures have been buying and selling on the CME since 2021, establishing a regulated futures marketplace for ETH.

“ETH Futures are already Buying and selling on CME”

The SEC has authorized Ethereum futures ETFs, demonstrating regulatory consolation with Ethereum-based monetary merchandise.

“The SEC has already authorized ETH futures ETFs”

CME has the identical surveillance-sharing settlement between BTC and ETH.

“The CME has equivalent surveillance sharing agreements for each Bitcoin (BTC) and Ethereum futures”.

Final, a excessive correlation between futures and spot markets.

“The correlation of ETH futures to identify is over 90% (identical to BTC). That is main purpose they authorized the BTC spot etf”.

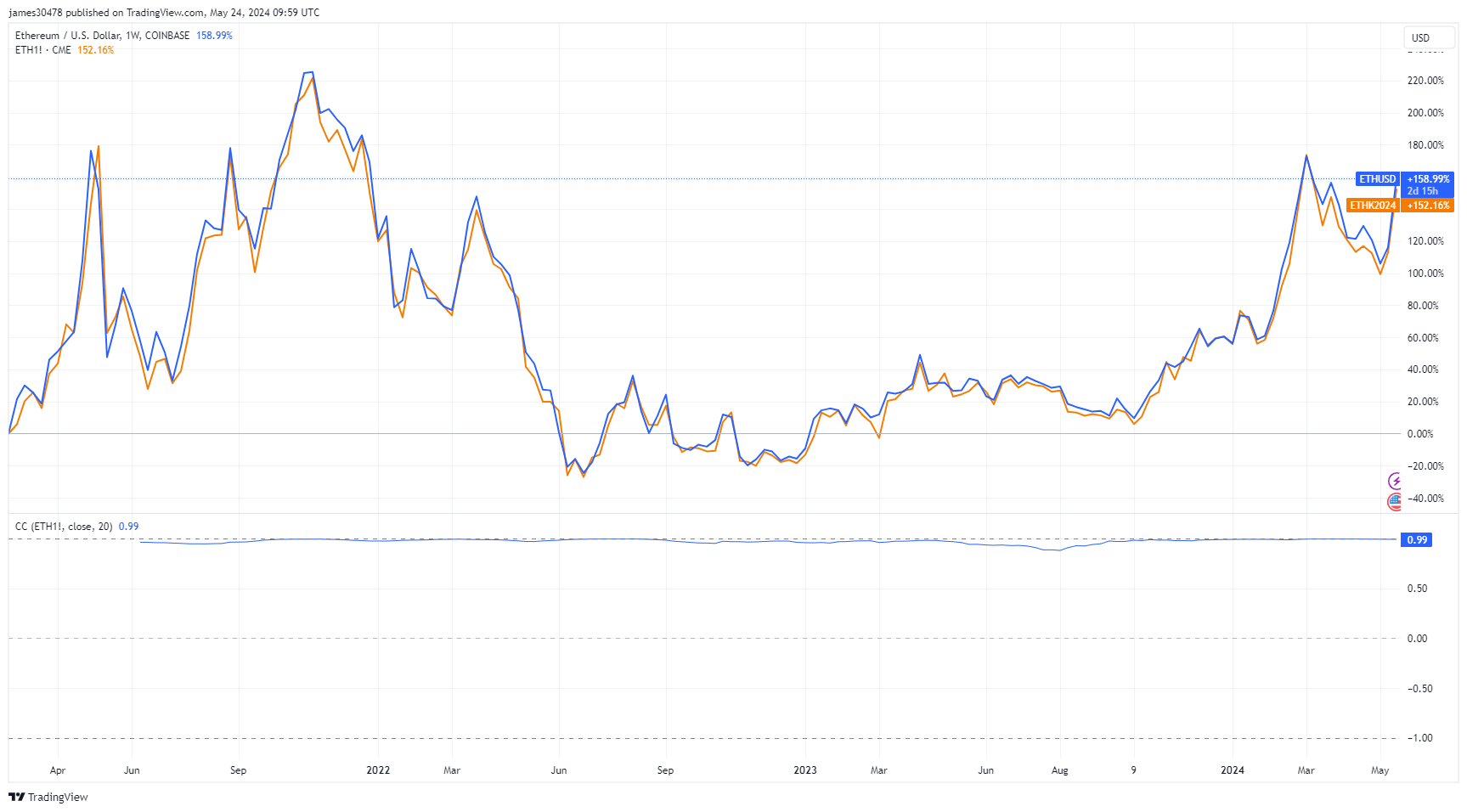

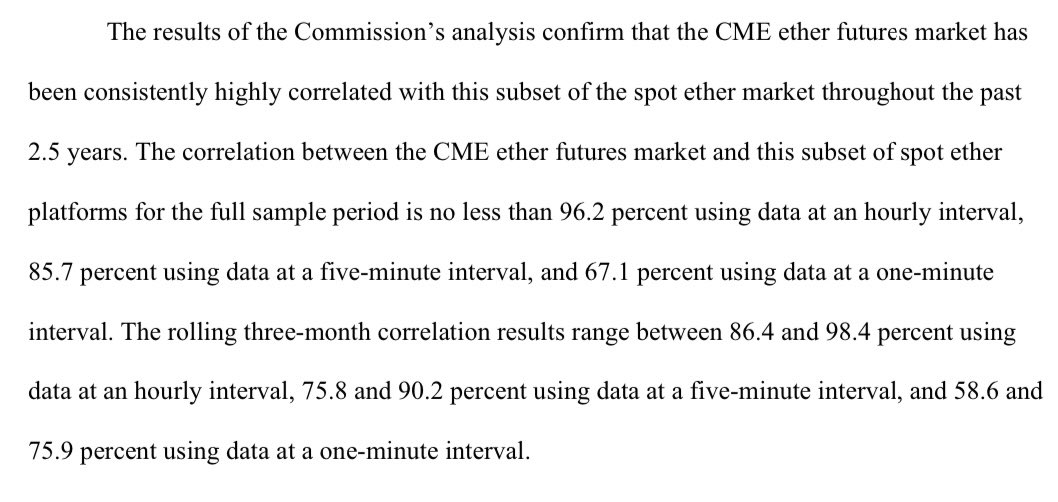

Based on TradingView information, the correlation between Ethereum futures and the spot market has been roughly 99% for the reason that approval of the Ethereum futures ETF on CME in 2021.

Nate Geraci, President of The ETF Retailer, shared paperwork highlighting the shut relationship between the ETH spot and futures markets, a degree acknowledged by the SEC.

Given these elements, no different digital property token apart from Bitcoin and Ethereum would obtain ETF approval within the close to future with out new CME product releases. CME does provide reference charges for extra digital property akin to Aave, Chainlink, Polkadot, and Uniswap however doesn’t provide them as tradeable merchandise.

The submit Bitcoin, Ethereum ETFs stand alone as SEC unlikely to approve non-CME futures listed digital property appeared first on CryptoSlate.