Bitcoin has witnessed a constructive flip of occasions because it reclaimed the $43,000 mark on Tuesday, due to a big discount in promoting strain from asset supervisor Grayscale. The reversal in Bitcoin ETFs throughout day 12 of buying and selling has seen extra inflows than outflows. Constancy and Blackrock recorded a mixed $400 million throughout their Bitcoin ETFs underneath the ticker names FBTC and IBIT, respectively.

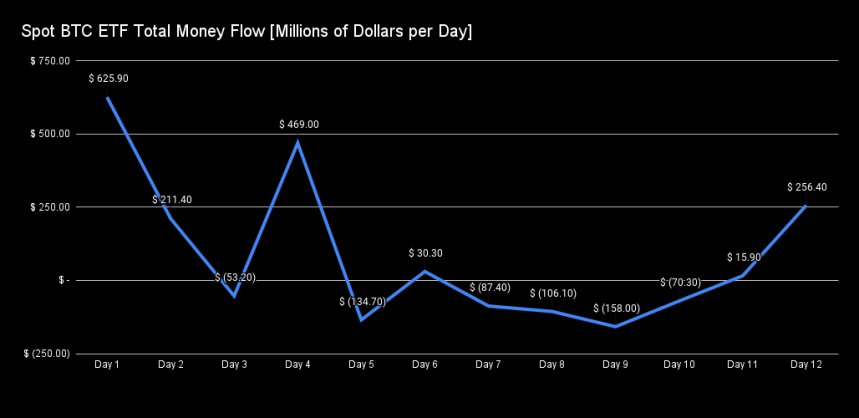

Bitcoin ETFs Report Third-Largest Cash Day

In accordance to market knowledgeable James Mullarney, Grayscale Bitcoin Belief (GBTC) has skilled a noticeable discount in promoting strain, as mirrored by the slowing down of GBTC promoting.

Day 12 of buying and selling confirmed a considerable influx in comparison with outflow, marking the third-largest cash day ever in internet cash stream, bringing in $256 million.

Mullarney additional states that including new Bitcoin ETFs has contributed to a internet constructive of $1 billion in ETFs, with an estimated 25,000 Bitcoin added to the market. The brand new Bitcoin ETFs now maintain a complete of 150,000 BTC in combination.

Miners Promote Most Cash Since Could 2023

Regardless of these constructive developments with Bitcoin ETFs, there may be an ongoing enhance in promoting strain from miners. A current CryptoQuant report reveals that miners have offered essentially the most cash since Could 2023.

The stream of cash from miner wallets to identify exchanges reached its highest worth since Could 16, 2023, with over 4,000 Bitcoin amounting to roughly $173 million in promoting strain.

Though miners have elevated their promoting exercise, CryptoQuant asserts that the market has absorbed this strain “calmly”. You will need to be aware that the reserves in mining portfolios have remained on the identical stage because the starting of January.

CryptoQuant highlights that it’s essential to think about that these actions don’t essentially point out a “dump” by miners. The agency concluded:

It’s true that there have been a number of interactions with exchanges throughout this era, some fairly important, however this doesn’t correspond to a “dump” on the a part of these entities. Moreover, it’s essential to watch out when studying messages like “miners are dumping cash”, this analyzes could not take into consideration the return of those cash to miners’ wallets.

New All-Time Excessive For Bitcoin After November?

Famend crypto analyst, CryptoCon, cautions in opposition to the idea that “this time is completely different” for Bitcoin, highlighting the recurring nature of its market cycles. With three accomplished cycles and a fourth underway, CryptoCon emphasizes that historic patterns, together with the launch of Bitcoin ETFs, have constantly influenced Bitcoin’s worth trajectory.

CryptoCon emphasizes that Bitcoin’s worth actions have adopted distinct cycles, and he warns in opposition to the notion that every cycle will deviate considerably from the previous ones.

Regardless of the anticipation surrounding the launch of ETFs, historic proof means that they’ve coincided with native worth highs slightly than prompt new all-time highs.

CryptoCon argues that the repeated incidence of such patterns ought to function a reminder that “this time is completely different” usually proves to be an illusory perception.

Based on CryptoCon’s evaluation, a interval of sideways motion is predicted to begin quickly after the completion of the continuing correction, which noticed BTC retrace to the $38,500 stage on Tuesday, January 23.

This part is predicted to final roughly 4 months, culminating in a second early worth peak in June 2024, based on Crypto Con.

Following this, the analyst foresees the potential of new all-time highs occurring after November twenty eighth, 2024. Nonetheless, it’s essential to notice that the cycle’s peak will happen inside roughly 21 days from this date, round November twenty eighth, 2025.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use info offered on this web site fully at your individual danger.