Institutional buyers more and more sought publicity to crypto in the course of the first quarter of the yr following the launch of a number of US-based spot Bitcoin exchange-traded funds (ETFs) in January.

The CoinShares Digital Fund Supervisor survey revealed that these institutional buyers have considerably elevated their digital asset allocations, reaching 3% of their portfolios. This marks the very best stage because the survey’s inception in 2021.

Many of those buyers attributed their elevated publicity to digital asset investments to distributed ledger know-how.

Moreover, they now understand digital property as providing good worth and an elevated demand for investing in BTC as a diversifier.

Bitcoin exhibits essentially the most compelling progress outlook.

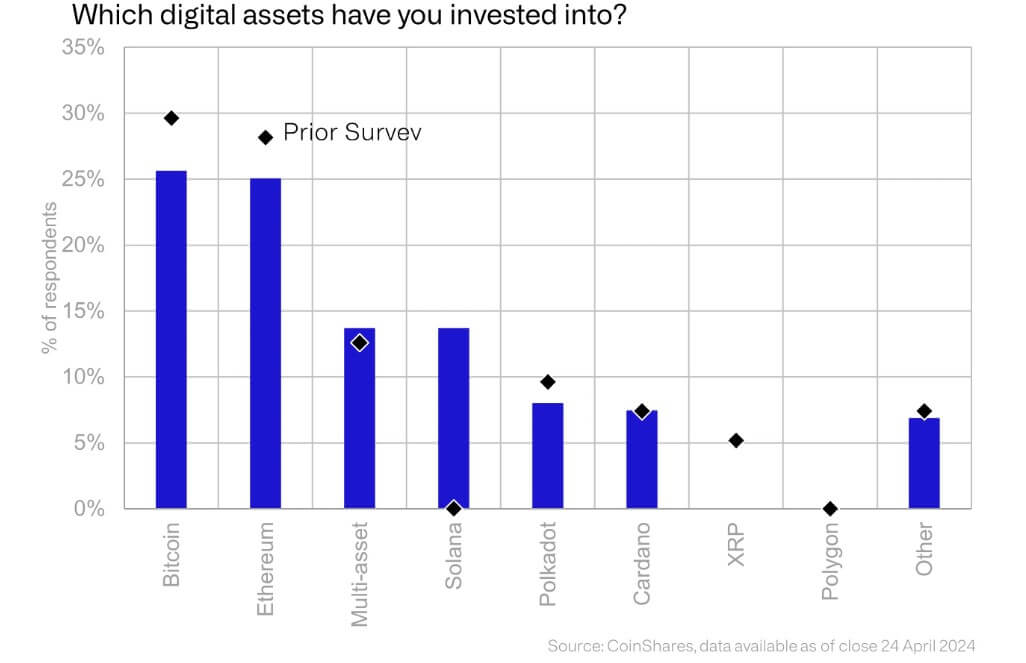

Institutional buyers’ portfolios predominantly function Bitcoin, the premier digital asset in demand amongst this cohort. In line with James Butterfill, head of analysis at CoinShares, over 1 / 4 of those respondents stated their portfolios had publicity to BTC by way of the spot ETFs.

Following Bitcoin, Ethereum holds the second place, though investor curiosity has declined because the earlier survey.

In line with buyers, BTC and ETH stay the digital property with essentially the most compelling progress outlook.

Nonetheless, Solana has seen a surge in investor enthusiasm, evidenced by an uptick in its allocation to 14%. This enhance is primarily pushed by a choose group of great buyers increasing their holdings within the fast-rising blockchain community, which has loved fast progress in value and adoption over the previous yr.

Whereas different various digital property have struggled, XRP stands out for its appreciable decline. Not one of the surveyed buyers talked about holding it.

Funding boundaries

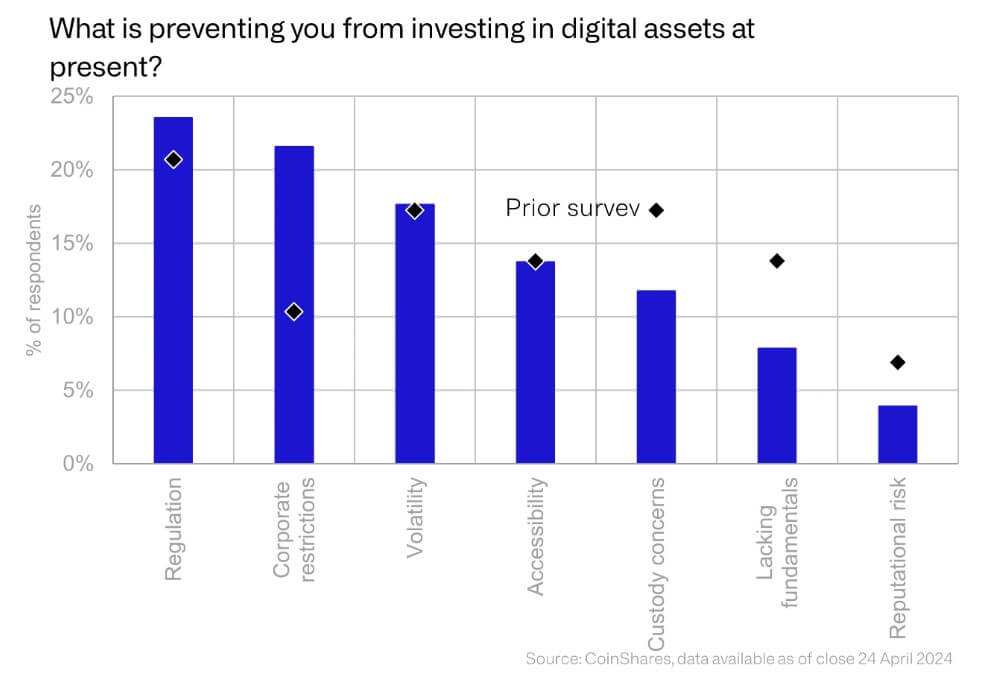

Regardless of the rising publicity to digital property and the appearance of Bitcoin ETFs, many buyers nonetheless wrestle to entry this asset class.

The CoinShares survey confirmed that regulatory considerations stay the foremost barrier for many buyers. The rising trade faces regulatory scrutiny, significantly within the US, the place monetary regulators just like the SEC have filed a number of authorized actions towards main gamers like Binance and Coinbase.

In the meantime, the inherent volatility of the rising sector continues to be a major concern for some buyers. Nevertheless, custody points, fame danger, and the absence of a elementary funding case have gotten much less problematic.