In simply over a month since their approval by the US Securities and Alternate Fee (SEC), Bitcoin ETFs have swiftly gained traction available in the market, posing a formidable problem to the long-standing dominance of gold ETFs.

Bitcoin ETFs Acquire Floor on Gold ETFs

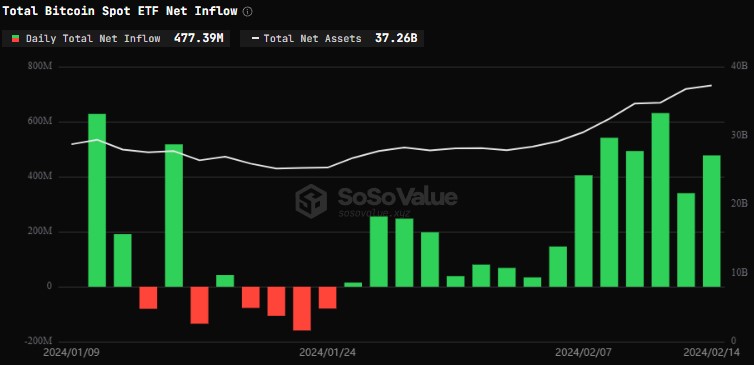

The fast rise of Bitcoin ETFs has led to a convergence in asset values, with BTC ETFs closing the hole with gold ETFs. Bitcoin ETFs maintain roughly $37 billion in belongings after solely 25 buying and selling days, whereas gold ETFs have accrued $93 billion in over 20 years of buying and selling.

On this regard, Bloomberg’s Senior Commodity Strategist, Mike McGlone, emphasizes the shifting panorama, stating, “Tangible Gold is Shedding Luster to Intangible Bitcoin.”

In accordance to McGlone, the US inventory market’s continued resilience, the US foreign money’s energy, and 5% rates of interest have introduced headwinds for gold. Furthermore, because the world more and more embraces digitalization, the emergence of Bitcoin ETFs in america provides additional competitors to the dear metallic.

McGlone additional states that whereas the bias for gold costs stays upward, traders who solely deal with gold might danger falling behind potential paradigm-shifting digitalization traits.

In the end, McGlone means that traders ought to take into account diversifying their portfolios by incorporating Bitcoin or different digital belongings to remain forward within the evolving funding panorama.

Bitcoin Rally Pushed By Institutional Demand

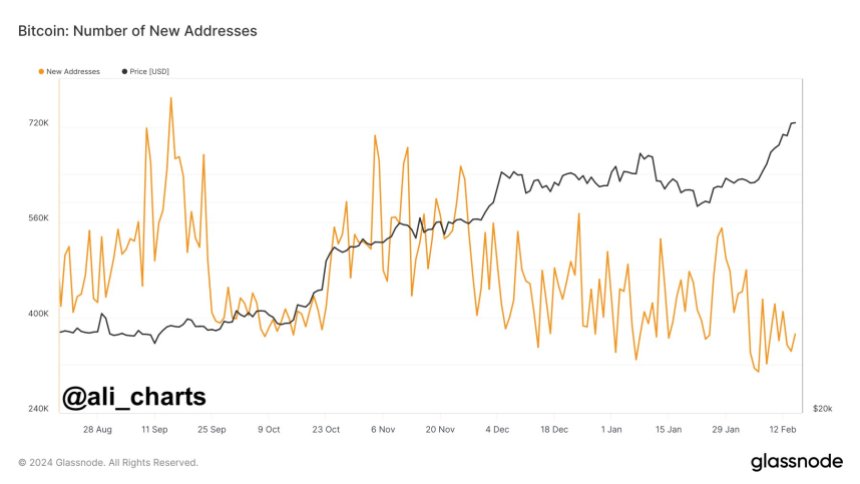

The success of Bitcoin ETFs is additional demonstrated by current knowledge suggesting that the upward development in Bitcoin costs is pushed primarily by institutional demand. On the similar time, retail participation seems to be declining.

In accordance to analyst Ali Martinez, as the worth of Bitcoin continues to hover between $51,800 and $52,100, there was a noticeable lower within the creation of latest Bitcoin addresses every day, indicating a scarcity of retail participation within the present bull rally and highlighting the rising affect of institutional traders within the cryptocurrency market.

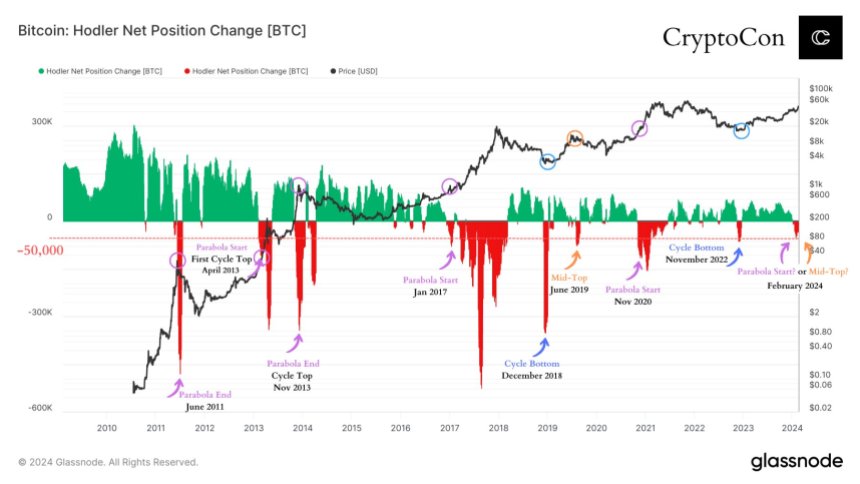

Nevertheless, market knowledgeable Crypto Con factors out a big shift in Lengthy-Time period Bitcoin holder positions, signaling a possible draw back motion.

As seen within the chart under shared by Crypto Con, the place change line crossed under -50.00 for the primary time in over a yr, a sample that has traditionally occurred at important moments in Bitcoin’s market cycles. These moments embrace the cycle backside, mid-top (which occurred solely as soon as), and the beginning/finish of a cycle high parabola (which occurred most incessantly).

In response to Crypto Con, this current shift in long-term holder positions raises two potential eventualities: a mid-top or an imminent parabolic motion. Such a motion at this stage within the cycle is taken into account uncommon.

Primarily, it signifies that long-term Bitcoin holders are exiting their positions in vital numbers, probably anticipating a market correction or a change within the general development.

General, the shift in Bitcoin holder positions and the decline in retail participation current contrasting dynamics within the present market panorama. Whereas institutional demand continues to drive the worth of Bitcoin greater, long-term holders seem like taking revenue or adjusting their positions.

Whereas BTC is at present buying and selling at $51,800, it stays to be seen what the route of the following transfer might be and the way establishments will proceed to affect the worth motion of the most important cryptocurrency as spot Bitcoin ETFs achieve traction.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site solely at your individual danger.